Who had short US and long Spain going into 2025? Anybody?

US assets are taking it on the chin lately. Treasuries are being sold down (rates are up), US dollar is at a multi-year low and still can’t find support, and US stocks are down double digits. This is highly unusual. So, where is the money going?

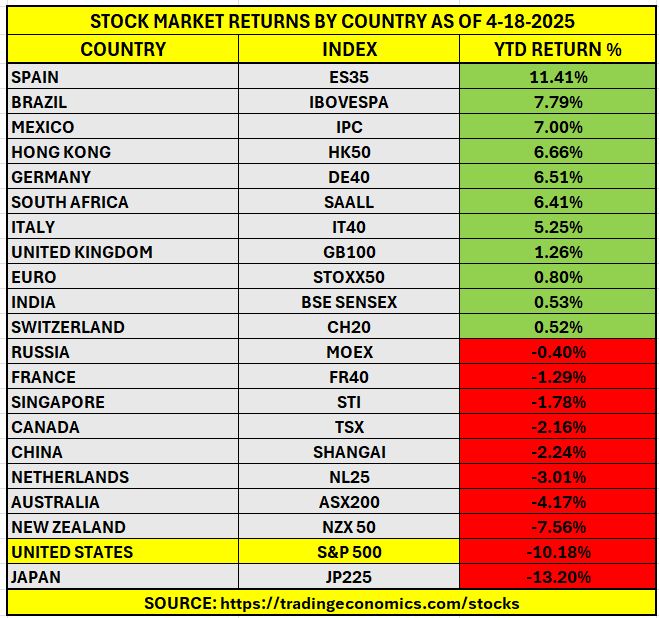

Turns out, it’s going almost everywhere but here. Of the 20 most important equity markets, most are still up YTD or near breakeven, while the US comes in 2nd to last. It’s been a very, very long time since we could say that.

We still have more than half a year to go, and a lot could change by then. It’s dangerous to make any definitive statements based on short-term price reactions.

I’m still as concerned as I’ve been in a while. It’s difficult to believe we can hold a 19-20x PE against this backdrop. But I think these calls of the US demise are greatly exaggerated. US companies will adapt to anything eventually.

Yes, there will be short-term tantrums to what many perceive to be (including myself) a very misguided tariff "solution", but ultimately, there is still no better alternative.