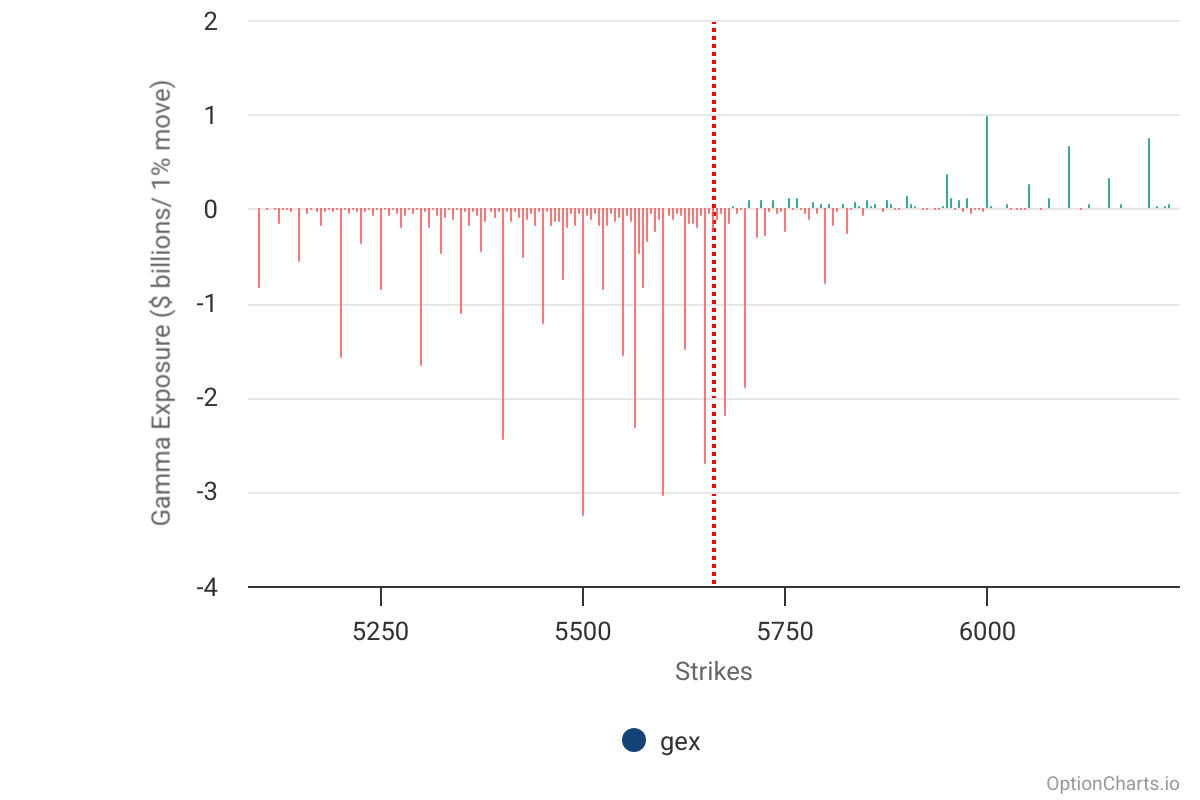

Stocks had another choppy session yesterday, but that will likely change today with the passing of quarterly options expiration. The market has been pinned between 5,600 and 5,700 all week. However, today, gamma levels will begin resetting at the open as monthly index options expire.

The 5,600 level will no longer be the dominant put position on the board next week, shifting instead to 5,500. As a result, it’s quite possible that the sell-off, which paused this past week, resumes next week—at least based on yesterday’s data.

Also, for now, the

S&P 500

continues to remain below the 10-day exponential moving average, which has been serving as a reliable resistance level during this drop.

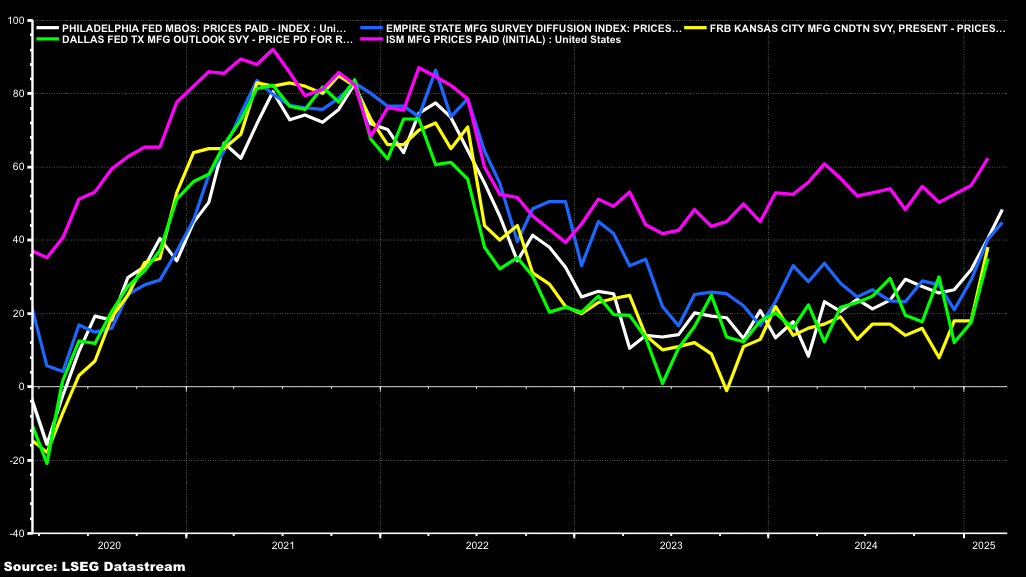

In other news, the prices paid indexes for the Empire State and Philly Fed continued to rise in March. Both have returned to levels last seen in the summer of 2022.

This data puts us in a challenging position. On the one hand, we have data suggesting

inflation

remains a significant problem, while on the other, the Trump administration continues to claim it will implement policies to lower rates. I’m not even sure stagflation would bring rates down on the back end of the curve—the only thing that can lower both

rates

and prices is a recession.

Japan was closed on Thursday for the Vernal Equinox—yes, it’s officially spring, even if it doesn’t feel like it.

Anyway, see you Sunday.

Original Post