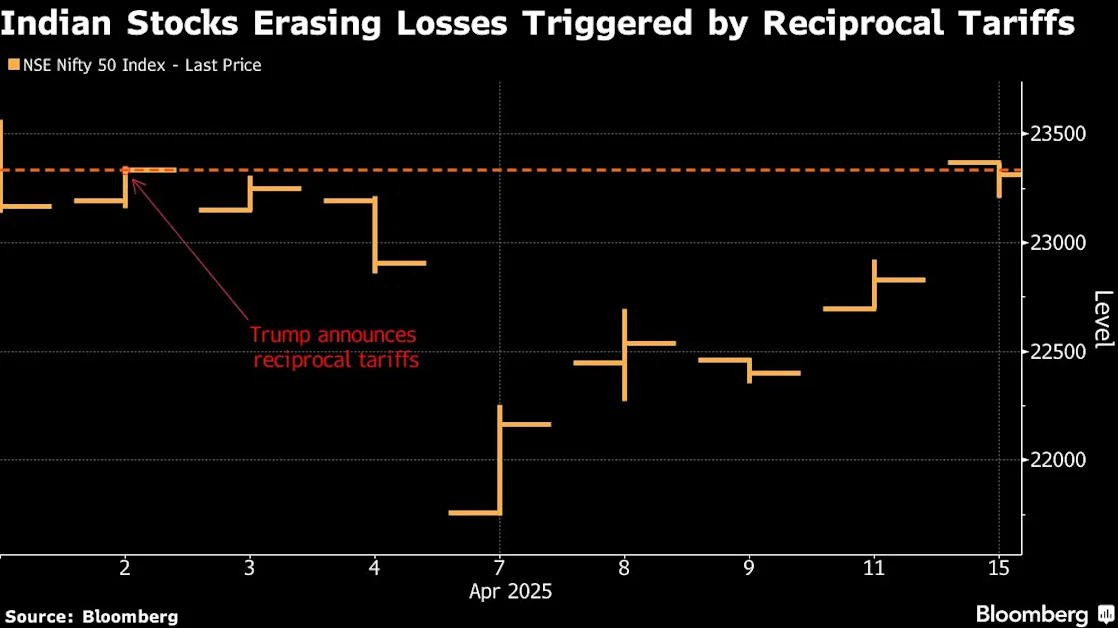

India Is First Major Market to Erase Losses From April 2 Tariffs

(Bloomberg) -- Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.Most Read from BloombergHow Did This Suburb Figure Out Mass Transit?The Secret Formula for Faster TrainsEven Oslo Has an Air Quality ProblemNYC Tourist Helicopter Crashes in Hudson River, Killing SixLisbon Mayor Wants Companies to Help Fix City’s Housing ShortageIndian stocks rallied as trading resumed after a long weekend, with the benchmark e