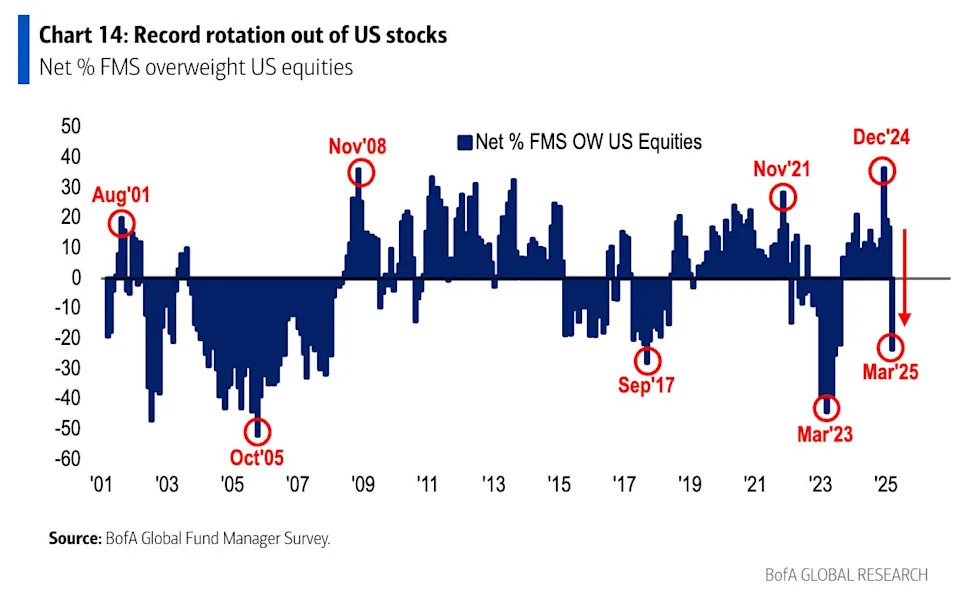

As US stocks slipped into a 10% correction last week, investors were dumping shares at a record clip.

Global fund managers reduced their allocations to US equities by the most ever between March 7 and 13, according to a Bank of America survey featuring 171 investors overseeing a combined $426 billion in assets.

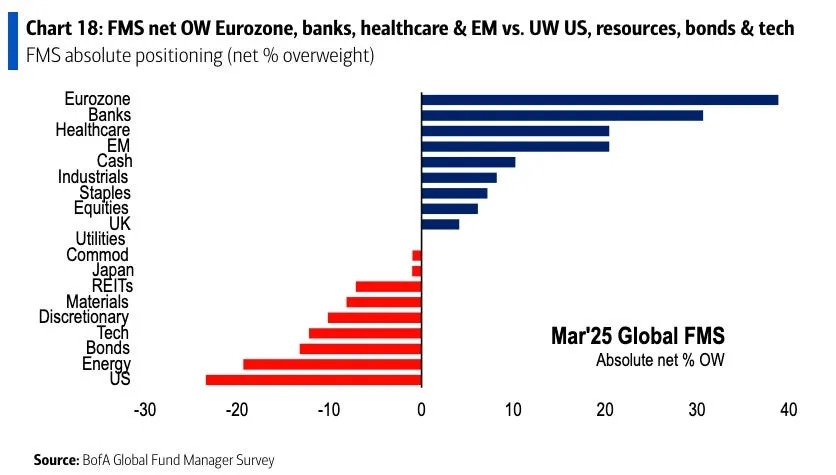

Bank of America says the rotation out of US stocks into international assets like eurozone, UK, and emerging-market equities was driven by concerns of an economic slowdown .

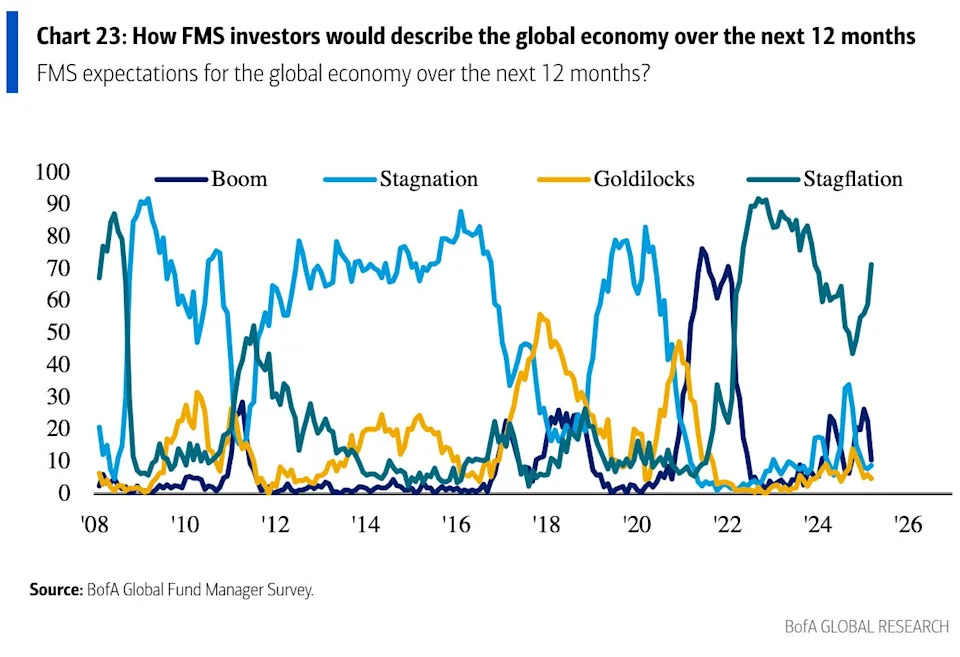

Key among investor worries is the possibility of stagflation , which involves a toxic mix of below-trend growth and persistently high inflation. It effectively ties the Fed's hands, leaving them unable to raise or lower rates in order to address either situation.

71% of fund managers said they expected a stagflation to hit the global economy over the next 12 months, the survey showed.

The main culprit in the stagflation narrative is Trump's trade war . After an initial boom period built around pro-business expectations, the luster has worn off, and investors and economists alike have started to fret about a global slowdown.

The chart below shows how pronounced stagflation worry has become in recent months:

Another common refrain in the fund manager survey was that US exceptionalism as we know it may be over. 69% of fund managers said they think US outperformance relative to the rest of the world has "peaked."

As such, following the record-sized allocation trimming last week, fund managers are now positioned 23% underweight the US equity market, the lowest since June 23.

Bank of America strategists led by Michael Hartnett do see the possibility of a near-term rebound in US stocks, with the S&P 500 potentially climbing past 6,000 in the second quarter if concerns about inflation and the trade war begin to subside. On the flip side if the economy tips into a recession, the bank says the S&P 500 could drop below 5,000.

Read the original article on Business Insider