As new presidential terms go, this one’s off to a rocky start for the economic outlook, thanks largely to disruptive tariff plans that risk triggering a global trade war. Perhaps most surprising is that the blowback so far has been mostly self-inflicted. Unforced errors due to policy shocks are rare, but President Trump’s norms-busting behavior is forging yet another new precedent on this front.

To be fair, the majority of numbers published to date still skew comfortably in favor of US growth. But Trump’s tariff plans could derail the moderately expanding economy he inherited when he became president on Jan. 20. Economic reports are always out of date to some degree because they arrive with a lag. That caveat may now apply in the extreme.

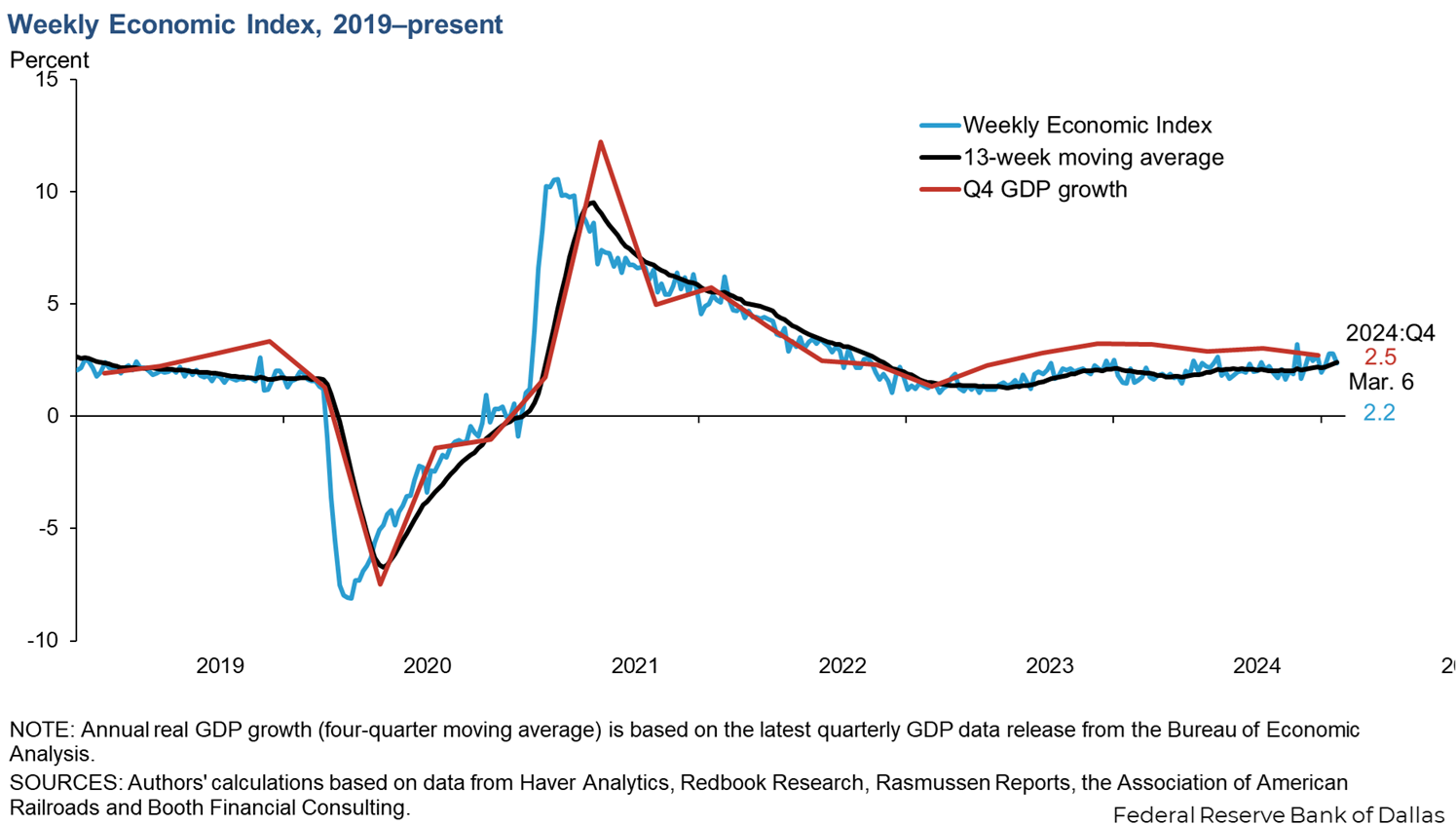

For the moment, it’s reasonable to argue that a solid tailwind is still blowing for US economic activity. The Dallas Fed’s Weekly Economic Index (WEI) currently points to moderate growth that’s in line with recent history. “The WEI is currently 2.24%, scaled to four-quarter GDP growth, for the week ended March 1 and 2.43% for February 22,” the regional Fed bank reports.

“The 13-week moving average is 2.46%. This is compared with 2.51% four-quarter GDP growth through the fourth quarter of 2024.”

Using WEI as a guide suggests that economic activity continues to hum. But reading the headlines paints a very different picture. The question is whether the surge of uncertainty and concern about the implications of Trump’s tariff plans will take a toll on growth in the weeks and months ahead.

The answer is almost certainly “yes,” but the main mystery is in what degree and when. Does the economy downshift moderately, or does it take a hefty blow and trigger a recession? Will the pain unfold gradually, then suddenly? Forecasts from analysts near and far are all over the map.

The lion’s share of doubt is due to Trump’s mercurial decision-making process. To be blunt, no one’s sure what he’ll say, or when, on any given day, or how dramatic a shift in his comments du jour will compare to the previous round of announcements. The net effect is that everyone is constantly guessing where we go from here.

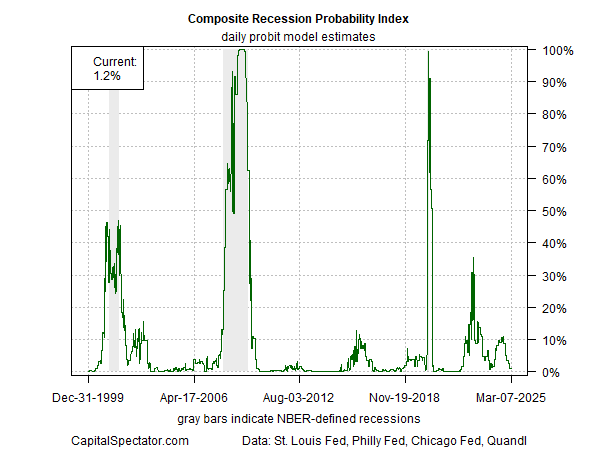

The added complication: predicting recessions is hard, really hard. CapitalSpectator.com’s weekly newsletter, The US Business Cycle Risk Report (BCRR), projects the US macro trend out a couple of months using a wide range of indicators – a modeling effort that’s proven to be mostly accurate. The main exception was the pandemic shock in the spring of 2020, an unusual exogenous shock. Normally, the tell-tale signs of recession accumulate, providing early clues of an approaching storm. Presumably, a repeat performance will unfold this time if a recession is near.

For the moment, however, worries about an economic downturn are based primarily on projections rather than compelling data. That could change, perhaps quickly, but the current profile still looks solid. BCRR’s main recession indicator, which aggregates signals from several business-cycle indicators, is currently estimating a low 1% probability that an NBER-defined contraction has started or is imminent, as of Mar. 7.

Such profiles are always snapshots of economic conditions at a particular point in the past – in this case, the recent past. The worry is that the near-term future will create a sharply weaker profile. The worst-case scenario was outlined last week by Andrew Wilson, deputy secretary-general of the International Chamber of Commerce, a global business and trade group:

“Our deep concern is that this could be the start of a downward spiral that puts us in 1930s trade-war territory.”

The reality is that no one knows how the near term will play out, largely due to the unpredictable decisions of one man sitting in the Oval Office. For now, the numbers suggest that the US economy is still relatively resilient and probably more so than some analysts recognize, albeit at a time when a storm is brewing.

This is a precarious moment for the US economy and beyond. We are at the point when dramatic shifts in the macro trend are possible, perhaps likely, on a week-by-week basis. The good news is that the risk could evaporate in a heartbeat if – if – one man changes his mind.