March

retail sales

came in above expectations and a record high. Autos were the strongest category, leading to believe the strength may be related to tariffs. But

core sales

(ex autos) also beat expectations.

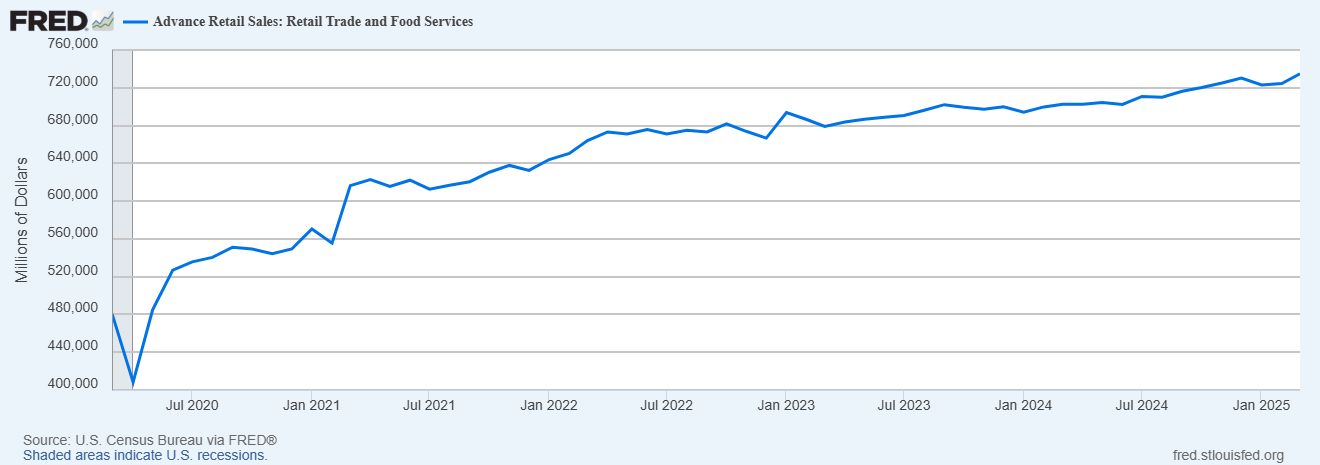

- Total retail sales came in at $734.9B, a gain of 1.4% (vs. +1.3% expected)

- January & February results were revised higher by a combined $3.4B

- Biggest monthly gain since January 2023

- 4.6% year-over-year growth rate, highest since December 2023

Retail sales ex autos ( core retail sales ) came in at $590.9B, a gain of +0.5% (vs. +0.4% expected)

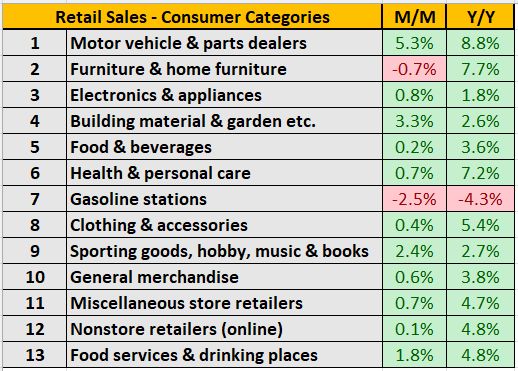

11 of the 13 retail categories gained for the month. Gasoline sales (-2.5%), & furniture (-0.7%) the lone decliners.

Motor vehicles and parts dealers (+5.3%) were the strongest category by a wide margin.

Real retail sales (retail sales adjusted for inflation) came in at $229.9B, still 1.6% below the April 2021 highs. Meaning the record retail sales are all contributed to consumers having to pay higher prices.

We probably won’t know how much of this strength is related to buying ahead of the tariffs until after the fact. It certainly appears that it played a significant factor, but it was still a welcome sign to see a consumer-related data point come in better than expectations.