POUND STERLING ANALYSIS & TALKING POINTS

- All eyes shift to economic data to guide monetary policy forecasts.

- Fed and BoE speakers to come.

- GBP/USD holds above 1.22 within bear flag.

GBPUSD FUNDAMENTAL BACKDROP

The British pound kicks off the trading week marginally higher against the US dollar after a significant depreciation last week. A hawkish Fed Chair Jerome Powell kept the greenback supported throughout as markets prepare for key economic data from both the UK and US throughout the week. Earlier this morning Rightmove announced that UK housing prices have fallen at its quickest pace in five years reiterating the tight credit conditions as a result of high interest rate s delivered by the Bank of England (BoE) .

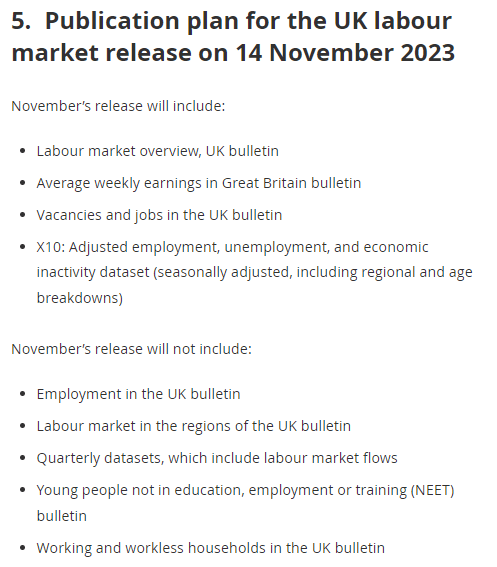

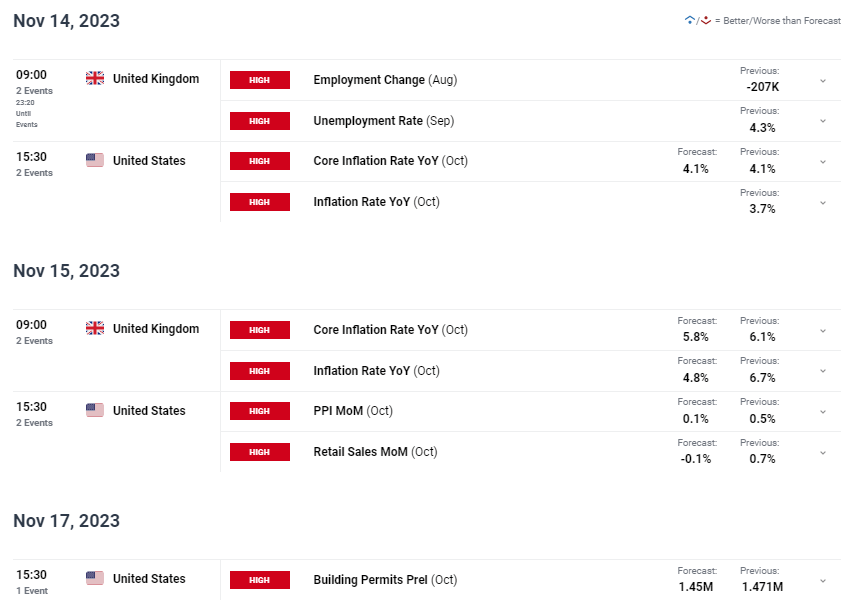

Today's economic schedule is rather muted with Fed and BoE speakers in focus ahead of a stacked week (see economic calendar below). UK jobs data although important will have some missing elements that could hamper its accuracy and impact on both the pound and BoE monetary policy – refer to image below. That could make the upcoming UK inflation print that much more influential. US CPI will likely be the focal point for the week and could supplement Fed Chair Powell's remarks in which case the USD could strengthen further.

Source: Office for National Statistics

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

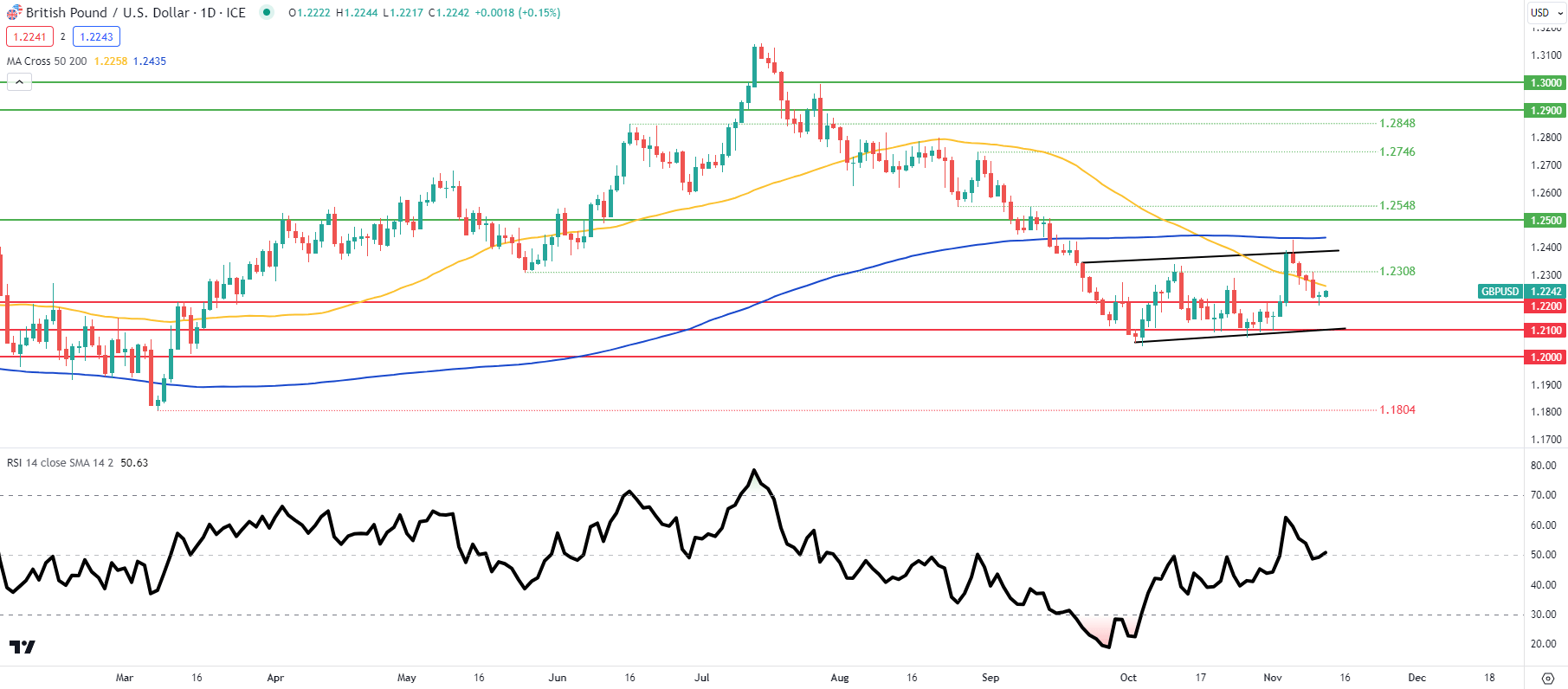

GBP/USD DAILY CHART

Chart prepared by Warren Venketas , IG

Daily GBP/USD price action trades between the 50-day moving average (yellow) and the psychological handle, while continuing within the developing bear flag pattern (black). The Relative Strength Index (RSI) highlights hesitancy at the moment hovering around the midpoint level. Short-term directional bias will be attained through the upcoming data releases.

- 200-day MA (blue)

- Flag resistance

- 1.2308

- 50-day MA (yellow)

- 1.2200

- 1.2100/Flag support

- 1.2000

- 1.1804

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net on GBP/USD with of traders holding long positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course