Car rental services provider Avis (NASDAQ:CAR) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 2% year on year to $2.71 billion. Its GAAP loss of $55.66 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Avis Budget Group? Find out in our full research report .

Avis Budget Group (CAR) Q4 CY2024 Highlights:

“We took the necessary actions to accelerate our fleet rotation in the Americas segment, which will create more certainty in our fleet costs and better position us for sustainable growth for 2025 and beyond. Travel demand is strong, and our brands are well-positioned to take advantage of this activity,” said Joe Ferraro, Avis Budget Group Chief Executive Officer.

Company Overview

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ:CAR) is a provider of car rental and mobility solutions.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

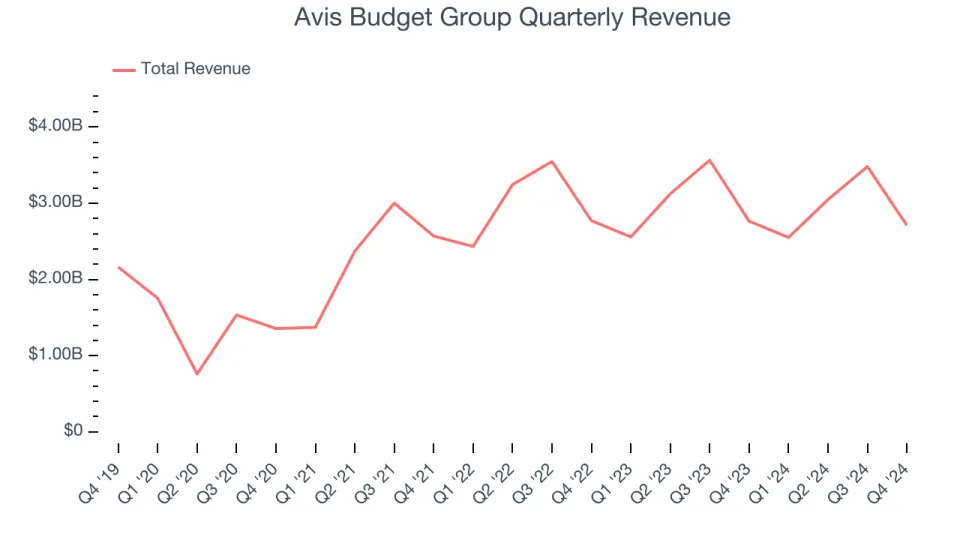

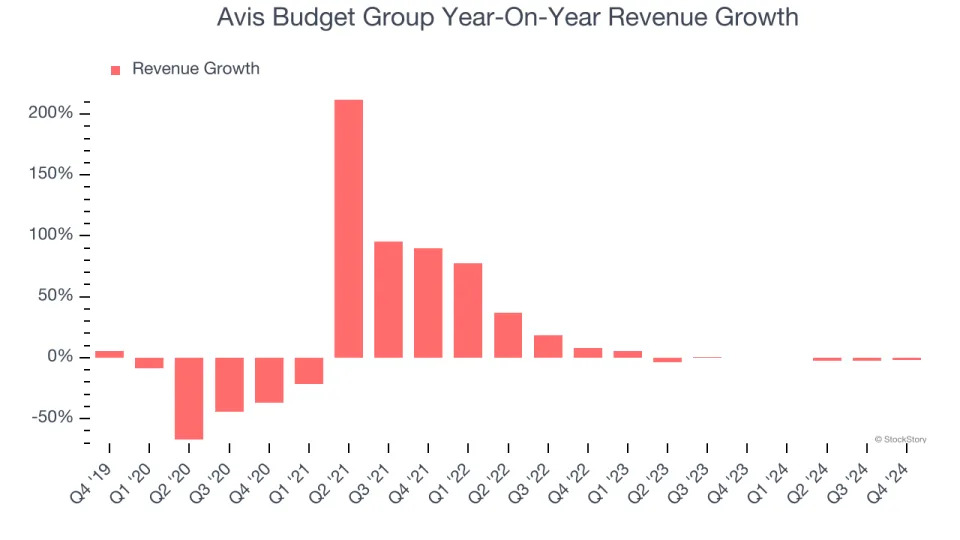

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Avis Budget Group’s sales grew at a tepid 5.1% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Avis Budget Group’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Ground Transportation businesses have faced declining sales because of cyclical headwinds. While Avis Budget Group’s growth wasn’t the best, it did perform better than its peers.

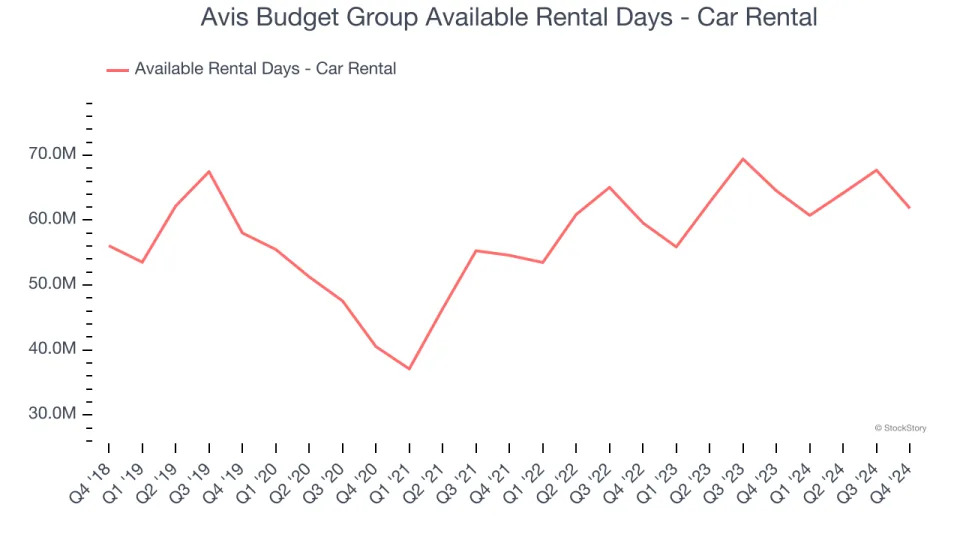

We can dig further into the company’s revenue dynamics by analyzing its number of available rental days - car rental, which reached 61.82 million in the latest quarter. Over the last two years, Avis Budget Group’s available rental days - car rental averaged 3.4% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Avis Budget Group missed Wall Street’s estimates and reported a rather uninspiring 2% year-on-year revenue decline, generating $2.71 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

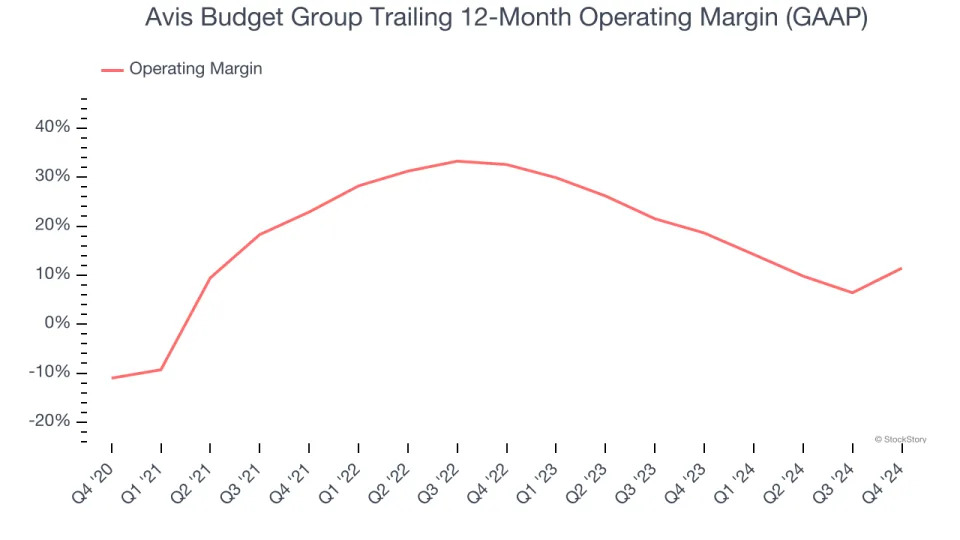

Operating Margin

Avis Budget Group has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Avis Budget Group’s operating margin rose by 22.4 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, Avis Budget Group generated an operating profit margin of 30.8%, up 21.9 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

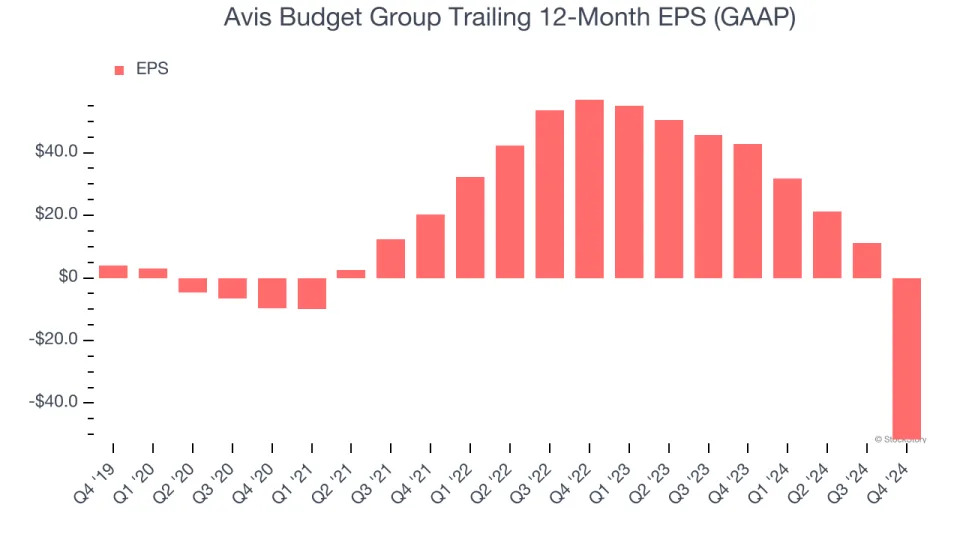

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Avis Budget Group, its EPS declined by 71.6% annually over the last five years while its revenue grew by 5.1%. However, its operating margin actually expanded during this time and it repurchased its shares, telling us the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Avis Budget Group, its two-year annual EPS declines of 70.5% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q4, Avis Budget Group reported EPS at negative $55.66, down from $7.14 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Avis Budget Group’s full-year EPS of negative $51.75 will flip to positive $12.05.

Key Takeaways from Avis Budget Group’s Q4 Results

Revenue missed by 1%. EBITDA missed significantly due to a change in strategy to "significantly accelerate fleet rotations, which resulted in shortening the useful life of the majority of our vehicles in the Americas segment." Overall, this was a weaker quarter. This was driven The stock remained flat at $88.99 immediately after reporting.

Avis Budget Group’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .