Non-lethal weapons company Byrna (NASDAQ:BYRN) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 78.9% year on year to $27.98 million. Its GAAP profit of $0.41 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Byrna? Find out in our full research report .

Byrna (BYRN) Q4 CY2024 Highlights:

Byrna CEO Bryan Ganz stated: “The fourth quarter was the culmination of a remarkable year for Byrna. We successfully generated a record $28.0 million in revenue while also expanding our gross margins to 62.8%. This success allowed us to deliver a 101% increase in revenue from the full year 2023 to 2024 and underscores the overall growth in brand recognition and normalization of the less-lethal space."

Company Overview

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ:BYRN) is a provider of non-lethal weapons.

Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

Sales Growth

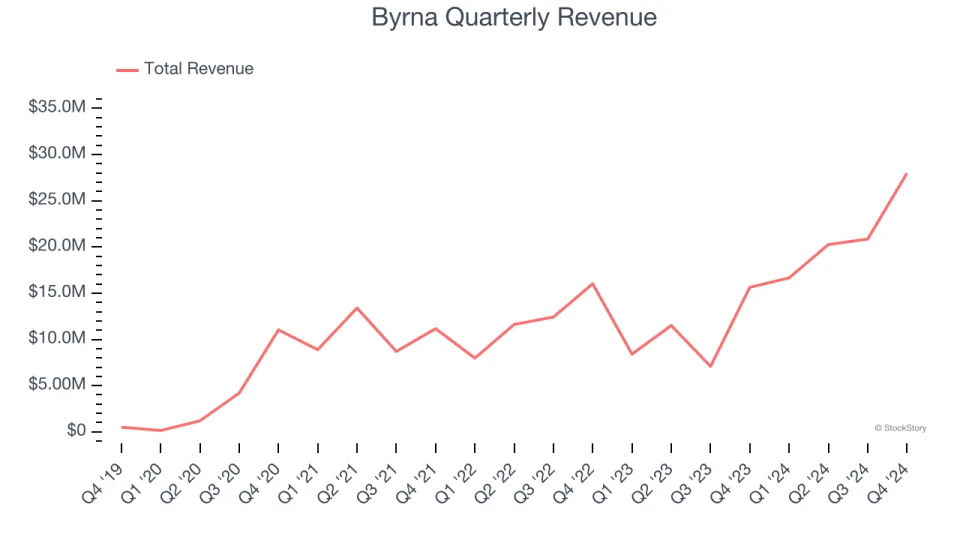

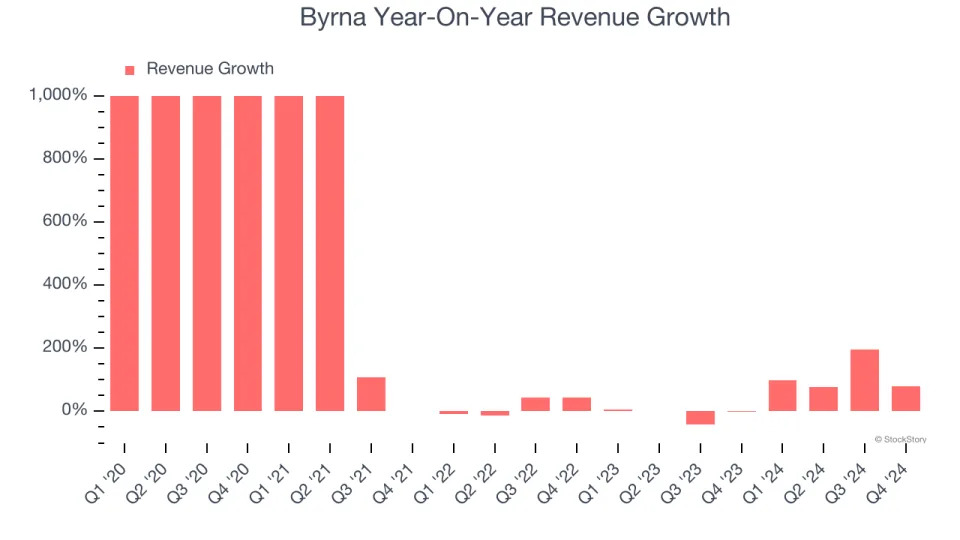

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Byrna’s sales grew at an incredible 147% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Byrna’s annualized revenue growth of 33.6% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Byrna’s year-on-year revenue growth of 78.9% was magnificent, and its $27.98 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 18.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and suggests the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

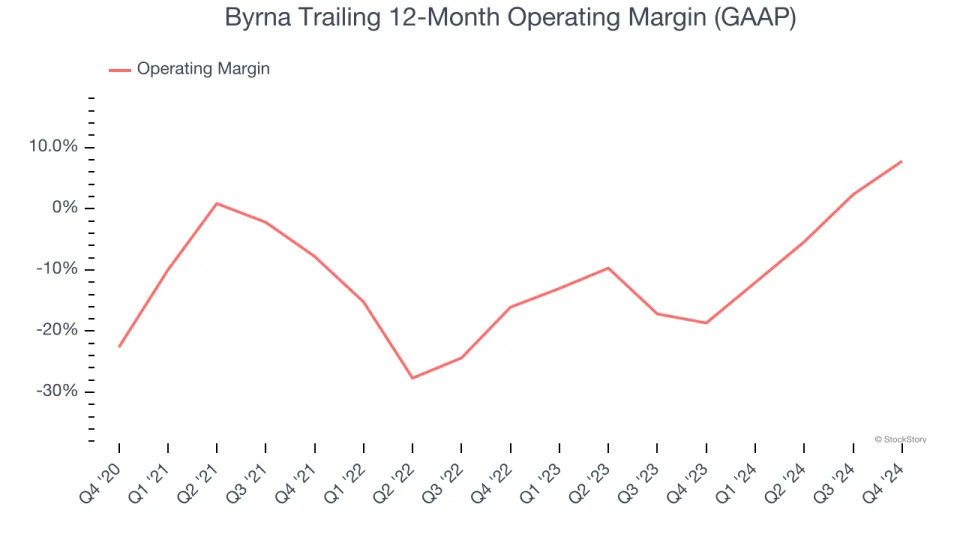

Although Byrna was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Byrna’s operating margin rose by 30.4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Byrna generated an operating profit margin of 14.6%, up 20.2 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

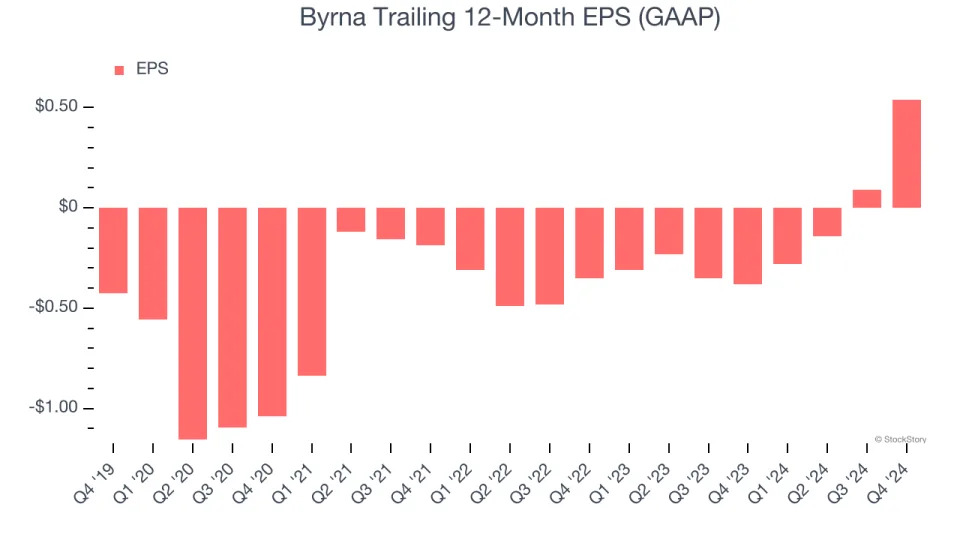

Byrna’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Byrna, its two-year annual EPS growth of 88.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Byrna reported EPS at $0.41, up from negative $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Byrna to perform poorly. Analysts forecast its full-year EPS of $0.54 will hit $0.28.

Key Takeaways from Byrna’s Q4 Results

We were impressed by how significantly Byrna blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock traded up 9.1% to $30 immediately following the results.

Sure, Byrna had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .