USD/CAD ANLAYSIS & TALKING POINTS

- Souring risk sentiment leaves CAD on the backfoot this Monday morning.

- BoC unlikely to bolster CAD.

- USD/CAD hesitates at 1.35.

CANADIAN DOLLAR FUNDAMENTAL BACKDROP

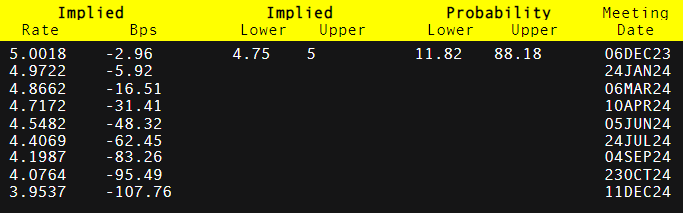

The Canadian dollar upside rally looks to be fading as we enter a big week in terms of key economic data for both Canada and the US. Safe haven demand has bolstered the USD as the war between Israel and Hamas gathers steam. The OPEC+ decision last week did not help the loonie either as markets reacted negatively to the announcement, resulting in lower crude oil prices . Ahead of the Bank of Canada (BoC) interest rate decision later this week, money markets are pricing in a rate pause with roughly probability (refer to table below). If we take into account the recent Canadian economic data including muted growth , marginally higher unemployment and weaker manufacturing PMI's, there is little benefit for the CAD on the local front.

BANK OF CANADA INTEREST RATE PROBABILITIES

Source: Refinitiv

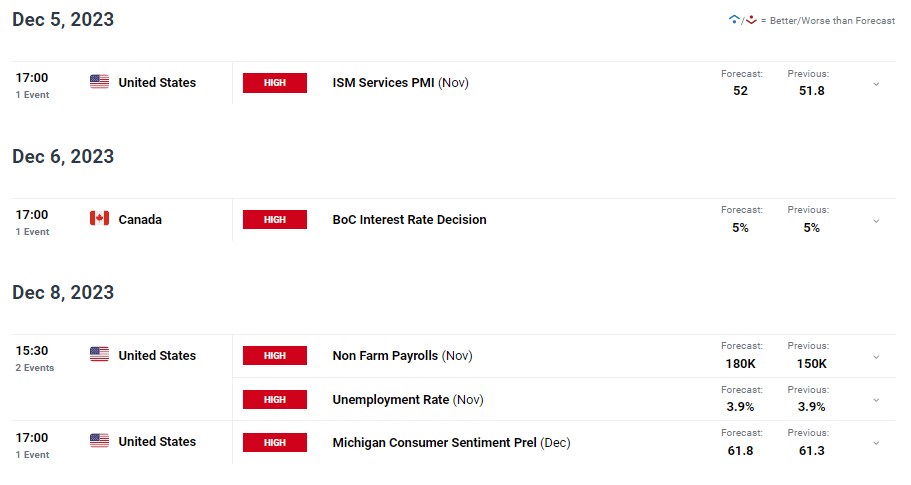

The week ahead will be mostly dictated by US factors (see economic calendar below) with short-term focus on ISM service PMI tomorrow. A key data point for the US considering the economy is largely services driven. JOLTs data will also monitored closely ahead of Friday's Non-Farm Payroll report. Both sets of data are expected to improve which could limit support for the CAD.

USD /CAD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

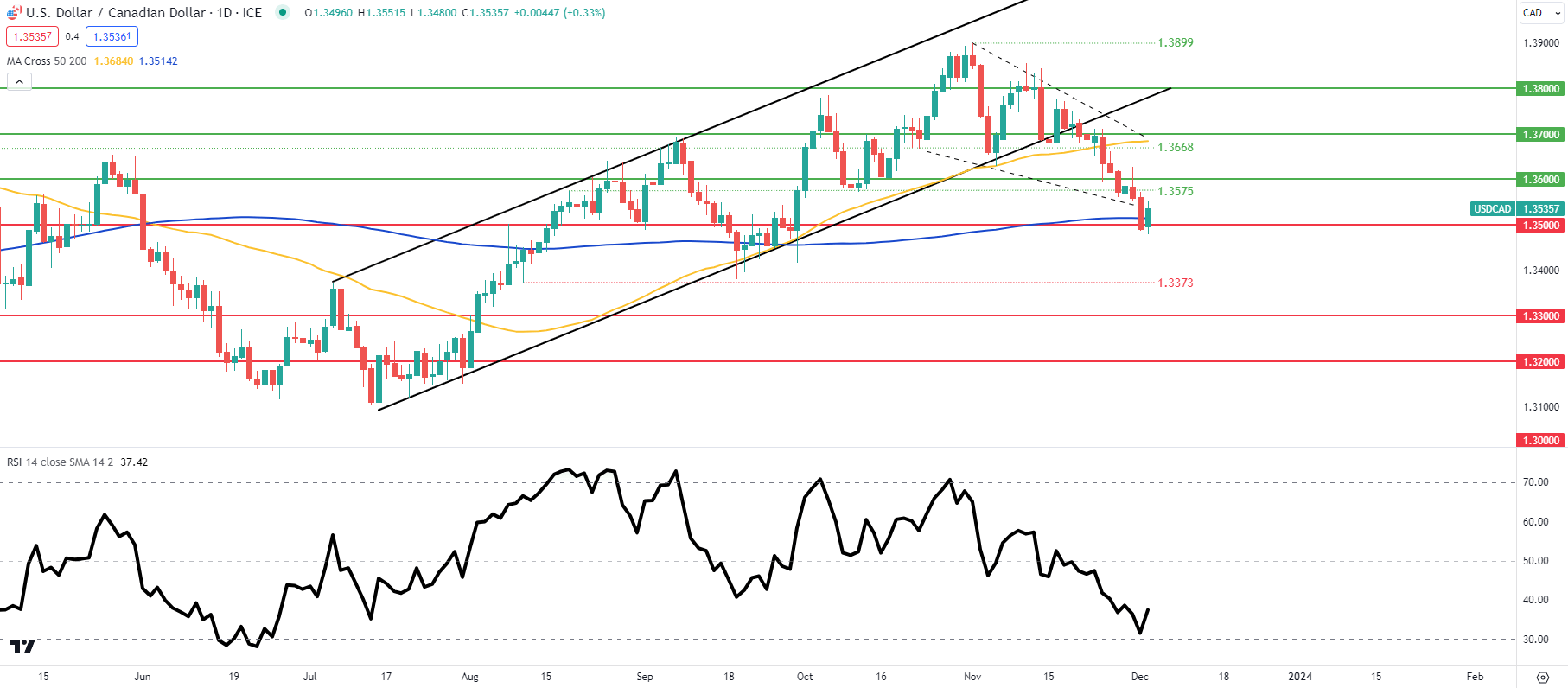

TECHNICAL ANALYSIS

USD/CAD DAILY CHART

Chart prepared by Warren Venketas , IG

Daily USD/CAD price action above shows bears being constrained around the 200-day moving average (blue) and psychological support level respectively. Although the falling wedge pattern (dashed black line) has been broken, the bullish continuation development may still be on the cards. A confirmation close below the aforementioned support zones could invalidate this but with the pair nearing oversold territory on the Relative Strength Index (RSI) , a USD reversal is likely.

- 50-day MA

- 1.3668

- 1.3600

- 1.3575

- 200-day MA

- 1.3500

- 1.3373

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently net on USD/CAD , with of traders currently holding long positions (as of this writing).

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Start Course