Markets had an interesting end to the week with a mixed bag of jobs data leaving a lot to be desired. However, in 2025 Fridays have proven anything but disappointing thus far, and this week did not disappoint.

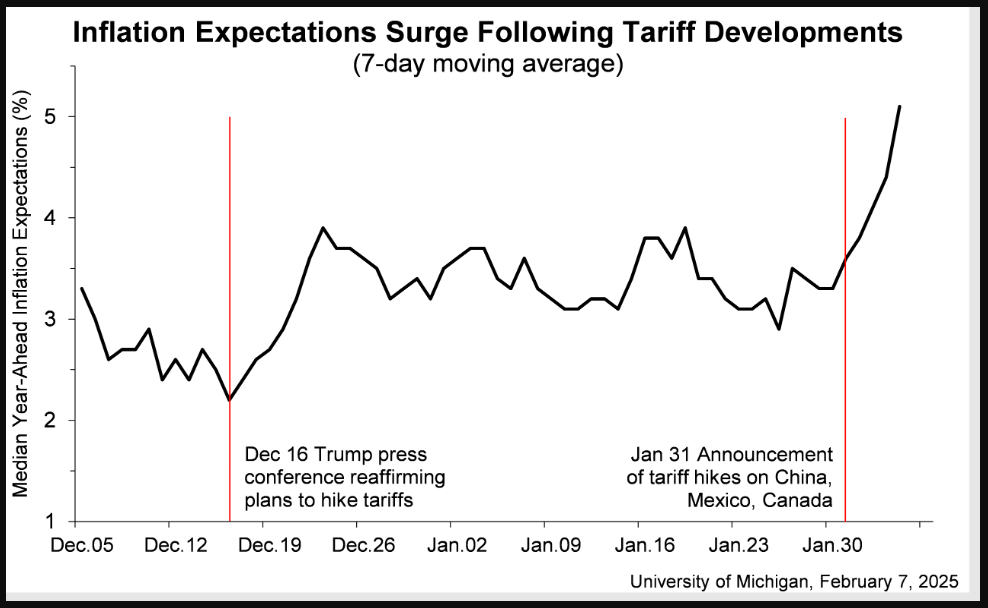

A significant uptick in inflation expectations was seen with the release of the preliminary Michigan consumer sentiment data. Inflation expectations for the next year jumped to 4.3%, the highest since November 2023, up from 3.3%. This is only the fifth time in 14 years that year-ahead inflation expectations have risen by one percentage point or more in a single month.

Many people are worried that high inflation could make a comeback within the next year. Meanwhile, long-term inflation expectations also increased slightly to 3.3%, the highest since June 2008, up from 3.2%.

There was also an impact on the overall sentiment, with the report showing sentiment in the US dropped to 67.8 in February 2025 from 71.1 in January. This was below expectations of 71.1. It marks the second month of declines, with sentiment hitting its lowest level since July 2024.

The current economic conditions index fell to 68.7 from 74, while the expectations index also dropped to 67.3 from 69.3. Additionally, views on buying durable goods fell by 12%, partly because many believe it’s too late to avoid the negative effects of tariff policies.

This news actually had a bigger impact on the markets than the actual NFP and jobs report which was highly anticipated.

The Labor Department reported that the U.S. economy added 143,000 jobs in January, which was less than the 170,000 jobs economists had predicted. The unemployment rate was 4%, slightly better than the expected 4.1%. However, the data also showed that the economy created 598,000 fewer jobs in the year up to March than previously estimated.

In the aftermath of the data releases we saw the US indices surrender the initial gains made to trade lower on the day. The S&P 500 was down around 0.83% while the Nasdaq was trading down around 1.15%.

My take on the data is that there is just enough in the data to stoke some concern in the minds of market participants.

On the FX Front, there was a solid end to the week for the US Dollar Index (DXY) after the rise in inflation expectations. The Dollar looked on course to end the week with a whimper before finishing the week strong and dragging all dollar denominated majors lower.

EUR/USD and GBP/USD both struggled on Friday with cable in particular surrendering some of its weekly gains.

Gold rose to print fresh all time highs once more before falling hard following the Michigan data release as well. Gold surrendered its all time high at 2886 before trading at 2858 at the time of writing.

Oil on the other hand enjoyed a rather mixed week but is set to conclude its third consecutive week of losses with Brent trading at 75.00 at the time of writing. Fear around Iranian sanctions were overcome by tariffs and how they may impact growth and thus global demand.

Weakening Oil demand remains an even greater concern following the arrival of the Trump administration and a period of tariff uncertainty.

The Week Ahead: US CPI and Powell Testimony to Dominate

Asia Pacific Markets

The main focus this week in the Asia Pacific region is tariff developments and inflation data from China.

From China, the key event to watch is whether China and the US hold high-level talks soon. Currently, the US has added 10% tariffs on Chinese goods, though exemptions for items in transit mean the impact may take time.

China plans to impose its own tariffs on February 10, leaving a short window for potential negotiations to ease tensions. President Trump did say on Friday that he will probably meet Xi Jinping soon but no date has been given as yet.

On the data side, China will release January’s CPI inflation on Sunday. A slight increase to 0.4% YoY is expected, driven by higher food prices from the Lunar New Year, while non-food inflation is likely to stay low. The People’s Bank of China will also report January’s credit activity data next week.

Europe + UK + US

In developed markets, the US CPI release and testimony from Fed Chair Jerome Powell will dominate proceedings. We will also get a glimpse into the growth picture for both the UK and EU this week. GDP growth continues to plague the Euro Area, with Eurozone GDP Preliminary data being released on Friday.

US inflation data is expected to show a 0.3% monthly rise in both headline and core measures. Food and energy costs, housing prices, and rising vehicle prices are driving this increase. While tariffs have been paused for now, there’s a chance they could return later this year, keeping inflation high. This makes it unlikely the Fed will cut rates before June.

Fed Chair Jerome Powell will testify to Congress as the Fed releases its semi-annual monetary policy report. I expect the report to touch on the uncertainty caused by Trump’s policies but confirm that further rate cuts depend on economic data. Despite Trump’s initial rhetoric of pressure on the Fed, recent suggestions by his administration is that such a move is unlikely.

UK GDP data is due on Thursday with growth likely to have slowed in the second half of last year, and fourth-quarter GDP likely flat. Growth may improve in 2025 due to higher government spending, but it’s expected to fall short of the 2% forecast by the Office for Budget Responsibility. This, along with potential data revisions, adds pressure to the Treasury’s March Spring Statement, especially as rising debt costs have reduced fiscal flexibility.

Chart of the Week – US Dollar Index (DXY)

This week’s focus is on the US Dollar Index (DXY) after it recovered late on Friday and is looking like it is ready to print a fresh high.

The rising inflationary expectations may get a nod if US CPI comes in higher than expected, while any new tariff announcements will likely add to the USDs appeal.

Looking at the technical picture, the DXY has printed a higher low on the daily timeframe hinting at the possibility of a change in structure. The daily candle on Friday is struggling to close above the key 108.00 resistance level however, with a close above likely to give bulls confidence that further gains may materialize.

Failure to do so could see the DXY retest the 107.00 handle in the early part of next week which may add a further dimension to the US CPI release.

US Dollar Index Daily Chart – February 7, 2025

Key Levels to Consider:

Support

- 107.00

- 106.13

- 105.63

Resistance

- 108.49

- 109.52

- 110.00

Original Post