FTSE 100, DAX 40, Dow Jones: Analysis and Charts

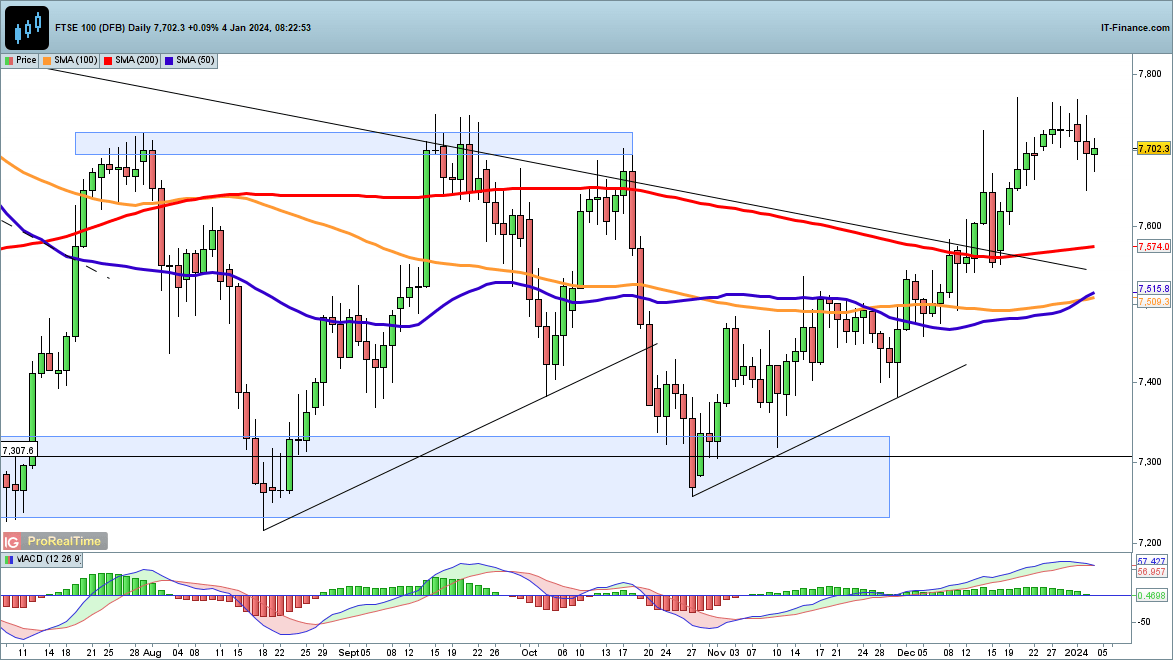

Wednesday saw the index drop briefly to a two-week low around 7650, but the price then rallied off the low. Some initial gains this morning have put the price back above 7700, which may then provide a foundation for another challenge of the 7750 highs seen at the end of 2023.

The uptrend from the October low is firmly intact, and it would need a move back below 7550 to suggest that the rally had run its course. Even further short-term weakness towards 7600 would still leave the move higher in place for the time being.

FTSE 100 Daily Chart

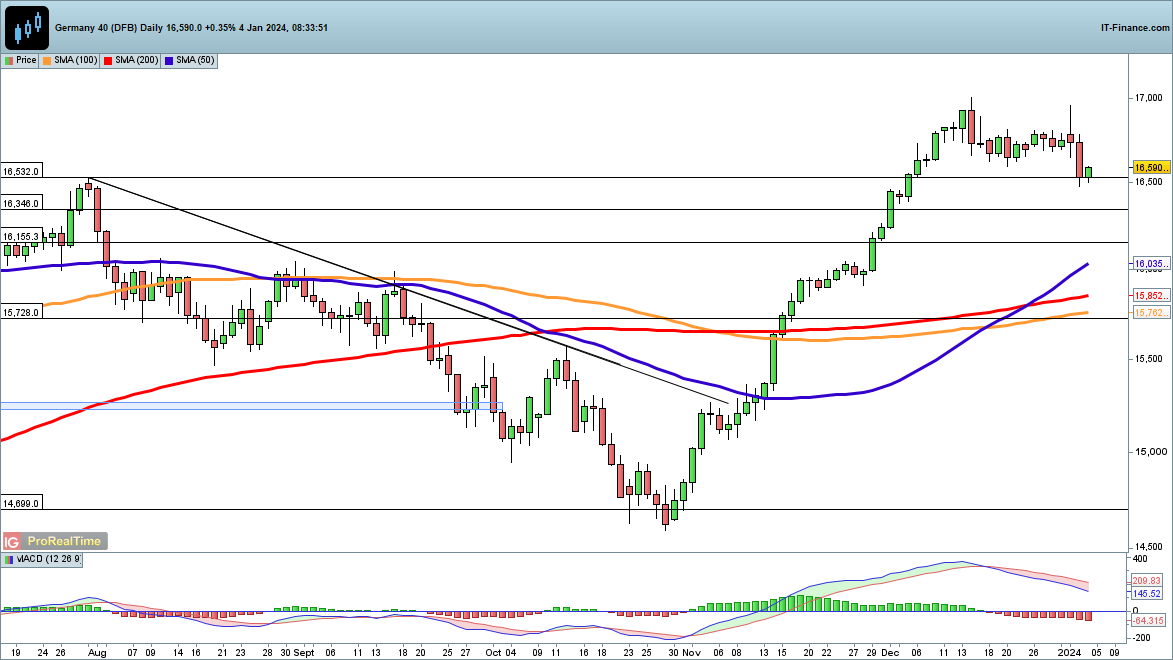

The index has continued to track lower since its December record high, but the losses have only put a modest dent in the gains made since the end of October.For the moment, buyers are defending the previous record high at 16,532, avoiding a close below this level and maintaining a medium-term bullish view. A close below 16,532 might open the way towards the June highs, and then on towards the 50-day SMA.

A close back above 16,800 restores a short-term bullish view and puts the price back on course to target the record highs of mid-December around 17,000.

DAX 40 Daily Chart

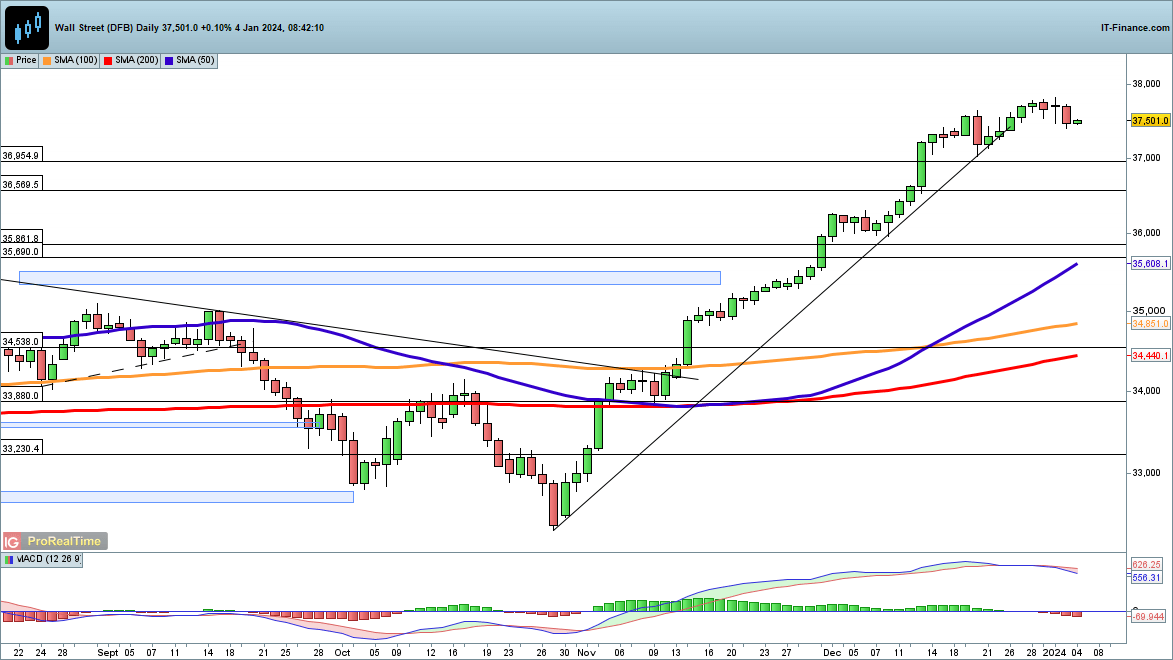

The Dow remains less than 1% off its record high, holding on to almost all of its gains made since the end of October. In the near term, 36,954 and then 36,569 could be short-term areas of support, but for the moment a deeper correction has yet to materialise.

A close back above 37,800 puts the index on course for new record highs and a push towards 38,000.

Dow Jones Daily Chart