Markets have seen another week of losses but a positive end to the week may be a sign that a rebound in US equities is the start of improving sentiment. The improved end to the week came about as encouraging inflation data was released on Wednesday and Thursday, but data remains overshadowed by U.S. President Donald Trump’s escalating trade war which continues to fuel recession fears and hamper risk appetite.

Despite a broad rally on Friday which sent all three major US Stock Indexes higher, the S&P 500 and the Nasdaq posted their fourth straight weekly losses.

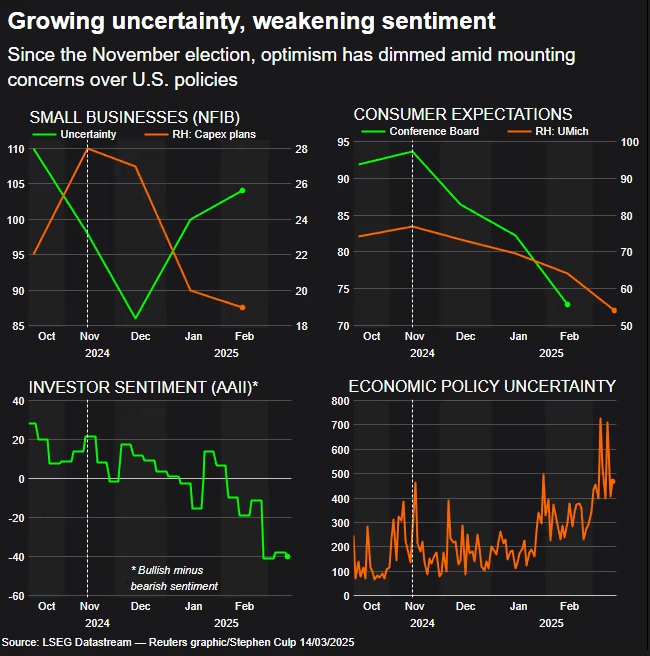

An alarming report from the University of Michigan revealed that consumer confidence has dropped to its lowest point in almost two years, and people expect inflation to rise to 4.9% over the next year. This mirrors other negative surveys, like a Reuters/Ipsos poll from March 11-12, which found that 57% of Americans think Trump’s policies will cause more harm than good.

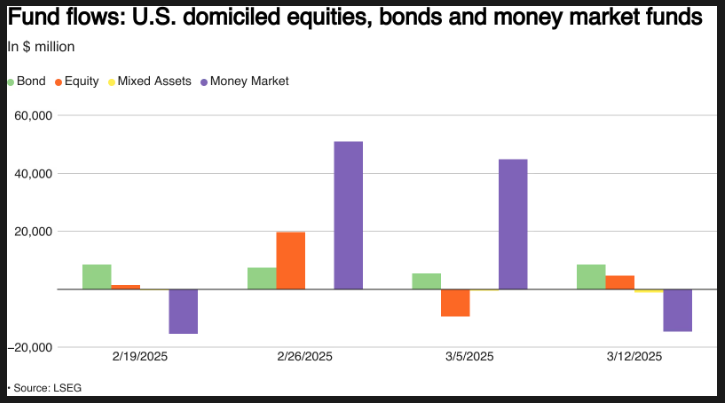

On the flip side though, U.S. equity funds saw more investments in the week ending March 12. Some investors felt optimistic due to lower inflation numbers.

U.S. equity funds had $4.67 billion in net purchases during the week, but the strong inflows from February, which reached about $9 billion, have slowed, with outflows of $4.81 billion in the first two weeks of March. Large-cap funds performed well, gaining $8.78 billion, marking their fifth straight week of inflows.

Multi-cap funds added $479 million, but investors pulled $1.32 billion from small-cap funds and $1.22 billion from mid-cap funds.

Sector-specific funds saw outflows for the second week in a row, with $3.25 billion in net sales. Investors sold off $1.59 billion in tech funds, $423 million in communication services funds, and $340 million in consumer staples funds.

A sign that a recovery rally may be beginning or just a temporary reprieve before bears continue their push?

On the FX front, the US Dollar was relatively flat last week as it looks like a period of consolidation may be ahead for the US Dollar Index . This has helped some currencies hold onto recent gains against the greenback with only moderate pullback for the likes of EUR/USD etc.

Gold turned out to be the biggest winner last week, breaching the crucial $3000/oz handle for the first time as safe haven demand spiked. The move proved short-lived however, with acceptance above this level likely to prove tricky in the days ahead.

Brent Oil Futures prices saw a rebound of around 1% on Friday, with Oil on course to end the week mostly flat as investors considered the decreasing chances of a quick resolution to the Ukraine war, which could have restored more Russian energy supplies to Western markets.

The Week Ahead: Central Banks in the Spotlight

Asia Pacific Markets

The main focus this week in the Asia Pacific region will be central bank decisions from Japan, China and Taiwan.

The Bank of Japan is not expected to take action at Wednesday’s meeting, though Governor Ueda might hint at future plans without specifying timing or scale.

With inflation likely to exceed the BoJ’s forecast and strong wage growth expected, rate hikes could resume in May. Despite tariff uncertainties, Japanese exports likely grew in February due to last year’s low numbers and early shipments of cars and IT goods.

China will release its first ‘data dump’ for 2025 on Monday, covering the year’s first two months.

Retail sales are expected to grow modestly by 4% year-on-year, with trade-in programs likely boosting future growth. Industrial production may ease to 5.2% due to weaker global demand, while fixed-asset investment is predicted to stay sluggish at 3.6%, dragged down by the private sector.

Loan prime rates, out Thursday, are expected to stay unchanged unless the central bank cuts its reverse repo rate soon.

Europe + UK + US

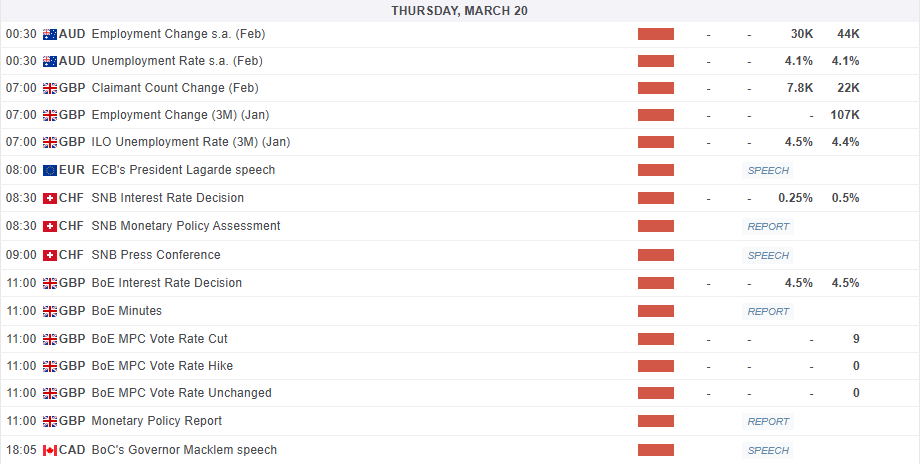

In developed markets, the US and UK interest rate decisions will take center stage.

The Federal Reserve is expected to keep interest rates steady for the second meeting in a row after 100bp cuts in late 2024. While growth has slowed, job gains and high inflation mean no immediate need for more support.

However, risks from government austerity and tariffs could change this later. For now, rate changes are unlikely until September in my opinion as the Fed gauges the impact of incoming policy. The Fed will also release updated forecasts, but no major adjustments are expected, with two 25bp cuts still projected for this year.

The Bank of England meeting will take place on Thursday with no rate cut expected as the BoE typically cuts rates once a quarter, with the next move planned for May after February’s cut. The key question is how many officials might vote for faster cuts. A 6-3 vote to keep rates steady is expected.

We do also have retail sales data from the US and the UK job report which may be overshadowed by general market sentiment and tariff developments.

This week’s focus is on the S&P 500 which has run into a key area of support at the 5500 handle.

A rebound has occurred pushing the index toward immediate resistance at 5635 before stalling at the time of writing. The overall trend on a daily timeframe remains firmly in bearish territory despite Friday’s rally.

Friday’s daily candle was a bullish engulfing candle close hinting at bullish momentum to end the week. However, with the overarching narratives in play at present it will be interesting to see how markets start the new week and if President Trump spring any surprises over the weekend.

Immediate resistance rests at 5669 and 5756 which is also where the 200-day MA rests.

Immediate support rests at 5538 before the key 5500 handle comes into focus.

Support

- 5538

- 5500

- 5421

Resistance

- 5669

- 5756

- 5828