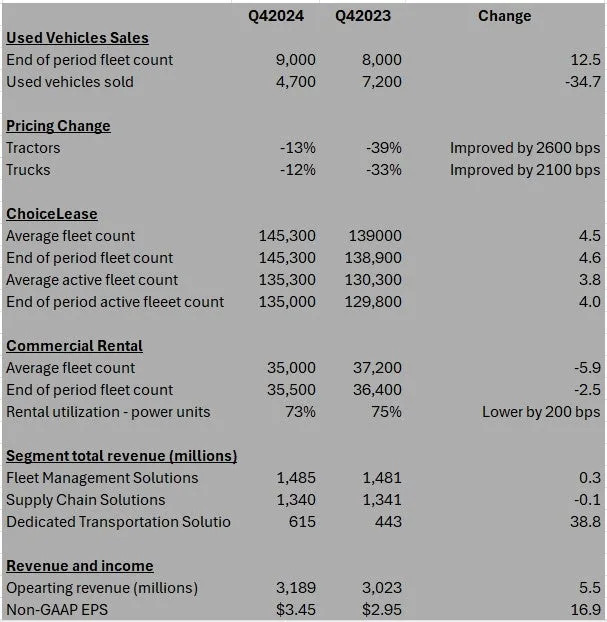

Ryder System’s data on used car sales showed a significant change year on year, according to the company’s fourth-quarter earnings released Wednesday morning. That Ryder data is considered a leading indicator of the strength of the used vehicle market. The company only sold 4,700 vehicles during the quarter, compared to 7,200 a year ago. Third-quarter sales also were 4,700 units.

The used vehicle price obtained by Ryder (NYSE: R) was down 13% for tractors and 12% for trucks year on year. However, a year ago, the rate of price decline from 2023 was 39% for tractors and 33% for trucks.

The 13% year-on-year decline for tractors was an improvement from the third quarter, when the decline was 22%. For trucks, the third-quarter decline year on year was 19%. Ryder also said unit sales out of the Fleet Management Solutions (FMS) segment were down 3% for trucks and 2% for tractors sequentially from the third quarter.

There was a drop in volume for rental demand across most Ryder divisions. SelectCare, a lease contract under the core FMS segment, had 44,900 vehicles under contract compared to 51,800 a year earlier. Vehicles under contract with Supply Chain Solutions (SCS) dropped to 13,000 from 13,800 a year ago. Not surprisingly, given the acquisition of Cardinal Logistics in February, vehicles under contract at Dedicated Transportation Solutions (DTS) were 19,100 versus 10,900 a year ago.

FMS revenue was flat year on year. SCS, the company’s contract logistics business, was up 3% year on year. The DTS group was up 39%, reflecting in part the Cardinal acquisition.

For the full year, Ryder reported GAAP earnings of $11.06, up from $8.73 in the prior year. In releasing its first forecast for 2025, the company said it expects GAAP earnings of $12.40-$13.40. Revenue growth is expected to be about 2%.

The earnings call with analysts is set for 11 a.m. EST. The first signals from the equity markets to the earnings were positive, with Ryder stock up about 2% approximately a half-hour after the earnings were released. Ryder stock is up about 35% in the past year.

More articles from John Kingston

Proficient, in midst of huge upheaval for auto carriers, is cautious in analyst earnings call

BLS revision: Far fewer workers in truck transportation than earlier estimated

In a weak quarter for brokerages, RXO’s stock price takes a pounding after earnings

The post First look: Ryder data offers mixed signals on strength of used vehicle market appeared first on FreightWaves .