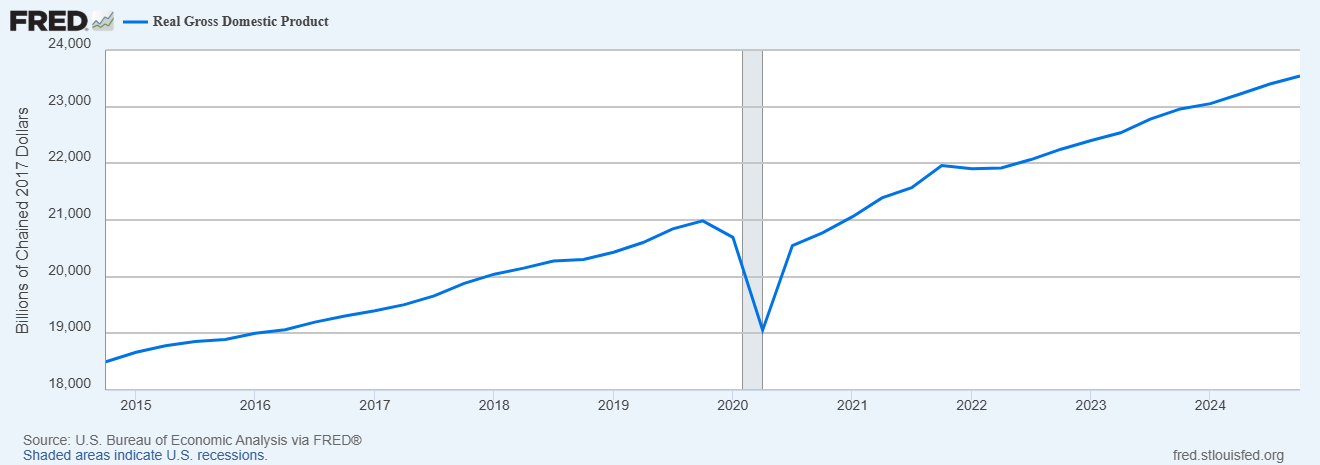

The economy grew to $29.7 trillion in Q4, or $23.5 trillion when adjusted for inflation (

real GDP

), according to the 3rd and final revision.

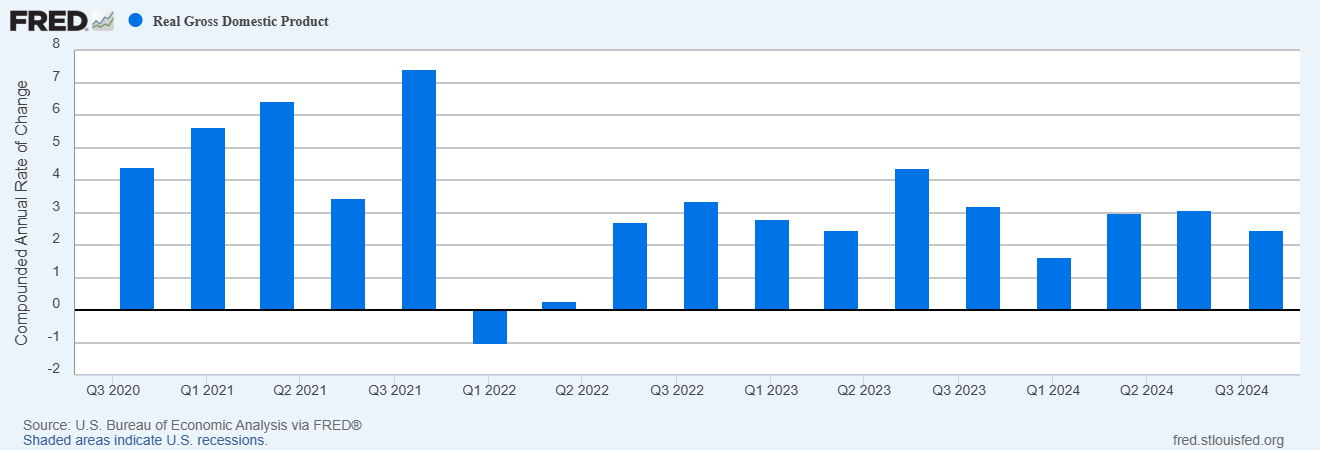

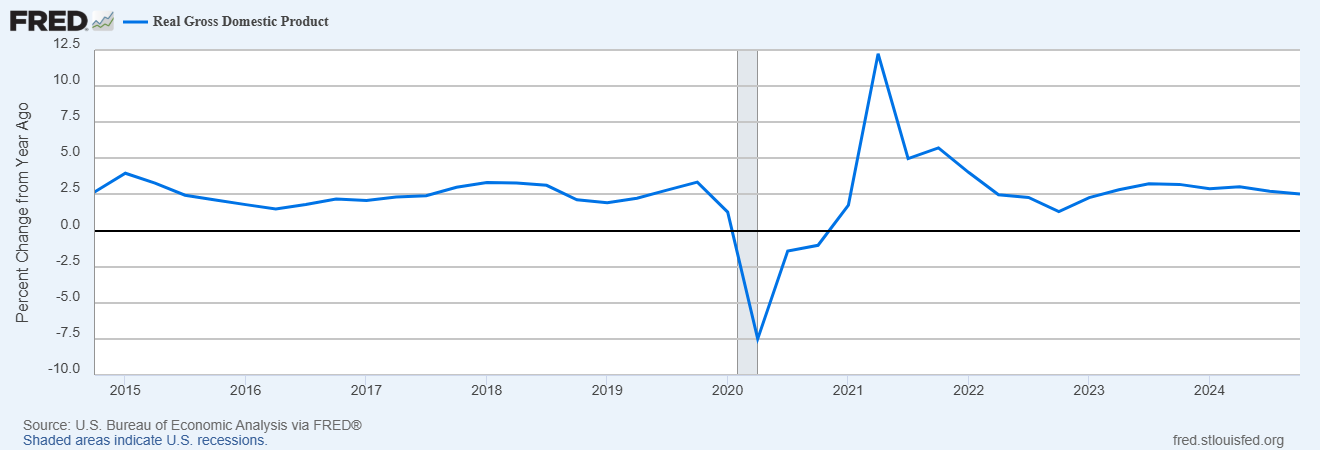

This represents a compounded annual growth rate of 2.4% in Q4, a modest increase from the 2.3% growth from the second revision. But below the 3.1% and 3.2% pace of growth from Q3 and Q4 2023 respectively.

The economy is 2.5% higher over the last 12 months. But the pace of growth has slowed from the 3.0% growth rate over the last few quarters.

The historical average real GDP growth rate for both Q/Q and Y/Y is 3.2%. Which means the economy has been growing below average by both metrics for the 4th straight quarter.

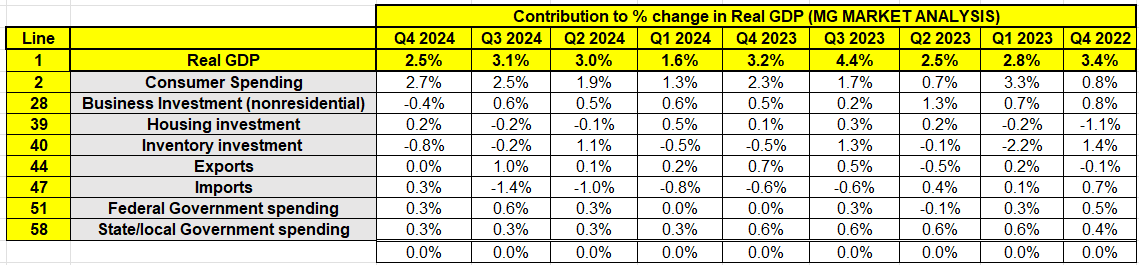

Breaking down the numbers by category, we see that consumer spending actually grew at a faster pace in Q4, contributing 2.7% to GDP (an increase from 2.5% in Q3 and the highest since Q1 2023).

Government spending added 0.6% to GDP (roughly 25%), while inventory and business (nonresidential) investments subtracted 1.2%.

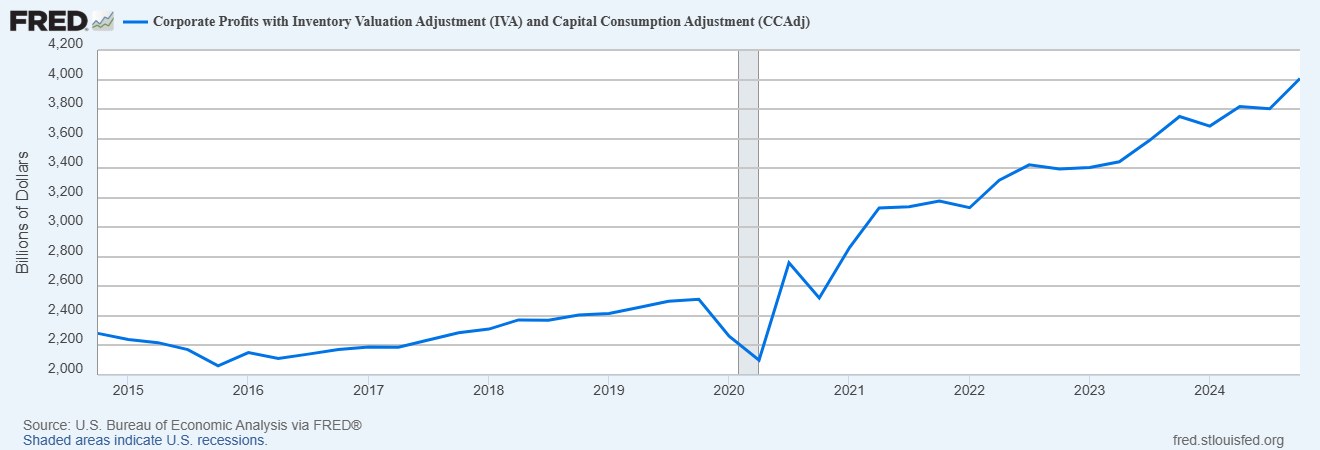

Along with the 3rd and final estimate for GDP, we got an update on corporate profits. Profits increased to $4 trillion in Q4, a gain of 5.4% for the quarter and 7% for the year. The largest quarterly gain since Q2 2022.

Unfortunately, much of this is old news, since a lot has changed since then. Q1 GDP estimates are still negative (although if adjust the gold imports it nets to +0.2%), with consumer spending growth falling to 0.3% (down from +4.0% in Q4).

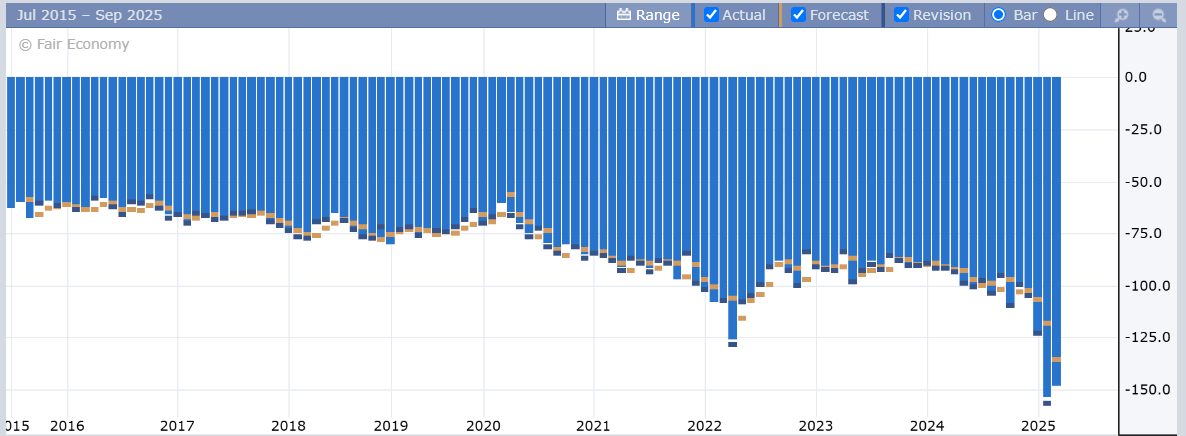

The February trade deficit in goods came in at -$147.9 billion. Which means net exports continue to look like they will be a major drag on Q1 GDP growth.

I will continue to give the market the benefit of the doubt as long as last week’s low holds. But so far, we failed the first attempt at the resistance level I pointed out in Sunday’s “surveying the week ahead” (blue dotted line on chart above).

Between tariffs (which could significantly impact supply chains and growth in the short term), a slowdown in consumer spending, a slowdown in government spending, and along with high valuations, is some serious potential hurdles to consider in the short term.

10-year treasury

rates look to be retesting the 4.40% level after finding support at the December low around 4.12%.

While the

US Dollar

has seemed to find support around the November 5th (election day) gap at $103.451. From a technical perspective, there doesn’t appear to be much in the way to stop a retest of the $105.42 level above. But the administration would like a weaker currency to be more competitive (attractive) to the rest of the world. And that is something I wouldn’t bet against.

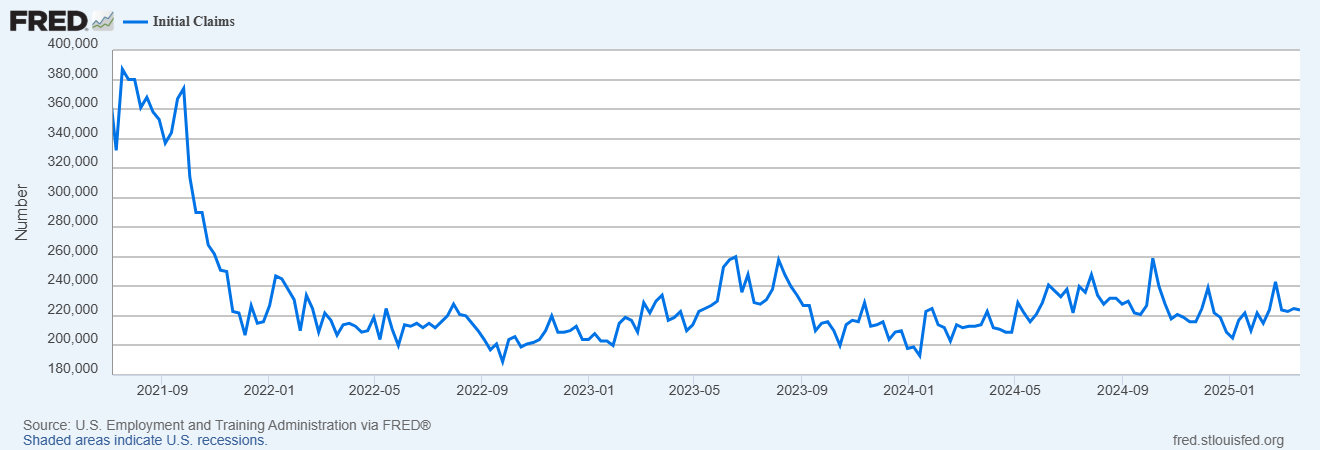

On a positive note, weekly

unemployment claims

remain low despite the challenger data and speculation about job losses.

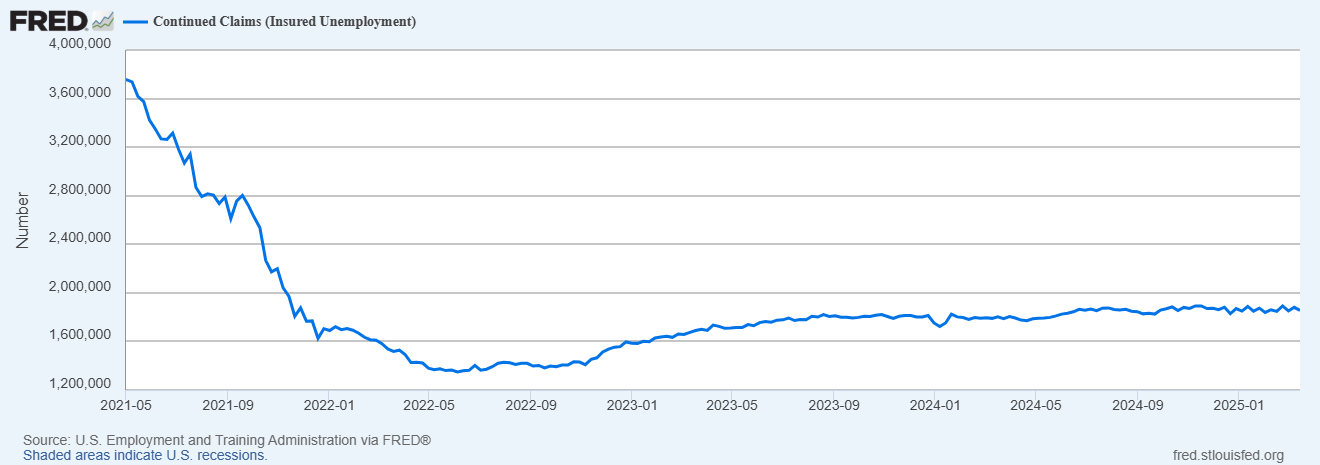

The same thing is happening with continuing unemployment claims. So far, there are no signs of anything out of the ordinary.