US Dollar Weakens After Monthly Inflation Cools, Gold Gains Momentum

- US Core PCE 2.8% vs 2.8% expectations and prior.

- US dollar edges lower, but move lacks conviction.

The US dollar slipped lower and gold picked up a small bid after the latest US PCE data hit the screens. Both the Core and Headline y/y PCE came in line with expectations, and March's readings, at 2.8% and 2.7% respectively, but the m/m Core reading came in marginally below expectations and last month's reading. Monthly personal income and spending both fell. It is a slightly positive release but unlikely to move any rate-cut expectations.

For all economic data releases and events see the WH Alliance

The US dollar index fell after the inflation release and is being propped up by the 200-day simple moving average at 104.45 ahead of the 38.2% Fibonacci retracement level at 104.37.

US Dollar Index Daily Chart

Chart by TradingView

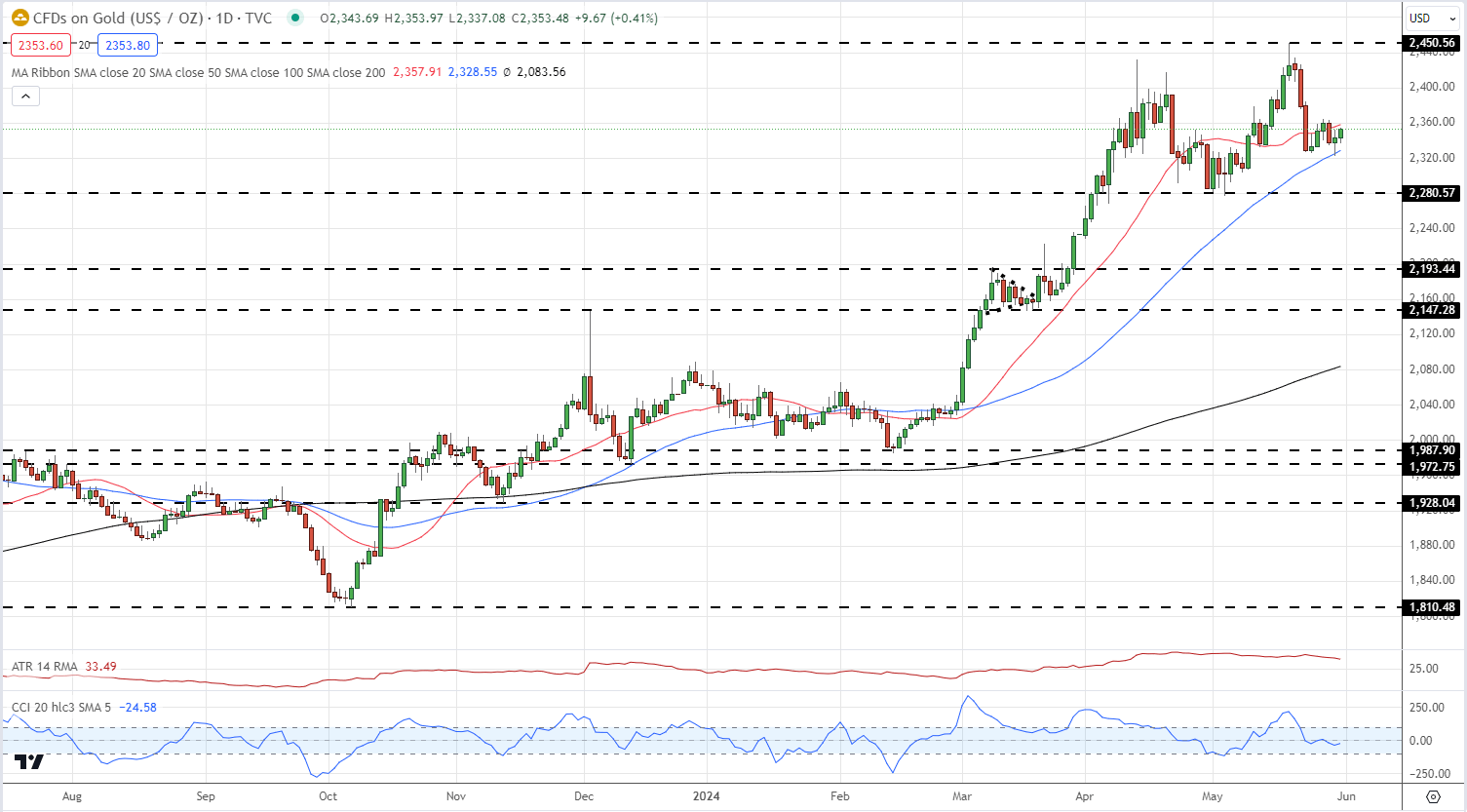

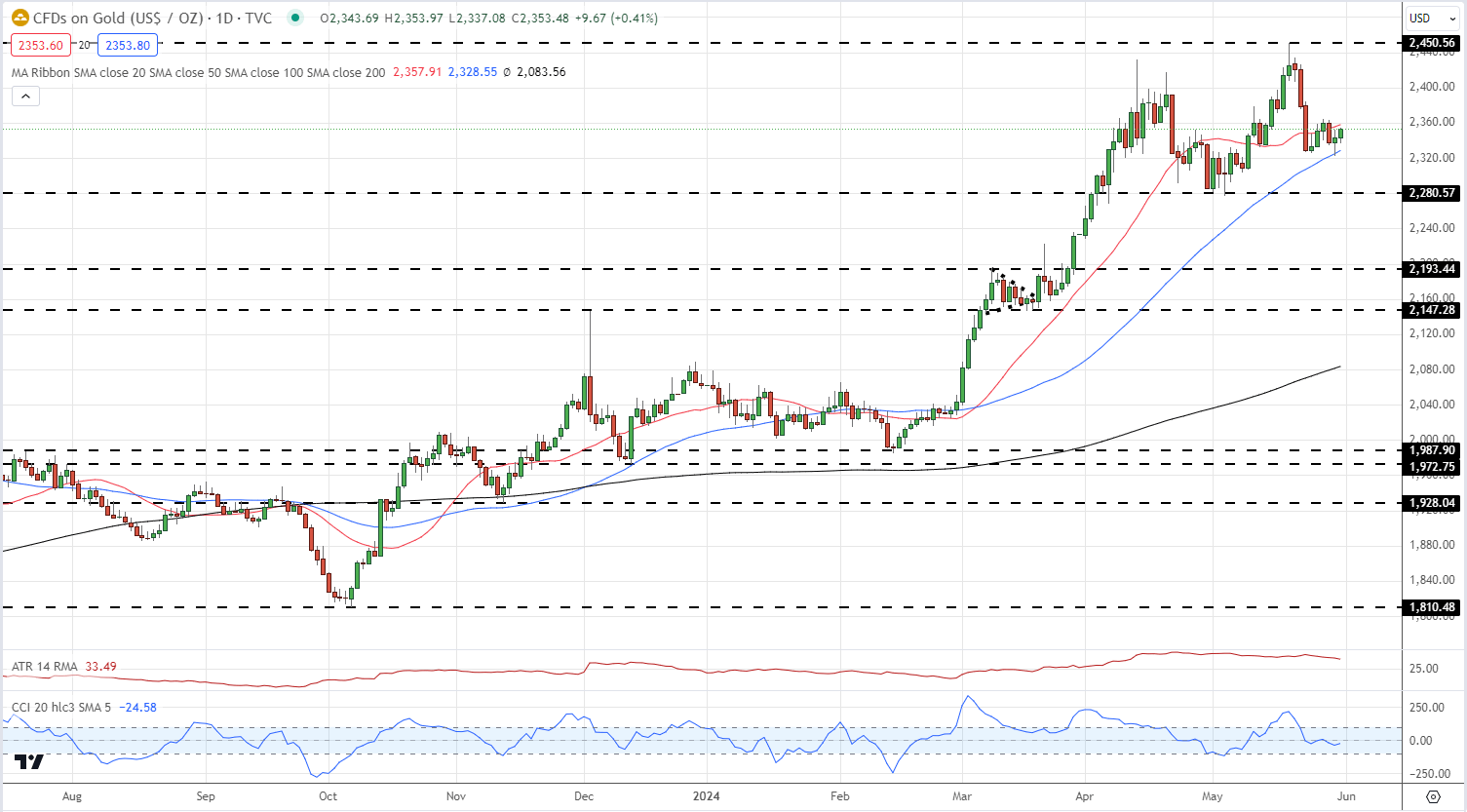

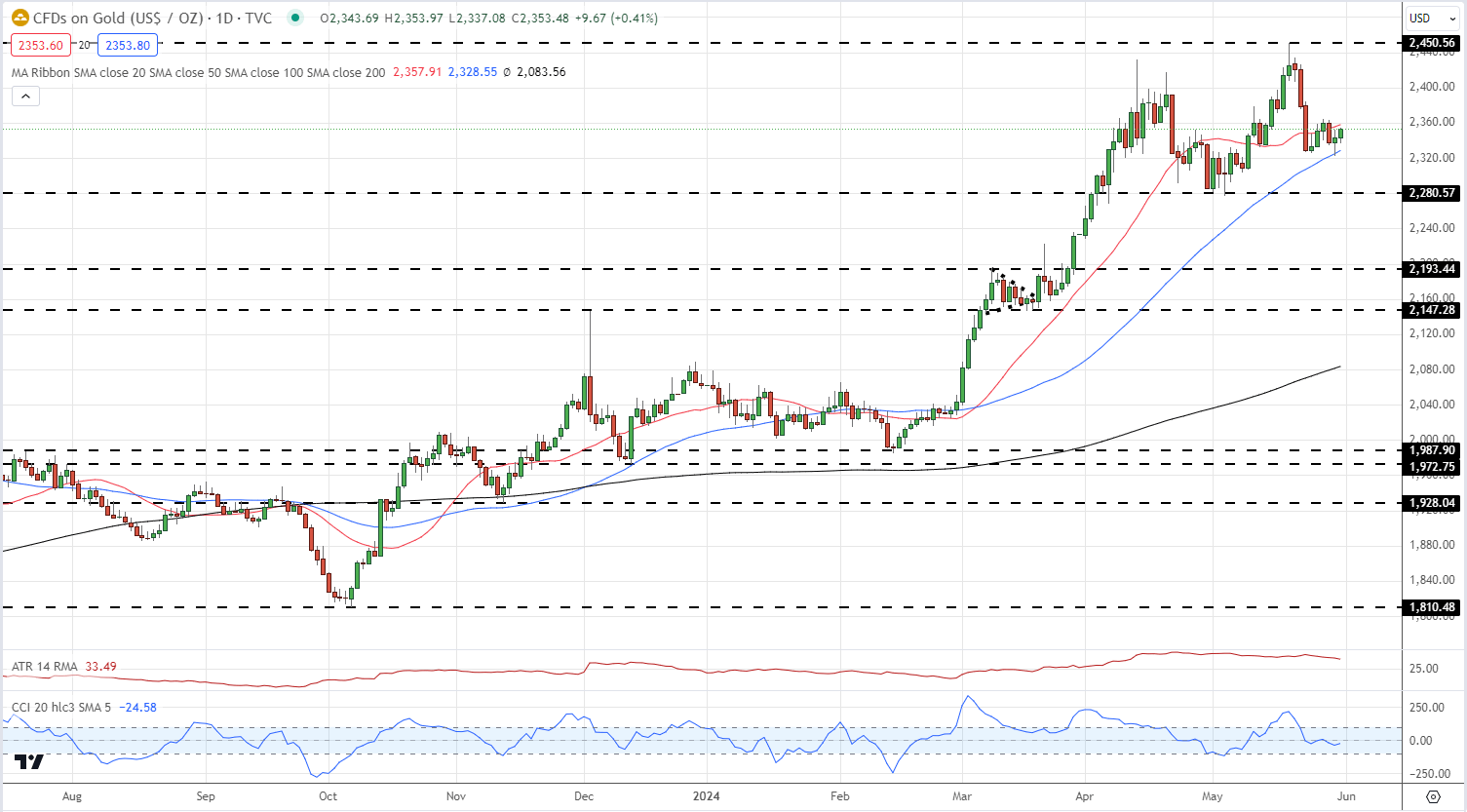

Gold is around 0.50% higher at $2,353/oz. and eyes near-term resistance from the 50-day simple moving average at $2,358/oz. Above here lies $2,400/oz.

Gold Daily Price Chart