Healthcare royalties company Royalty Pharma (NASDAQ:RPRX) missed Wall Street’s revenue expectations in Q4 CY2024, with sales flat year on year at $594 million. Its GAAP profit of $0.57 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Royalty Pharma? Find out in our full research report .

Royalty Pharma (RPRX) Q4 CY2024 Highlights:

“We had an incredibly successful 2024, delivering double-digit growth in Royalty Receipts, which was significantly above our initial guidance, and deploying $2.8 billion of capital on value-enhancing royalties” said Pablo Legorreta, Royalty Pharma’s founder and Chief Executive Officer.

Company Overview

Founded in 1996, Royalty Pharma (NASDAQ:RPRX) acquires pharmaceutical royalties and funds late-stage clinical trials, offering a unique revenue model centered on financing innovative drug development.

Branded Pharmaceuticals

The branded pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs. Successful products can generate significant revenue streams over their patent life, and the larger a roster of drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and intense competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Sales Growth

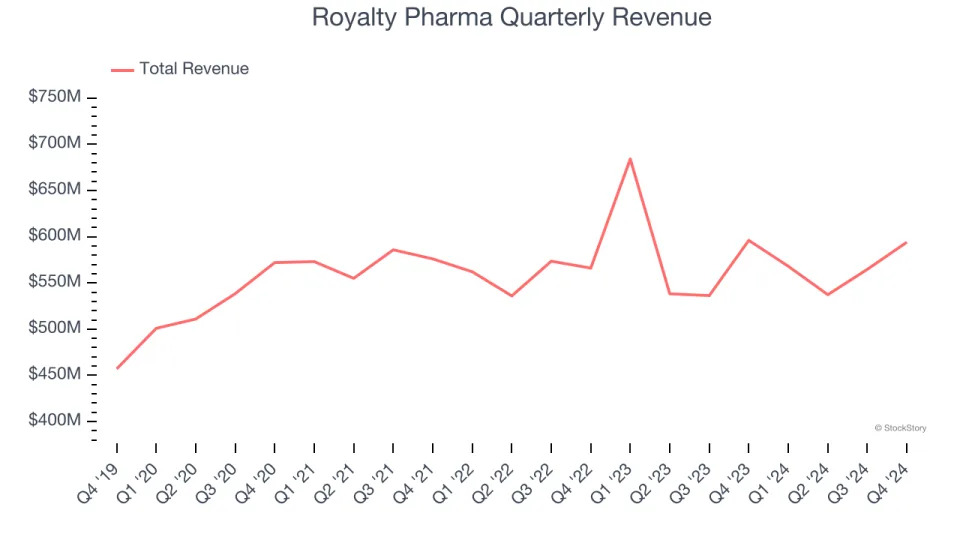

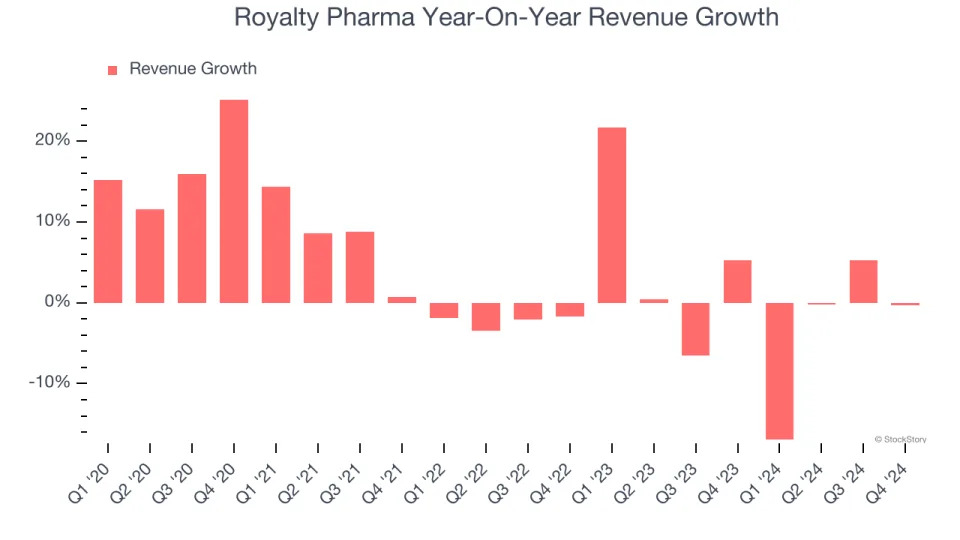

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Royalty Pharma grew its sales at a mediocre 4.5% compounded annual growth rate. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Royalty Pharma’s recent history shows its demand slowed as its revenue was flat over the last two years.

Royalty Pharma also breaks out the revenue for its most important segment, Portfolio Receipts. Over the last two years, Royalty Pharma’s Portfolio Receipts revenue averaged 10.7% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Royalty Pharma missed Wall Street’s estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $594 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 17.3% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

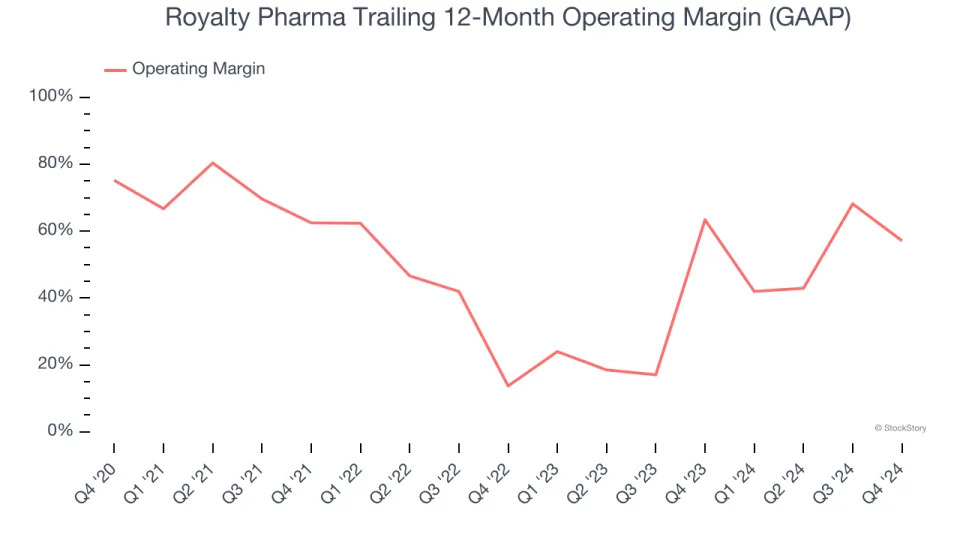

Royalty Pharma has been a well-oiled machine over the last five years. It demonstrated elite profitability for a healthcare business, boasting an average operating margin of 54.3%.

Analyzing the trend in its profitability, Royalty Pharma’s operating margin decreased by 18.1 percentage points over the last five years, but it rose by 43.4 percentage points on a two-year basis. Still, shareholders will want to see Royalty Pharma become more profitable in the future.

This quarter, Royalty Pharma generated an operating profit margin of 60.9%, down 41.9 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

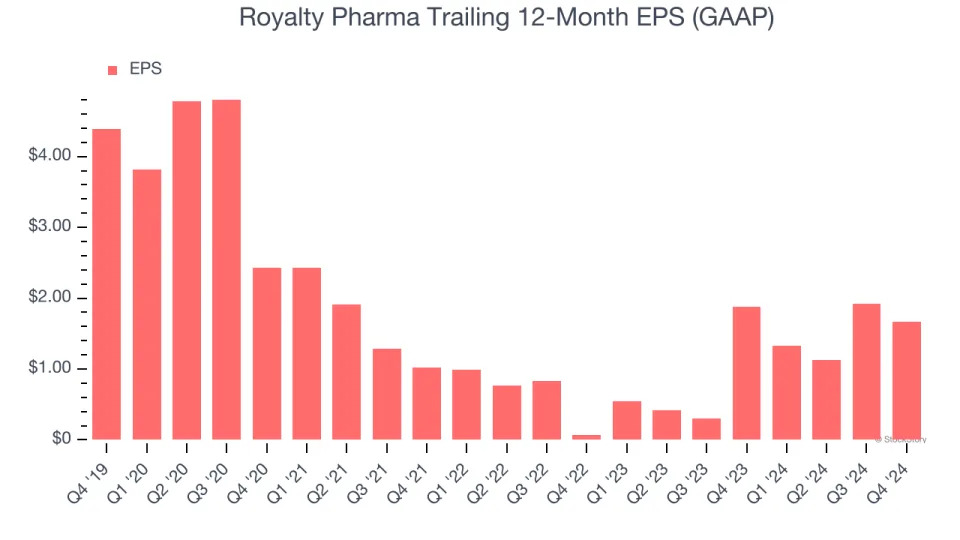

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Royalty Pharma, its EPS declined by 17.6% annually over the last five years while its revenue grew by 4.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Royalty Pharma’s earnings can give us a better understanding of its performance. As we mentioned earlier, Royalty Pharma’s operating margin declined by 18.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Royalty Pharma reported EPS at $0.57, down from $0.83 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Royalty Pharma’s Q4 Results

We were impressed by how significantly Royalty Pharma blew past analysts’ portfolio receipts and EPS expectations this quarter. We were also glad its full-year guidance for portfolio receipts exceeded Wall Street's estimates. Overall, this quarter was solid. The stock traded up 2.2% to $32.45 immediately after reporting.

So do we think Royalty Pharma is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .