Markets have had a rollercoaster 24 hours as President Trump has once again proved to be the market driver.

Wall Street looked ready to extend its best gains in two weeks, with S&P 500 futures rising 2.5%. This came after President Trump reassured markets he wouldn’t fire Federal Reserve Chair Jerome Powell. Hopes for easing US-China trade tensions also boosted investor confidence.

Market sentiment improved thanks to positive earnings reports. Tesla (NASDAQ: TSLA ) shares rose 7% in premarket trading, even though the company fell short of forecasts. The rise came about when Elon Musk announced he would step back from his government work to focus on the company.

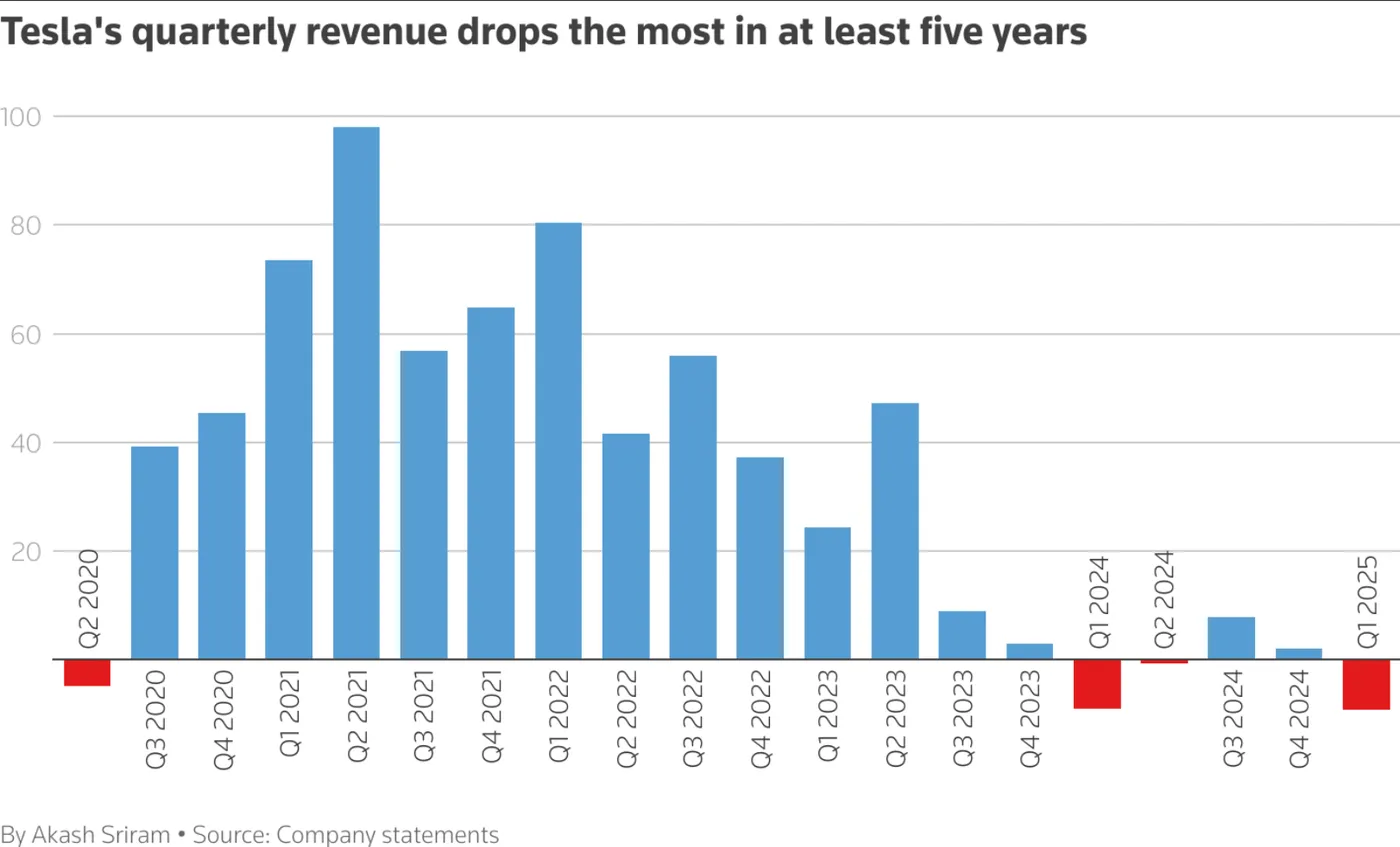

Tesla posted a 16.3% total gross margin, beating analysts’ predictions of 15.8%. A big decline from the 17.4% a year earlier.

Still, the revenue slumped 20% to $13.97 billion for the quarter.

Treasuries gained as concerns over Powell’s job eased, with 10-year yields falling to 4.30%.

The US dollar stabilized after a recent rally.

Bitcoin surged past $90,000 for the first time since early March.

Gold dropped as safe-haven demand weakened, while oil continued to recover.

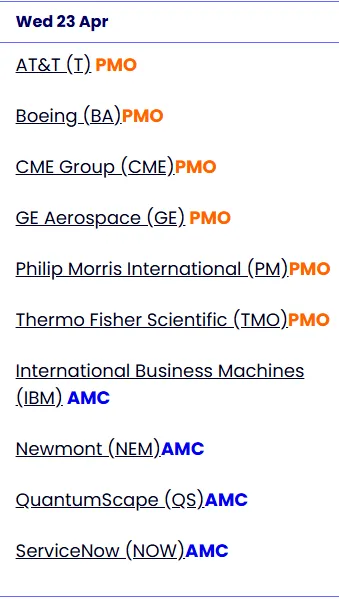

Other earnings releases that have come out include Boeing (NYSE: BA ), who reported a smaller loss for the first quarter, thanks to more production and deliveries after a strike and quality issues halted most aircraft manufacturing in late 2024.

The company plans to increase production of its popular 737 MAX jets to 38 per month by 2025, following last year’s setbacks from worker strikes and other crises.

AT&T (NYSE: T ) shares are up in pre-market trading after gaining more new wireless subscribers than analysts had predicted in the first quarter.

On the earnings front, there are still earnings after market close today which include IBM (NYSE:

IBM

), Newmont (NYSE:

NEM

), Quantumscape (NYSE:

QS

) and ServiceNow (NYSE:

NOW

).

The general improvement in risk sentiment still faces some challenges.Until there are some tariff deals announced officially or official word on US-China relations, the move may eventually run out of steam.

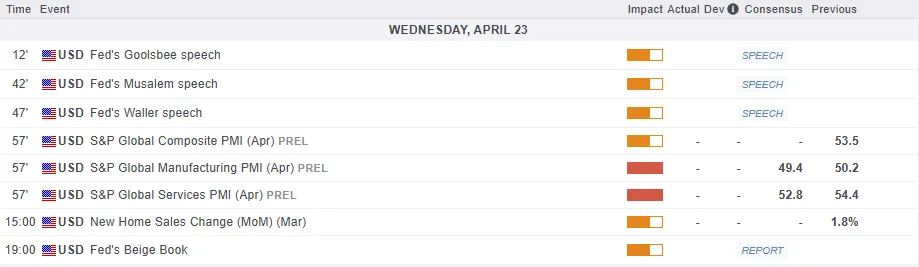

For a full review of Euro PMI data released this morning, please read Euro under pressure as Services PMIs slip

Economic Data Releases

For now, focus will shift to earnings, but may still be overshadowed by tariff developments.

Chart of the Day - Nasdaq 100

From a technical standpoint, the Nasdaq 100 is threatening a change of structure as it looks to print a fresh higher high.

A daily candle close above the 19123 handle should see the requirements being met and should increase the probability of further gains.

Of course, in the current climate, sentiment can shift quickly, but for now, the bias does appear to favor the bulls.

Immediate resistance rests at 19123 and 19436 before the 19781 and 20000 psychological levels come into focus.

A change in sentiment could knock the rally back, which would bring support at 18361, 17800, and 17304 back into focus.

Nasdaq 100 Daily Chart, April 23, 2025