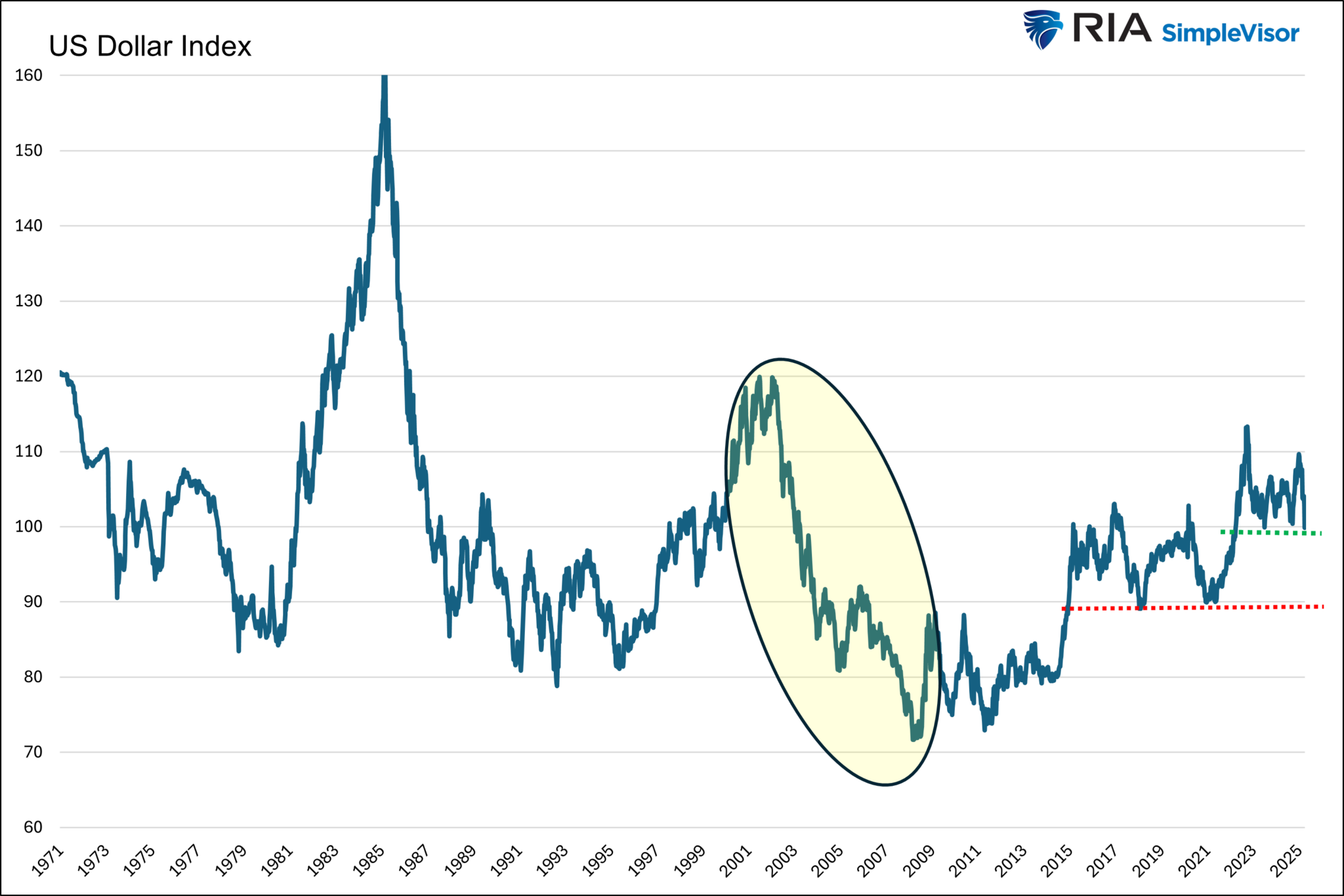

Recently, we have seen claims that the “ collapsing ” dollar will cause inflation. While a weaker dollar can create inflation, many factors impact prices. Accordingly, we have two issues with such dire statements. First, the dollar is not collapsing. Second, we have experienced much more significant dollar declines without an inflationary impulse.

The dollar has fallen nearly 10% since the new year. Yes, that is a big move for the dollar. However, context is vital. The graph below shows that the dollar, even after its decline, remains well above its average since the trough in 2008. The green dotted line shows that the dollar is at the lower end of its recent range. But it is still ten percent above the lows of the prior decade (red dotted line).

We circle the period from the dot-com bubble’s peak to the financial crisis’s worst days. The dollar fell from 120 to nearly 70, much more than the recent sell-off. During that period, CPI averaged 2.9%, compared to 3.1% in the ten years prior. The dollar collapse from 1985 to 1987 was met with lower inflation than the prior period.

A weaker dollar can be inflationary, but much larger forces are at work steering prices!

What To Watch Today

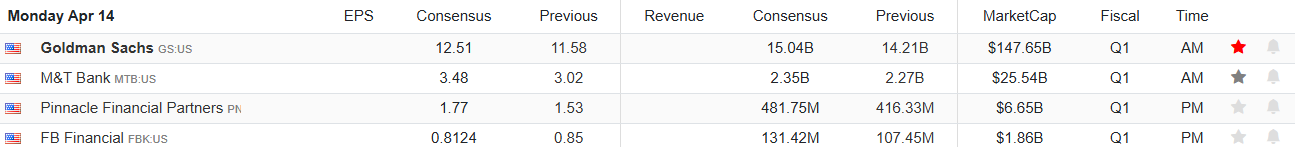

Earnings

Economy

The Week Ahead And PPI

PPI was much weaker than expected. The headline PPI was -0.4 % versus expectations of +0.2%. Moreover, the core PPI number was -0.1 %, 0.4% less than expectations. The data within PPI that feeds PCE prices also point to a weaker PCE report later this month.

Retail sales data on Wednesday, Fed speakers, and earnings will be interesting, but tariff discussions and volatile market activity will likely dominate the headlines. Retail sales could be strong if consumers started to stockpile goods in March. Yet, they could also be weak if consumers start to pull back on spending as recession fears increase. Regarding the Fed, we are listening closely for signs that liquidity is becoming problematic. Accordingly, will they offer any prescription ideas to potentially increase liquidity?

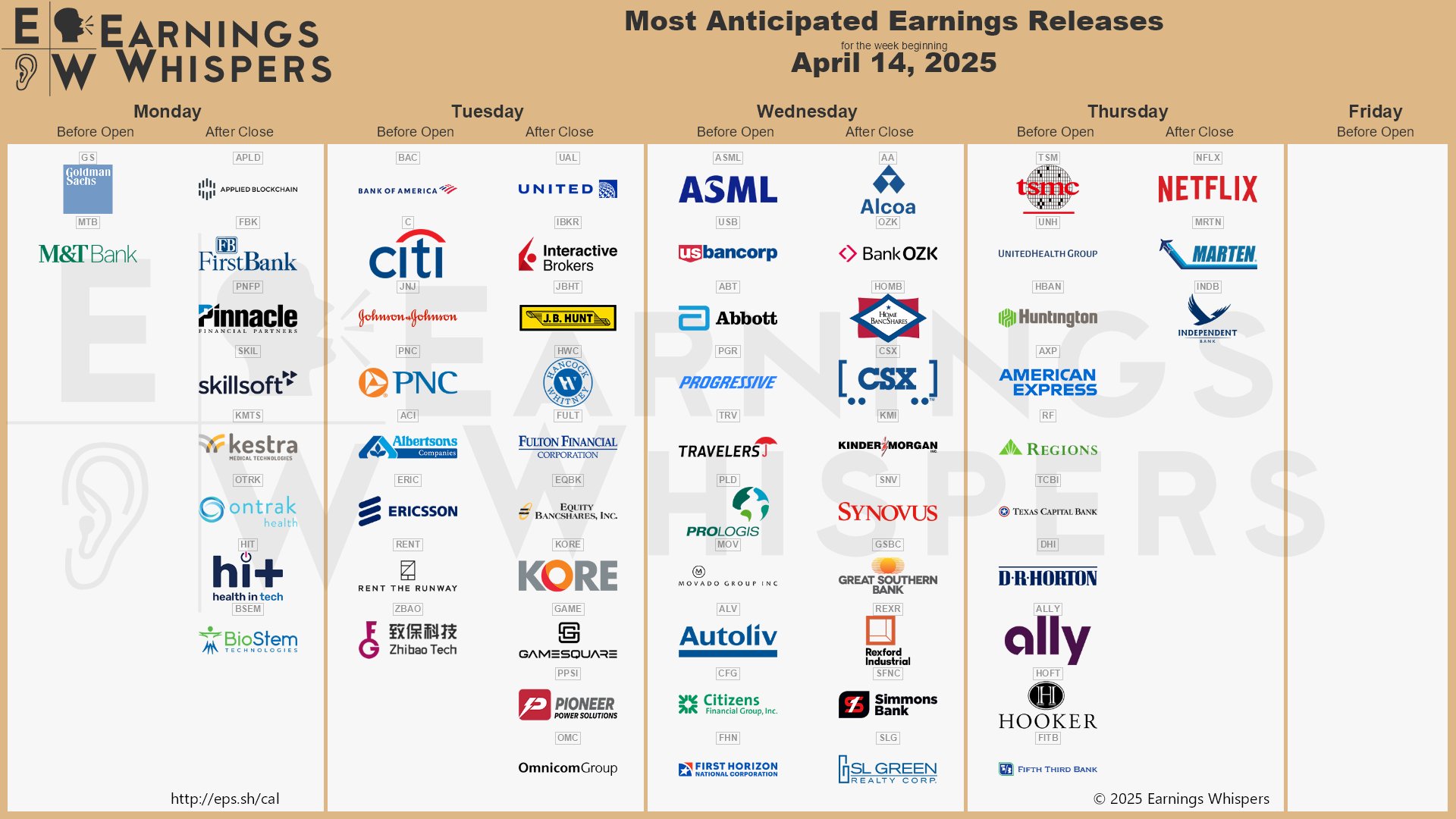

As shown below, courtesy of Earnings Whispers, there are a few big earnings announcements, but the following week will pick up significantly.

The markets will not be open on Friday for the Good Friday holiday.

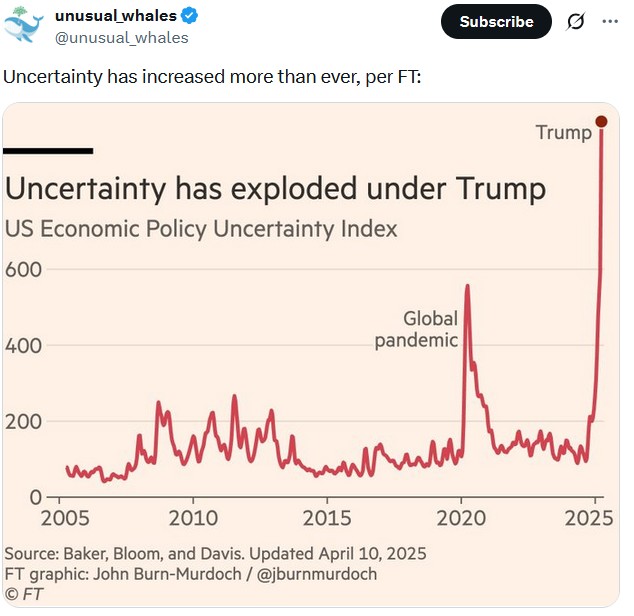

Tweet of the Day