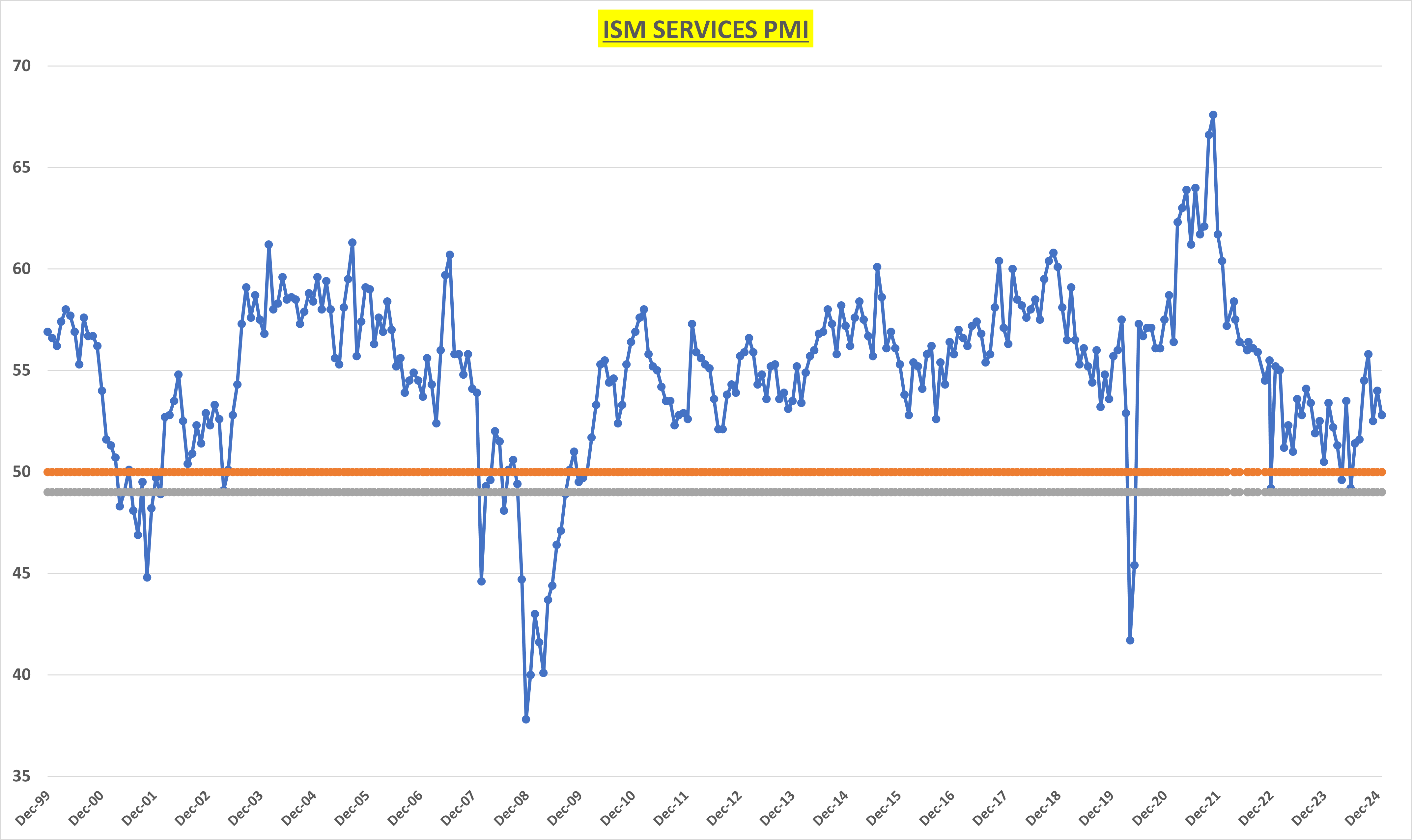

The services sector expanded at a slower pace than expected in January, with the

ISM PMI

coming in at 52.8. The street was expecting 54.2, and January’s result was lower than the previous month at 54. However, any reading above 50 is considered growing. This makes the 7th straight month of growth in the services sector (which comprises about 70% of the US economy).14 of the 18 major services industries reported growth for the month.

“Poor weather conditions were highlighted by many respondents as impacting business levels and production. Like last month, many panelists also mentioned preparations or concerns related to potential U.S. government tariff actions; however, there was little mention of current business impacts as a result.”

Business activity fell from 58 to 54.5 in January, with 9 industries reporting growth.

“Spending by customers has increased; unclear if it’s truly a pickup in business or panic buying ahead of potential tariffs driving up prices.”

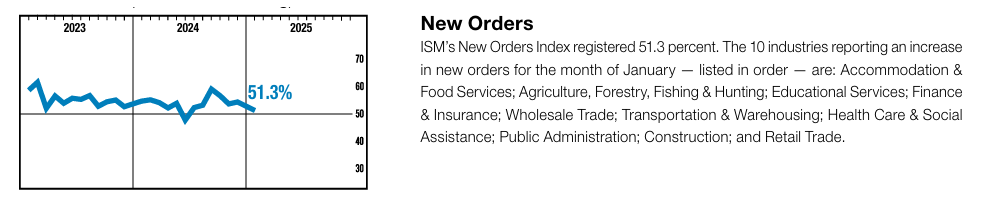

New orders fell from 54.4 to 51.3, with 10 industries reporting growth.

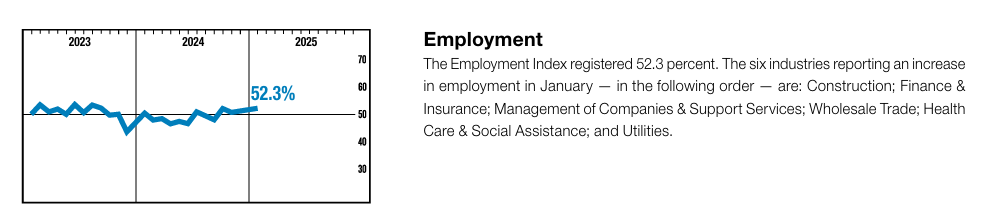

While employment increased from 51.3 to 52.3, with 6 industries reporting growth.

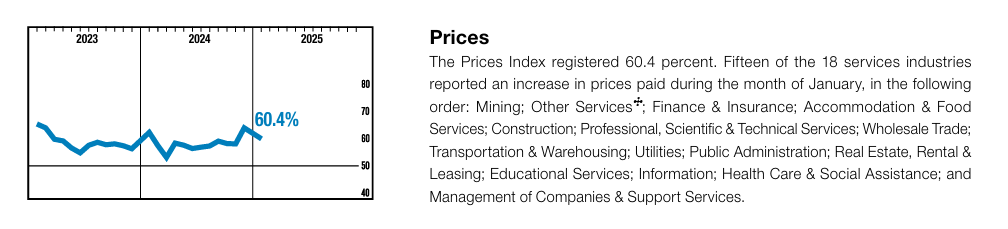

Prices paid fell from 64.4 to 60.4, with 15 of 18 service industries reporting having to pay higher prices for input costs. Although its good to see this subindex decline, it remains well above where we’d like to see it.

Altogether not a bad start to the new year, considering the manufacturing sector reported its first month of expansion in years. This combined with the services sector continues its expansion, although at a slower pace. This marks the first time that the services and manufacturing sectors have both been in expansionary territory since September 2022. Although it’s difficult to tell how much of this is related to the looming tariff threat.