- Tariff headlines remain at the top of investors’ agendas

- But flash S&P Global PMIs could attract special attention

- Auctions to reveal information about demand for Treasuries

- Tokyo CPI data and Canada’s retail sales also on tap

Trump’s Back and Forth Tariff Game

Since the beginning of the month, the spotlight has been locked on headlines surrounding Trump’s tariff policies and the response of the US trading partners, with economic data taking second place.

After announcing reciprocal tariffs, the US President decided to declare a 90-day pause and keep only a 10% baseline tariff. But China received different treatment. The tit-for-tat tariff game between the world’s two largest economies led to a 145% levy on Chinese imports to the US and China retaliated with a 125% duty on US imports.

Last Friday, the White House granted exclusions for certain electronics imported from China, though Trump said that the exemption will be short-lived. A few days later, he said that he is considering tariffs on semiconductors and pharmaceuticals.

The back-and-forth strategy of the US President has left investors scratching their heads about his next steps, with many remaining fearful about a recession later this year. This is evident by the fact that despite the three-month delay and the tech-related exclusions, the stock market has turned south again this week, while the dollar extended its tumble, raising questions about its sustainability as the world’s reserve currency. Although they stabilised during the last few days, US Treasuries were also abandoned massively last week, with gold and the Swiss franc acting as the ultimate safe havens.

Recession Fears Remain Elevated

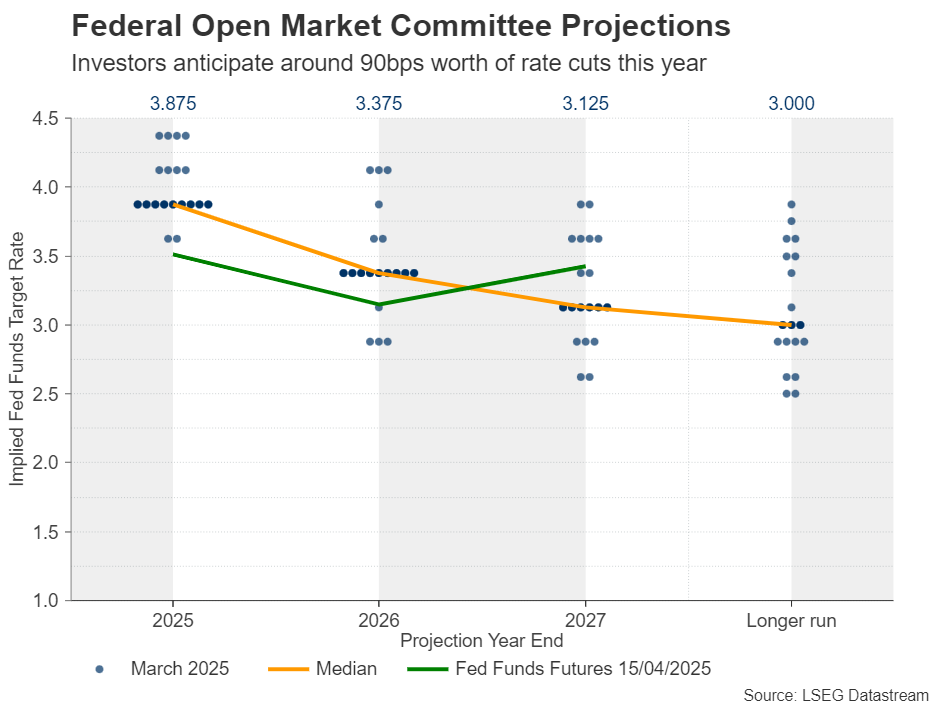

As for the Fed, Boston Fed President Susan Collins said on Friday that the Committee stands ready to stabilize the market if needed, while investors are pencilling in around 90bps worth of

rate cuts

this year.

Having said all that, although investors remain extremely nervous about a potential recession, such a scenario has not been fully priced in yet. Even JPMorgan, which is considered one of the most pessimistic commercial banks, is assigning a 60% probability of a recession. Goldman Sachs sees a 45% recession chance.

Therefore, with the agenda appearing very light in terms of economic releases and data next week, investors will keep their gaze locked on news surrounding tariffs and there may be more to digest should the trade landscape worsen. Not only could US-Sino tensions intensify, but Trump could withdraw the three-month delay adding pressure on US allies to deal with a new reality.

Flash PMI Data in the Spotlight

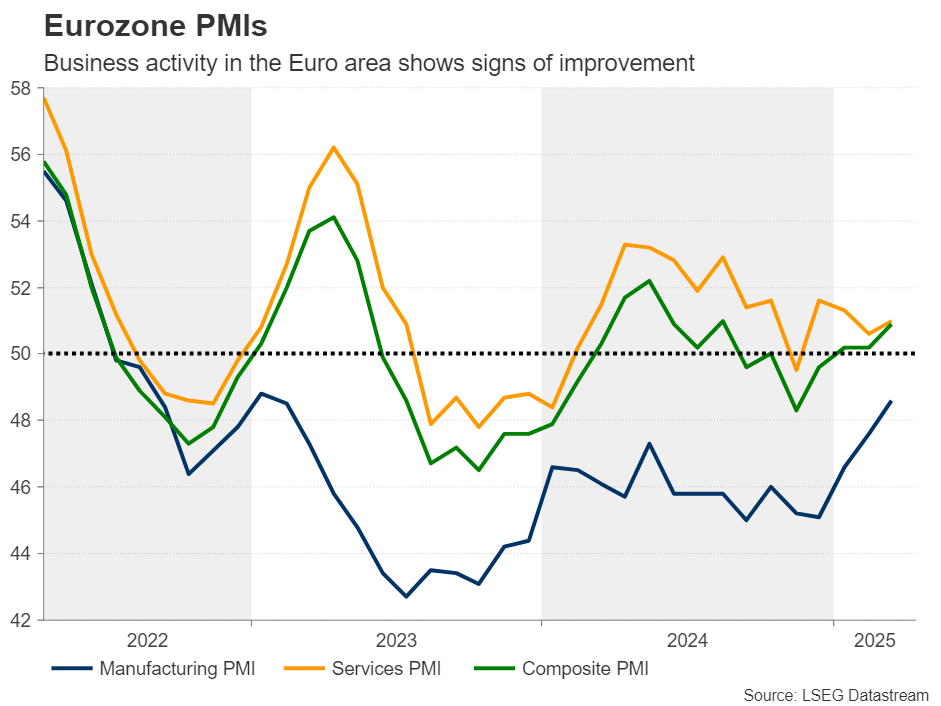

In terms of data, the highlight may be the preliminary S&P Global PMIs for the month of April from the Eurozone, the UK and the US.

In the Eurozone, business activity grew at its fastest pace in seven months in March and could gain more traction in the coming months due to optimism that massive spending for infrastructure and defence in Germany, Euro area’s

Having said that though, April was also faced with increasing uncertainty and volatility due to the changing tariff dynamics. This poses some downside risks as businesses may have turned a bit more cautious this month.

Ergo, weaker-than-expected numbers could result in a pullback in the euro , but whether this will signal the end of the prevailing rally remains doubtful. Investors are already pencilling in 85bps worth of rate cuts by the ECB this year, which makes it very difficult for the ECB to turn even more dovish. What’s more, the Eurozone holds a decent percentage of foreign owned US assets and, thus, when investors around the globe are dumping US assets, some of them are converted back to euros.

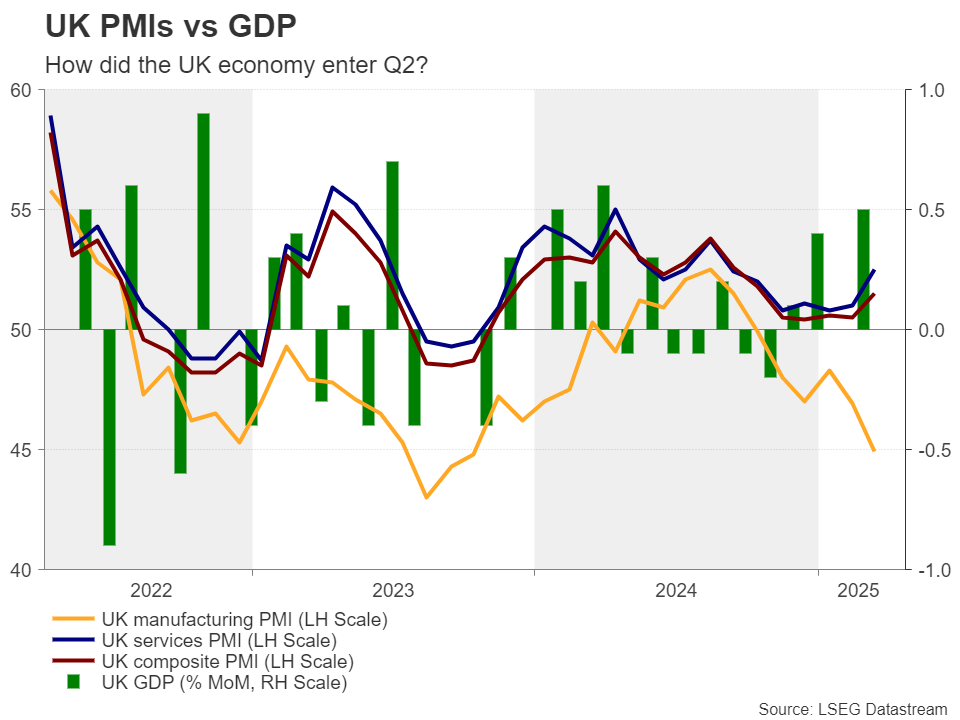

In the UK, following the slowdown in the CPI numbers for March, investors are assigning a strong 85% probability of a 25bps reduction at the May BoE decision, while by the end of the year, they are pencilling in 85bps worth of cuts.

A set of improving PMI s is unlikely to alter expectations of a rate cut at the upcoming gathering, but it could prompt investors to scale back their bets for the remainder of the year. The UK retail sales report is scheduled to be released on Friday.

The US PMI s may also attract special attention as, with the Atlanta Fed GDPNow model pointing to a 2.4% contraction for the first quarter of 2025, market participants will be eager to find out how business activity entered the second quarter. Next week, the agenda includes several Treasury auctions. Following last week’s massive selloff, it will be interesting to see whether demand remained subdued or showed some sort of improvement.

Tokyo CPI Data, Canada’s Retail Sales, Earnings Results

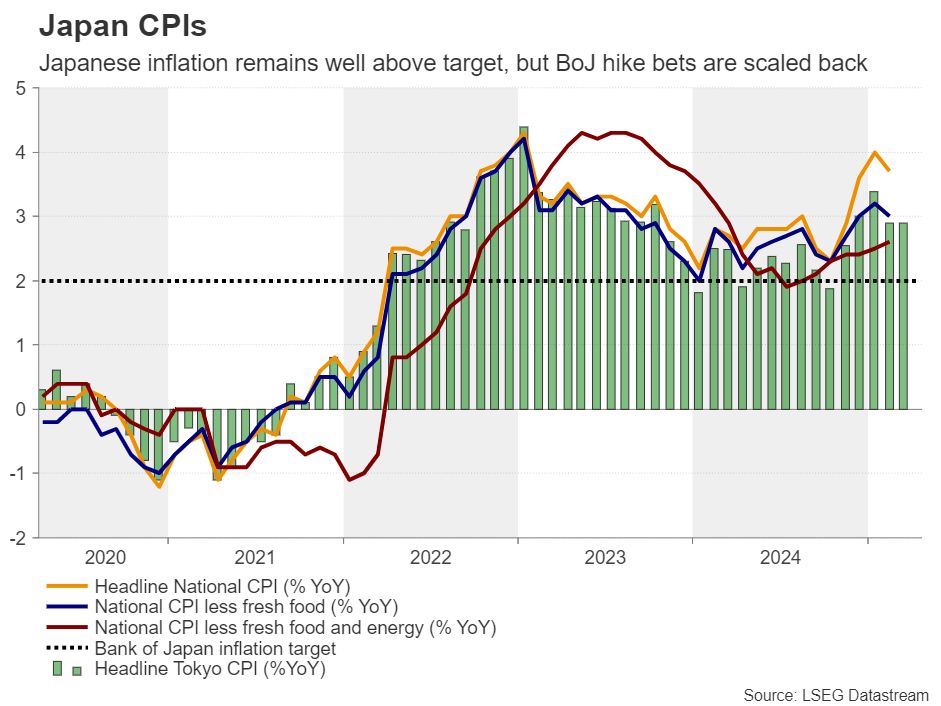

Elsewhere, from Japan, the Tokyo CPI numbers for April are due to be released during the Asian session on Friday, while later in the day, Canadian retail sales for March will be released.

Bets that the BoJ will proceed with at least another 25bps rate hike this year have been scaled back due to the tariff-related market turbulence, with traders now pencilling only 10bps worth or rate increases by December. Even if the CPI data reveals some acceleration, it is very doubtful that the market will return to its pre-tariff state, when there was an 80% chance of a quarter-point hike in June.

Yet, the yen seems to be enjoying some safe-haven inflows, with

dollar/yen

dropping to its lowest level since September.

As for Canada, the Bank of Canada kept interest rate s unchanged this week, with the forward guidance leaning towards the hawkish side. The statement emphasized that “Monetary policy cannot resolve trade uncertainty or offset the impacts of a trade war. What it can and must do is maintain price stability for Canadians.” Investors are now expecting less than two quarter-point cuts by the end of the year, and a decent set of retail sales could prompt them to further scale back those bets. This could help the loonie drift higher.

On the earnings front, Tesla (NASDAQ: TSLA ) and Google’s parent Alphabet (NASDAQ: GOOGL ) are scheduled to report their results on Tuesday and Thursday, respectively.