Consumer spending

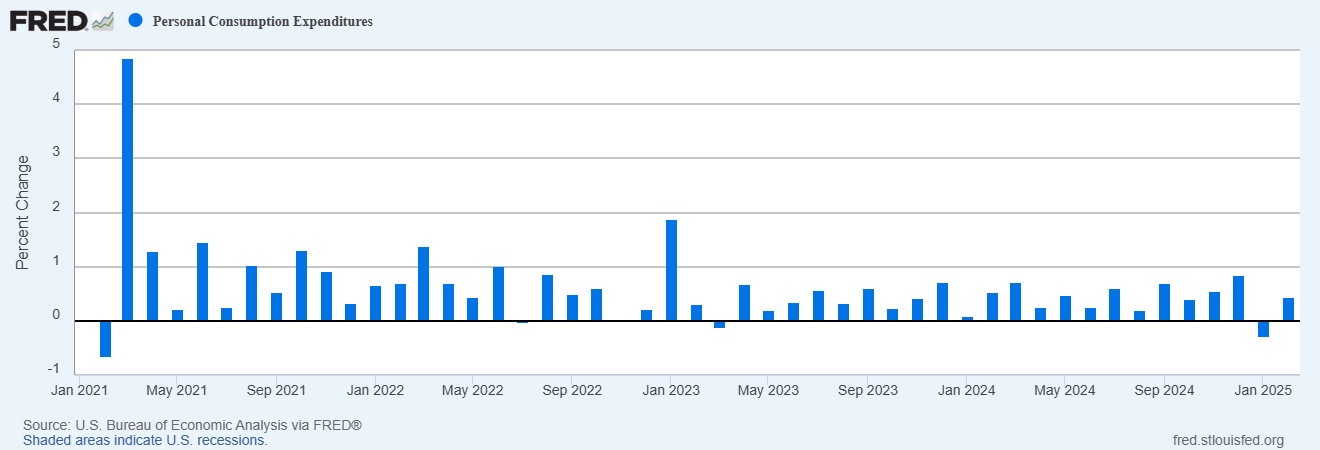

increased +0.4% in February, coming in below street estimates of +0.5%. This comes after January’s results (-0.3%), which were the worst in almost 4 years.

Spending is up 5.3% in the past year, but that is down from 5.8% to begin the year.

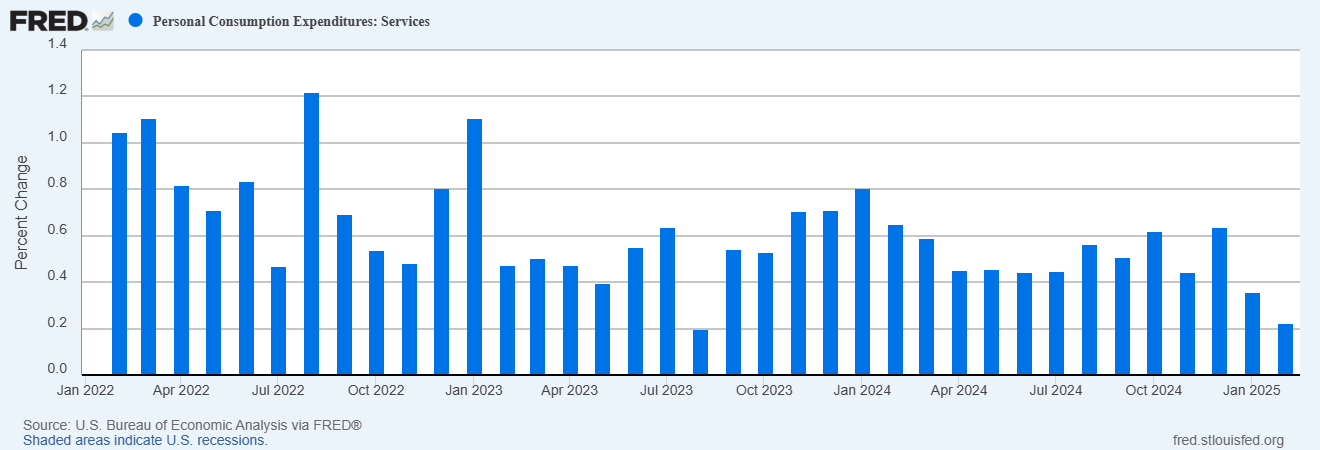

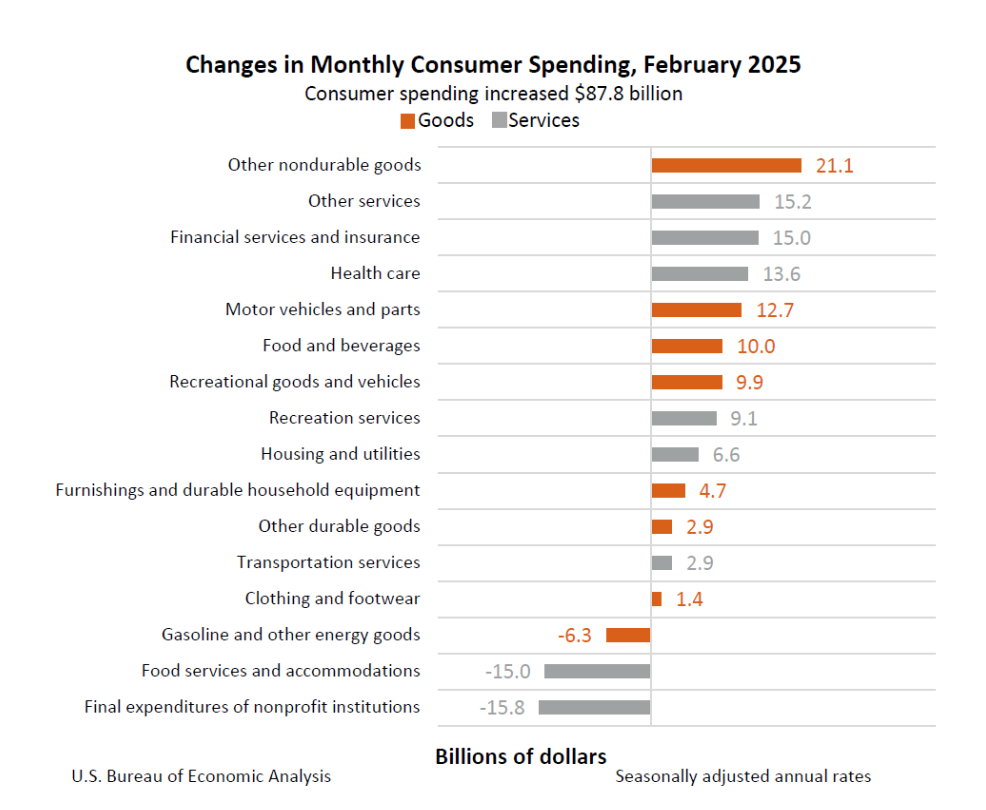

Spending on services grew 0.2% in February, an 18-month low. The monthly growth rate has fallen from 0.6% in December to 0.4% in January, to 0.2% in February.

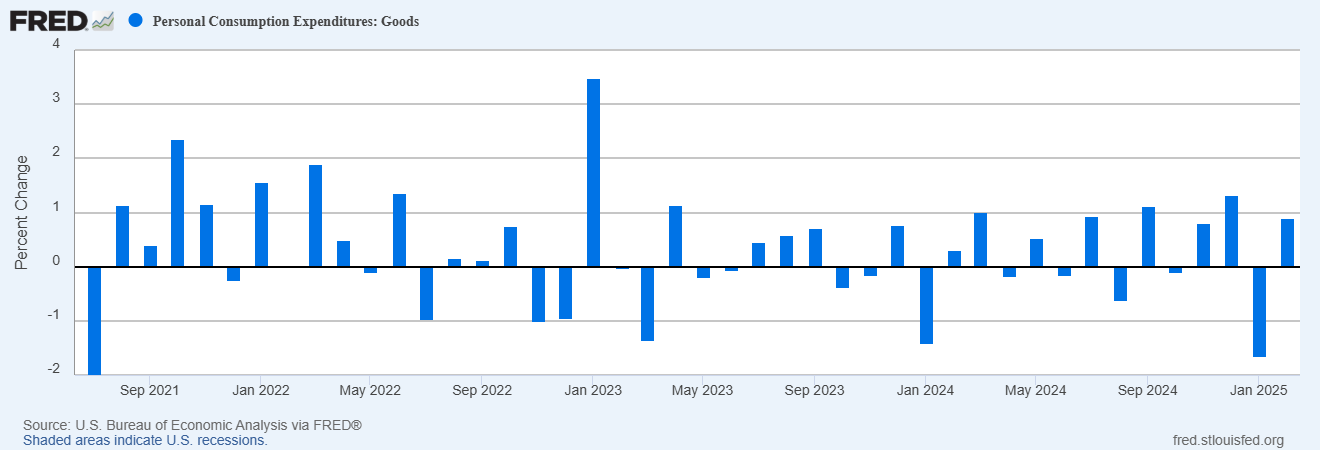

Spending on goods grew 0.9% in February, after declining -1.7% in January.

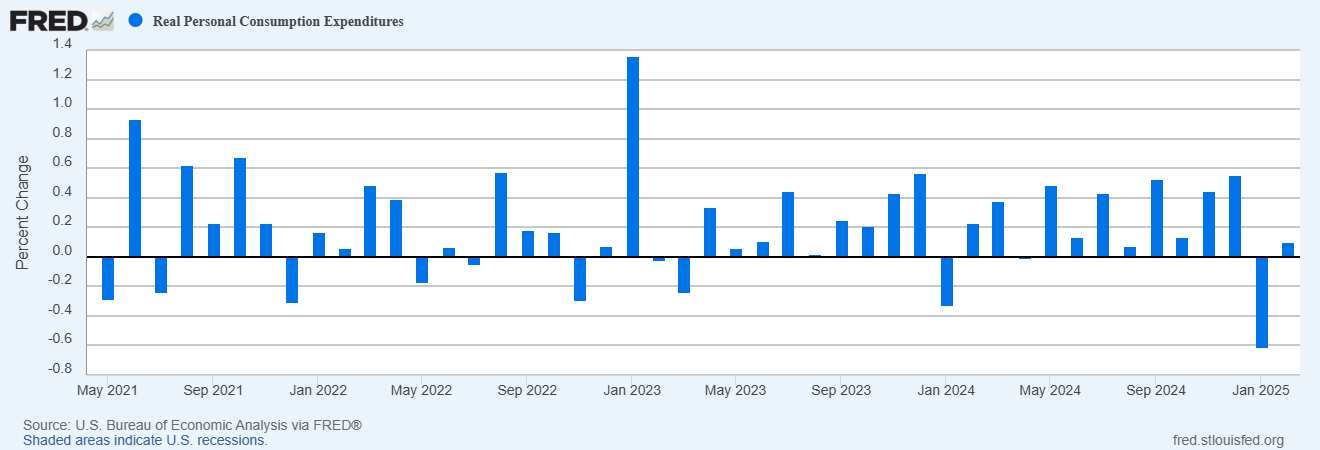

Adjusted for inflation, real consumer spending only rise 0.1% in February, after declining -0.6% in January. Which means the bulk of February’s spending increase was entirely due to rising prices.

Consumers pulled back on charitable giving (-$15.8 billion), and dining out (-$15 billion). The first discretionary items to typically get cut back during times of duress.

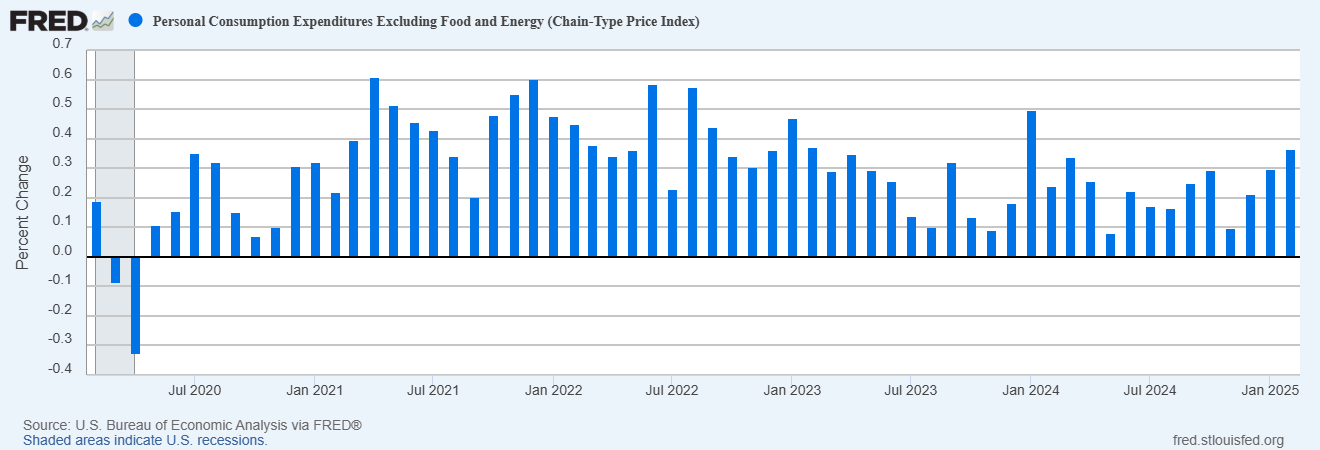

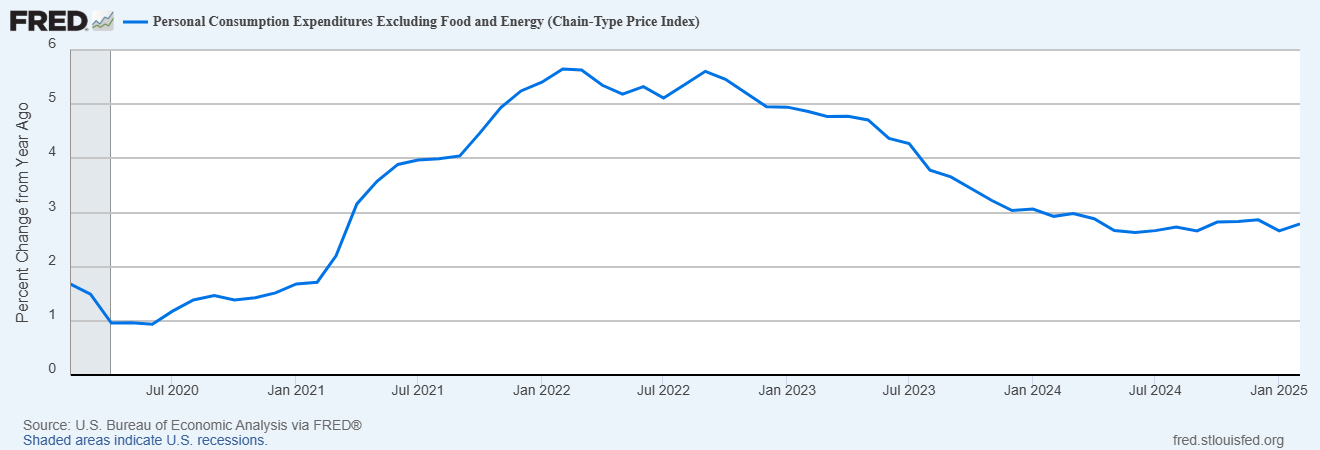

Core PCE

, the Fed’s preferred method of monitoring inflation, increased +0.4% in February. Worse then expectations and a 13-month high.

Over the last 12 months, core PCE is up 2.8%, remaining stubbornly above the Fed’s 2% target.

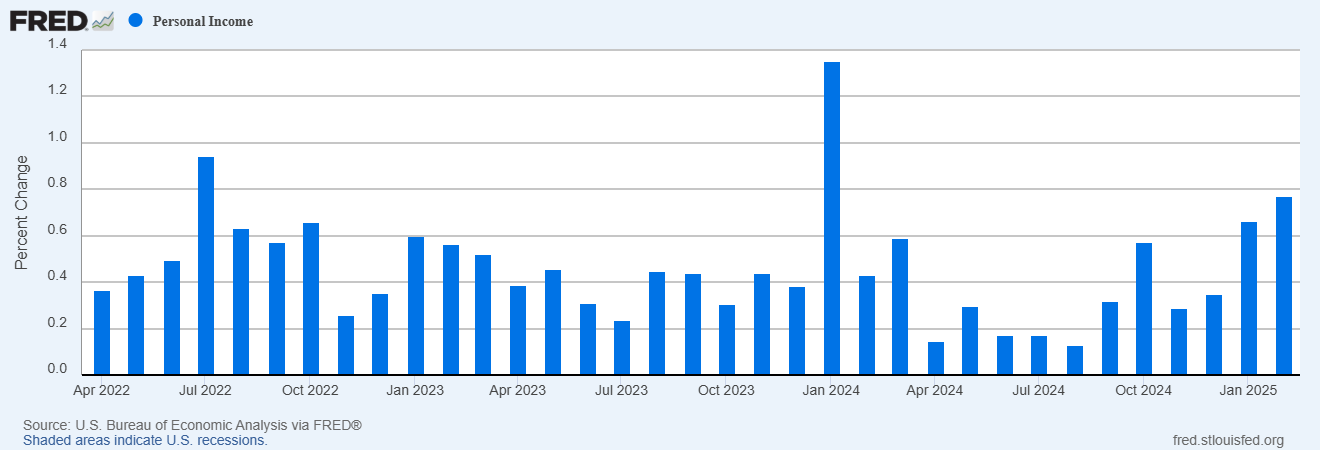

On a positive note,

personal incomes

rose +0.8% in February, handily beating street expectations. Incomes have risen above the inflation rate for the 10th straight month now.

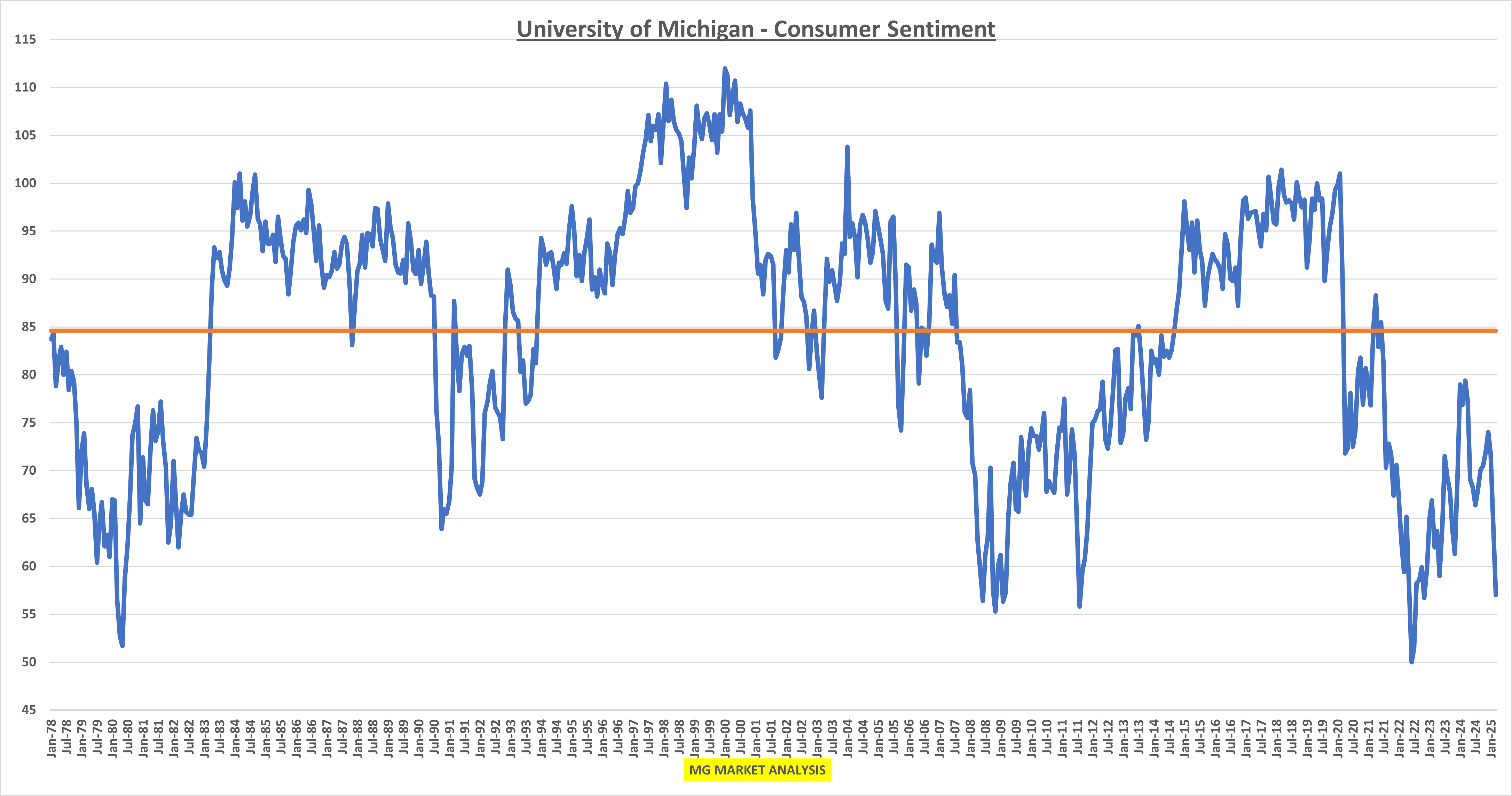

Meanwhile, consumer sentiment was revised even lower for March, from 57.9 to 57. Meanwhile, inflation expectations have shot up by 5%. This is meaningful. The 12% monthly decline in sentiment is the worst since June 2022.

“ This month’s decline reflects a clear consensus across all demographic and political affiliations; Republicans joined independents and Democrats in expressing worsening expectations since February for their personal finances, business conditions, unemployment, and inflation.

Notably, two-thirds of consumers expect unemployment to rise in the year ahead, the highest reading since 2009.”