Key Statistics:

- Release Period: December 2024

- Last Release Date: December 11, 2024,

- Actual: 2.7% vs Forecast: 2.7%. Previous: 2.6%

DECEMBER FORECAST = 2.9%

- Release Date: January 15, 2024, at 08:30 AM ET.

Purpose:

It measures changes in the price of goods and services purchased by consumers. Consumer prices account for most of the overall inflation. Inflation is important to the central bank to raise interest rates out of respect for their inflation containment mandate.

Key Highlights:

- US CPI expectation is between 2.80 (range low) to 2.93% (range high) YoY headline inflation, 3.3% YoY “ core ” inflation.

- Headline inflation 12-month trailing average is 3.0.

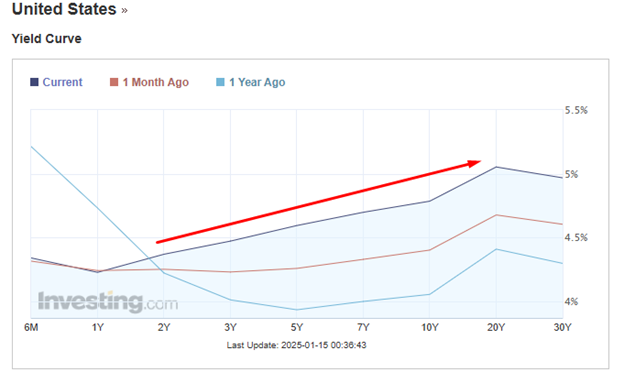

- US10Y yields have surged to 14-month peak at 4.799% on Monday Jan 13 a few days ahead of Trump taking White house.

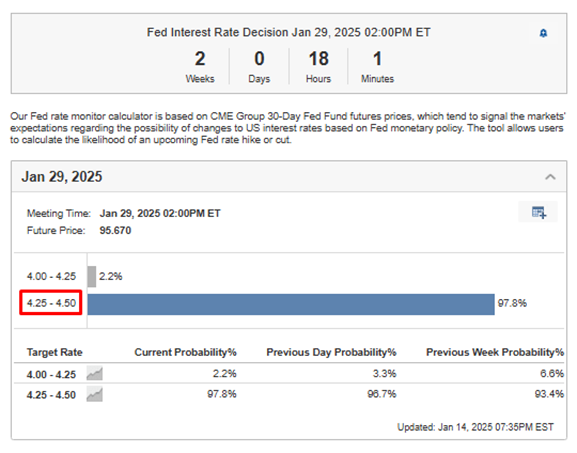

- Investing.com Fed Rate Monitor shows 97.8% probability of no rate cut on Jan 29 by Fed.

- The S&P 500 experienced a slight increase, while the Nasdaq declined following a turbulent trading session on Tuesday. Investors evaluated inflation data and prepared for upcoming quarterly earnings reports to validate stock valuations and assess the strength of the U.S. economy.

US Treasury & Bond Yields

FED Rate Monitor

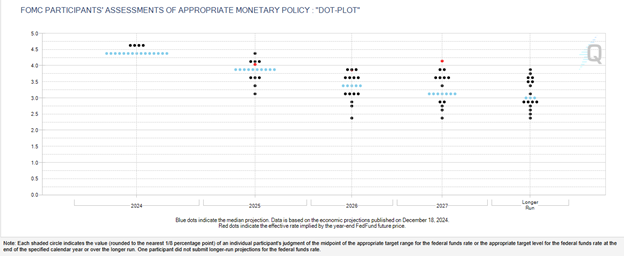

FOMC Projections (DOT-PLOT)

- The Fed’s dot plot records each Fed official’s projection for the Fed Fund rate on a quarterly basis.

- Blue dots indicate the median projections.

US 10Y Yields Technical View:

- US 10Y Yields rose in a channel from December 2023 to April 2024 for 17 weeks.

- Yields have been imitating a similar channel like scenario since September 2024 which is now in 17th week.

- As charts practitioners say that “history repeats itself” if that becomes a reality this time then a decline to 3.60% for 20 weeks is in the offing.

Technical Analysis Perspective:

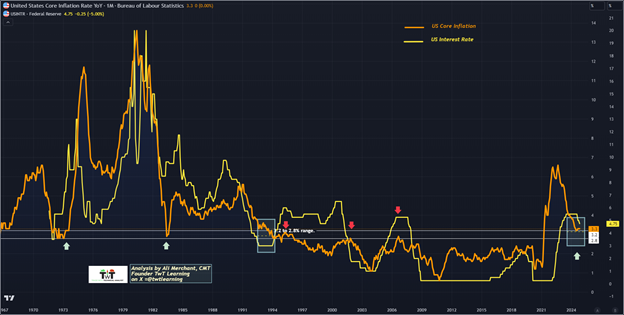

- The US Core inflation YoY has remained above 3.2% since August 2024.

- A key observation from the following chart suggests that if the core inflation rises higher from 3.2% to 3.3% like in August 1992, it takes a couple of months before it goes lower.

- From September 1992 the Fed kept the rates unchanged for a couple of months to bring the inflation down below 3% and raised rates once the inflation dropped to 2.8% in April 1994.

- Since August 2024 Core inflation has been maintaining 3.2 to 3.3% suggesting that Fed will have to be patient before the inflation meets their target of 2%.

- Fed may keep the rates unchanged for the next couple of meetings in 2025.

The US Core Inflation YoY chart overlayed with US Interest Rates:

Conclusion:

US 10-Year yields suggest that the interest rate will drop in the medium-term, while core inflation staying above 3.2 to 3.3% in August 1992 forced Fed to hold the rate for quite a long time. We need more data to have a better understanding of the future Fed action.

A word of wisdom:

“The market can remain irrational longer than you can remain solvent” is a quote by economist John Maynard Keynes that emphasizes the unpredictable nature of financial markets. The quote means that investors should not bet against the market, even when they believe it is mispriced or irrational, because it is difficult to predict when the market will correct itself.