-

Hopes were high for a rebound in capital markets activity this year.

-

A few notable Health Care deals along with M&A in the AI-adjacent and reshoring themes occurred in January.

-

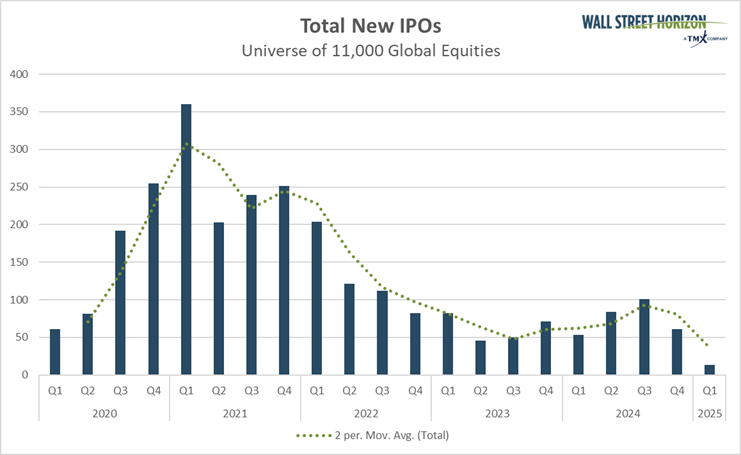

A pair of underwhelming IPOs to begin 2025 is far from a new-issue renaissance.

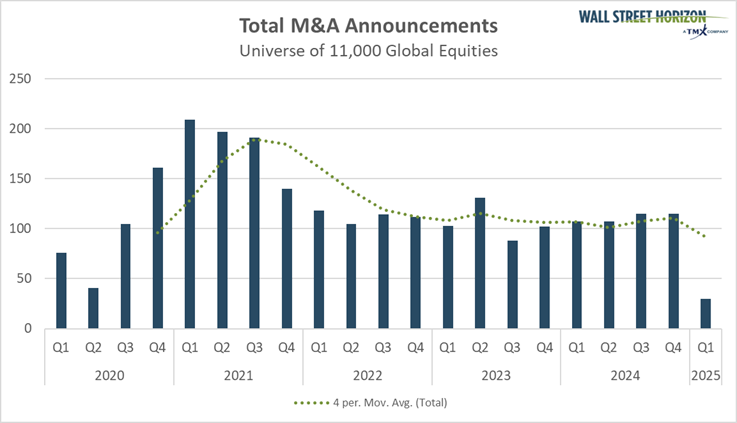

January is in the books, and markets are still waiting on a big rebound in the dealmaking space. Investors rooting for increased M&A and a flurry of IPOs will have to be patient as Q1 tracks with continued low counts on both fronts. Still, 2025’s first month featured notable buyouts while the year’s biggest IPO garnered some trading-floor buzz before shares fell flat on its first day of trading.

Most analysts and strategists have been upbeat on more fast-paced capital markets now that there’s some clarity when it comes to policy. Last November’s election results suggested that a wave of deregulation and business-friendly conditions may materialize. Of course, we are just two weeks into President Trump’s second term and the 119th Congress is barely a month old. For now, the focus seems to be tariff talk and cabinet confirmations rather than cutting much red tape.

M&A Announcements Rose Slightly in 2024

Vital Signs are Good in Health Care M&A

Politics aside, executives who gathered at the JP Morgan Healthcare Conference 2025 sounded broadly confident that this year will be more active for corporate consolidation. It wasn’t just a tone thing, either. Among the biggest global acquisitions, YTD was Johnson & Johnson's (NYSE: JNJ ) $14.6 billion takeover of Intra-Cellular Therapies Inc (NASDAQ: ITCI ). Also at the event, the UK’s GSK plc (LON: GSK ) announced a $1.2 billion buyout of IDRx, a Boston-based, clinical-stage biopharma company.

Both are significant moves, perhaps done more out of the reality that patent cliffs on the horizon could pose revenue risks. Moreover, drug pipelines must be replenished given today’s fast-paced and AI-aided pharmaceutical industry. Finally, the world’s most valuable healthcare sector company by market cap, Eli Lilly (NYSE: LLY ) purchased a clinical oncology drug candidate from Scorpion Therapeutics on January 13.

Deals Give an Alpha-Boost to Health Care

So, it was a healthy start to the year, M&A-wise, for one of the worst-performing sectors of the S&P 500 in 2024. The healthcare sector’s strong early-year return is potentially a shot in the arm, but interest rates that remain high compared with recent years could be a macro headwind, particularly for the biotech area.

Keep your eye on several conferences on tap in March for a potential second wave of M&A in the sector. We’re also in the heart of Health Care earnings season; Merck (NSE: PROR ), Pfizer (NYSE: PFE ), and Amgen (NASDAQ: AMGN ) reported earlier this week, and we’ll hear from Eli Lilly Thursday night.

This earnings season will provide crucial insights not just for the healthcare sector, but the broader market as well.

Will AI Save the Day? A ‘Shocking Deal’ in the Utilities Sector.

Venturing to other corners of the market, the C-suites from manufacturing to services are undoubtedly staying on top of the latest AI happenings. On January 14, nuclear power provider Constellation Energy (NASDAQ: CEG ) announced plans to acquire Calpine, a privately held natural gas and geothermal company, for $16.4 billion. It was one of the biggest deals in recent memory within the Utilities sector.

The cash-and-stock takeover preceded DeepSeek's language model release, which appeared to disrupt the nuclear power industry last month. As the balance of the reporting season unfolds, it will be interesting to see if power providers, namely those with significant data center exposure, hint at other corporate actions.

Reshoring Alive and Well?

Over in the industrial sector, United Rentals Inc (NYSE: URI ) announced its intention to buy H&E Equipment Services (NASDAQ: HEES ) for $4.8 billion on January 14. HEES shares more than doubled in the session that followed, but URI took off too. It’s common for the acquirer to receive a takeover premium, of course, but the acquirer doesn’t always rally; it could indicate that investors currently welcome buyouts in today’s environment. For URI, the company could be positioning itself for further reshoring and infrastructure construction demand in 2025 and beyond.

2025’s First Energy IPO

Is it an M&A boom? Surely not, but that scene may look better than the year-to-date IPOs. There have really only been a pair of major new listings, maybe due to the reality that private markets are very deep today.

The first was Venture Global Inc (NYSE: VG ), the second-largest US exporter of liquified natural gas. As a pure-play LNG company, it’s at the leading edge of domestic energy dominance and Europe’s need for low-cost energy. The stock priced at $25 but settled at $24 on its first trading day – a tepid beginning to what’s hoped to be a big year for big deals.

The Newest Consumer Staples Stock

VG is valued at about $50 billion; the other notable IPO in January was Smithfield Foods Inc (NASDAQ: SFD ) with a market cap of $8 billion. A household name, shares dropped from an opening gap higher on their debut, eventually closing under the IPO price. What’s more, Smithfield is priced at $20 per share, well below its expected range of $23-$27.

On Down the Road...

What new issues could be in the offing? Chime and Klarna seem to be perennial companies on the outlook list, but other firms like Cerebras Systems (another AI and deep learning enterprise) and CoreWeave (a cloud-computing startup catering to AI developers) could certainly attract major attention.

For now, we’ll all just have to monitor earnings reports, listen to earnings calls, and stay abreast of developments at early-year conferences and industry events for clues on future capital markets activity.

Global IPO Count: No Bounce Yet

The Bottom Line

Ready. Set. Wait. That's kind of been the disposition of investors and Wall Street bankers hoping for booming M&A activity and an IPO renaissance in 2025. The tenor is measured so far, but a slew of healthcare deals and other buyouts related to AI power demand and reshoring makes for an okay start. We’ve yet to see those exciting first-day IPO pops, though. Will it change? Stay tuned and keep your eye on that corporate body language!