Investors are on edge ahead of February’s Consumer Price Index ( CPI ) report today, which economists expect to show a slight cooling in inflation.

Forecasts point to a 3.2% year-over-year increase, down from January’s 3.3% reading. As stocks tumble, demand for safe-haven U.S. government debt has surged, pushing the US10Y yield down from 4.81% in January to 4.11% in early March.

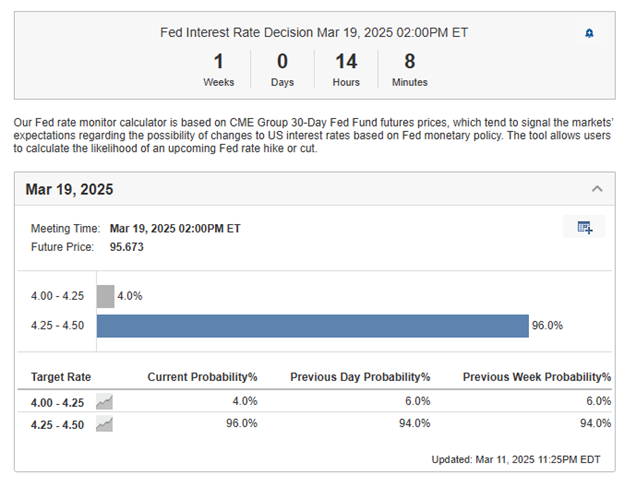

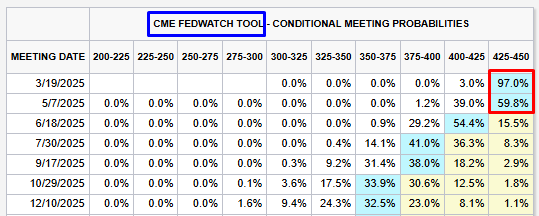

Despite the market turbulence, the Investing.com Fed Rate Monitor Tool shows a 97.8% probability that the Fed will hold rates steady at its March 19 meeting.

Meanwhile, the S&P 500 has plunged 10% from its record high on February 19, underscoring investor jitters ahead of the inflation data.

What Is the Market Expecting in February?

- YoY: Consumer prices are expected to rise by 2.9% vs. a 3% increase in January.

- MoM : 0.3% increase vs. 0.5% in January

- Core YoY : 3.2% increase vs 3.3% in January.

- Core MoM : 0.3% increase vs. 0.4%.

- Release Period: February 2025

- Last Release Date: February 12, 2025

- Actual: 3.0 % vs Forecast: 2.9%. Previous: 2.7%

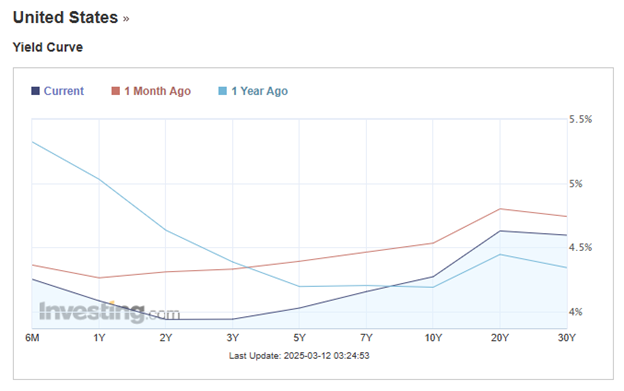

US Treasury and Bond Yields:

FED Rate Monitor:

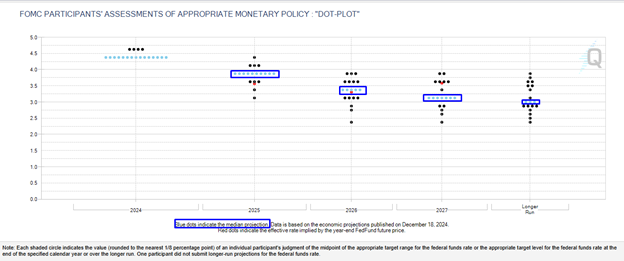

FOMC Projections (DOT-PLOT):

- The Fed’s dot plot records each Fed official’s projection for the Fed Fund rate on a quarterly basis.

- Blue dots indicate the median projections.

US 10Y Yields Technical View:

- US 10Y treasury yield rejected 4.80% in January, forming a double top technical pattern.

- Yields are sitting at 4.10 – 4.12 support zone since early March.

- Based on the pattern a rebound to 4.40 – 4.50% is likely before another move lower on a break below 4.10 strongly.

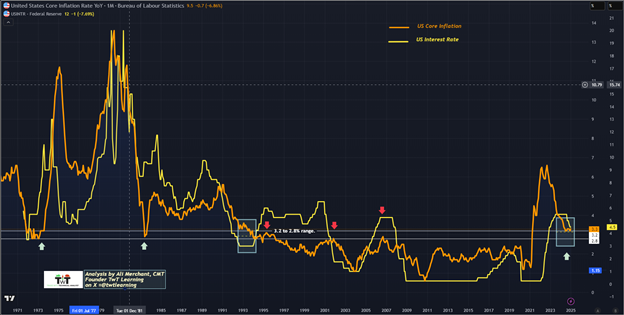

Technical Analysis Perspective:

- The US Core inflation YoY has remained above 3.2% since August 2024.

- A key observation from the following chart suggests that if the core inflation rises higher from 3.2% to 3.3% like in August 1992, it takes a couple of months before it goes lower.

- From September 1992 the Fed kept the rates unchanged for a couple of months to bring the inflation down below 3% and raised rates once the inflation dropped to 2.8% in April 1994.

- Since August 2024 Core inflation has been maintaining 3.2 to 3.3% suggesting that Fed will have to be patient before the inflation meets their target of 2%.

- Fed may keep the rates unchanged for the next couple of meetings in 2025.

The US Core Inflation YoY Chart Overlayed with US Interest Rates:

CME Fedwatch Rates Probabilities:

- Rates probabilities suggest no rate cut in the upcoming two meetings.

Conclusion:

The drop in 10-year yields signals expectations of lower interest rates in the medium term. However, history offers a cautionary tale—back in August 1992, core inflation staying above 3.2%-3.3% forced the Fed to hold rates steady for an extended period. With inflation still a concern, policymakers may need more data before making their next move.

A word of wisdom:

“The market can remain irrational longer than you can remain solvent”

This quote by economist John Maynard Keynes emphasizes the unpredictable nature of financial markets.

The quote means that investors should not bet against the market, even when they believe it is mispriced or irrational, because it is difficult to predict when the market will correct itself.

***

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters, Refinitiv, MAK Allen & Day Capital Partners, and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning .”