- US consumer and producer prices are the main focal point.

- UK economic output data is to be watched too.

- But Trump and tariff headlines might be a bigger market driver.

Trump rattles markets with tariff games

With the initial central bank decisions of 2025 out of the way, it will be somewhat of a quieter week. However, there’s still plenty for investors to look forward to as the all-important CPI report out of the United States is on the agenda.

Of course, that’s not to say that President Trump won’t find himself at the centre of the markets’ attention again. The tariff war is only just getting started and an escalation is more likely than a de-escalation, while Congressional Republicans have started work on how to finance an extension of the 2017 tax cuts that are due to expire at the end of 2025 amid worries about rising debt.

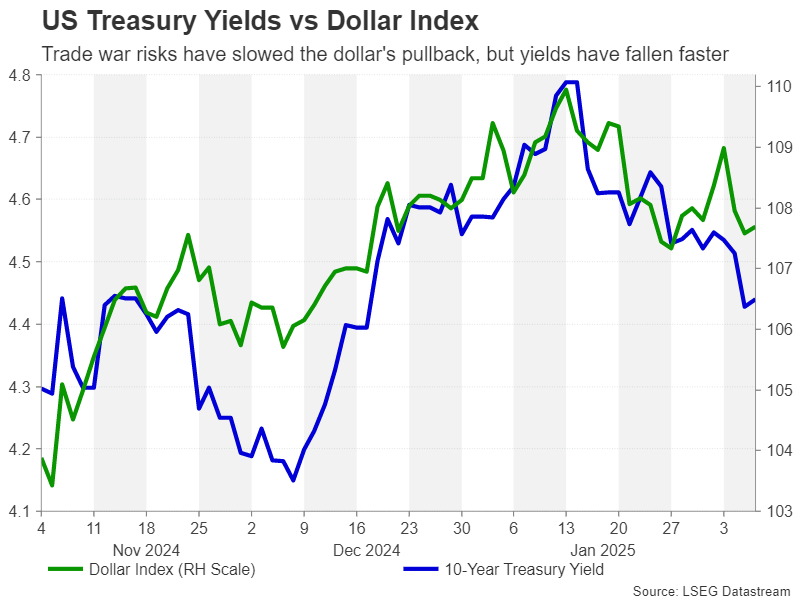

There’s been some relief, however, for the Treasury Department from the recent drop in Treasury yields. A slight slowdown in economic growth and signs that the uptick in inflation is peaking, alongside Trump’s conciliatory tone on tariffs, have contributed to the pullback in long-term borrowing costs.

Subsequently, the US Dollar has retreated from more than two-year highs against a basket of currencies. There could be more losses in store for the greenback in the coming week if the consumer price index begins to ease on a yearly basis.

US CPI might test dollar bulls’ resolve

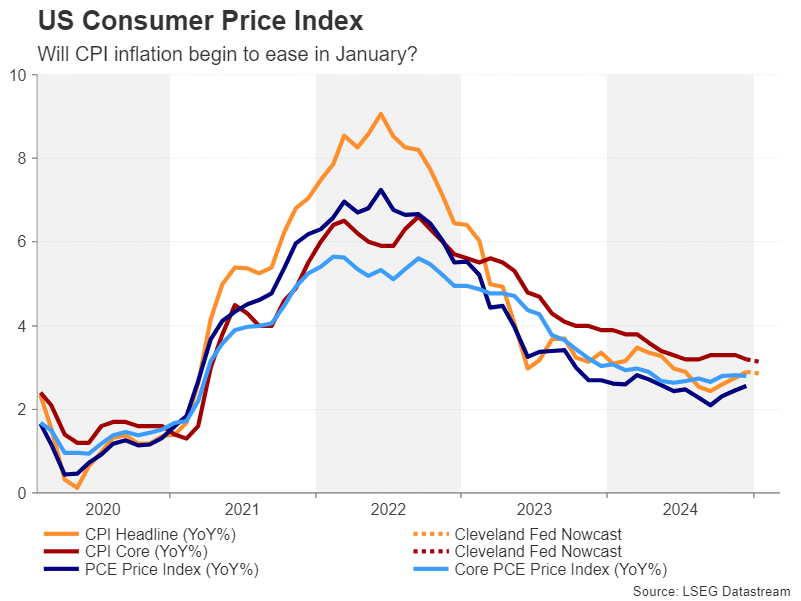

The headline rate of CPI edged up to 2.9% y/y in December, while the core rate softened to 3.2%. According to the Cleveland Fed’s Inflation Nowcasting model, headline CPI is anticipated to have moderated to 2.85% in January and the core rate to have ticked lower to 3.13%.

If the actual numbers meet these estimates, investors will likely read them as an indication that the disinflation process is back on track and yields could slide further.

The CPI figures are out on Wednesday and producer prices will follow on Thursday. US factory gate prices have also been trending north in recent months so a decline in the PPI data will be key for a sustained pullback in the dollar. Furthermore, retail sales for January will be an additional guide for Fed policy expectations as strong retail spending could partially offset any increase in rate cut bets.

Markets seem reluctant to fully price in two rate reductions for 2025, likely due to the active threat of higher tariffs. But should the incoming data significantly boost expectations of more aggressive easing, risk appetite could improve further, lifting Wall Street.

Pound eyes UK GDP update after BoE cut

The Bank of England lowered its benchmark lending rate by 25 basis points at its February meeting but maintained a cautious stance on the pace of future cuts. Worries about elevated wage growth and the inflationary impact of the Labour government’s budget measures continue to weigh on policymakers’ minds.

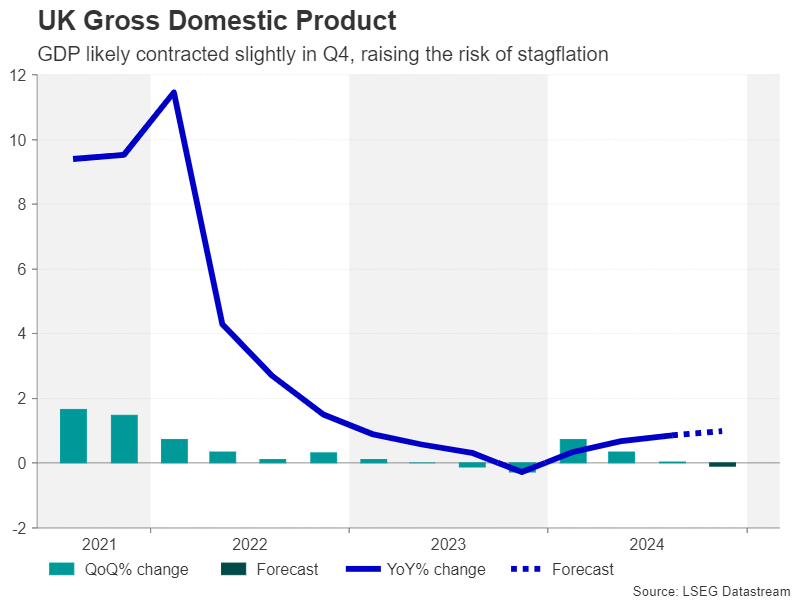

However, the BoE is also concerned about the anaemic growth that the economy has been eking out since last summer. GDP barely grew in the third quarter of 2024 so investors will be hoping that there was some improvement in Q4, although the forecasts show a small contraction.

The first estimate of Q4 growth is out on Thursday and will be accompanied by the monthly readings on services, industrial and manufacturing output. Stronger-than-expected data could aid the pound’s rebound from January’s more than one-year low of $1.2097.

The GBP/USD took a lesser hit from the tariff-led market turmoil than its counterparts as Trump hinted that he is not as of yet thinking about imposing any import levies on the UK. Any change in that rhetoric could hurt sterling, while political developments could also spur some volatility amid rumours that Prime Minister Keir Starmer is thinking of reshuffling his cabinet as a means of replacing his finance minister, Rachel Reeves.

On inflation watch

Elsewhere, CPI numbers are also due out of Switzerland and China . The latter will publish its stats for January on Sunday. The yearly CPI rate is expected to have stayed quickened from 0.1% to 0.4% and the decline in producer prices is forecast to have slowed to -2.1%, which would suggest a slight improvement in domestic demand.

In Switzerland, inflation has been subdued since the middle of 2023 and stood at just 0.6% y/y in December. The Swiss National Bank doesn’t meet until March 20, and although another 25-bps cut in rate is highly likely, whether policymakers maintain an easing bias or turn more neutral will depend on what the next two CPI reports will point to, the first of which is out on Thursday.

In the meantime, the safe-haven USD/CHF has made modest gains versus its major peers during the past week on the back of the Trump-induced uncertainty.

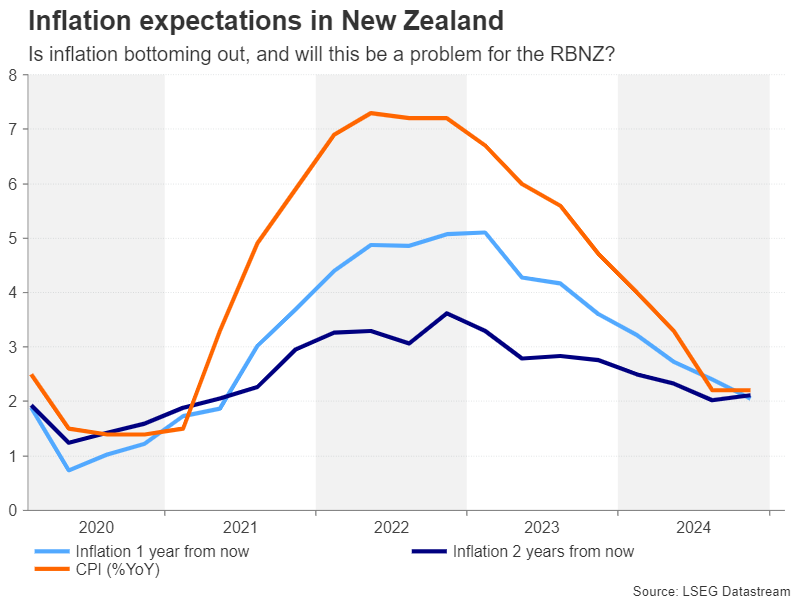

Another central bank that’s yet to meet this year is the Reserve Bank of New Zealand. Ahead of the February 19 decision, the central bank’s own survey of inflation expectations might sway rate cut bets on Thursday. In the previous quarter’s survey, two-year expectations edged up slightly to 2.1%. If there’s another uptick in the Q1 report, investors might scale back their bets of a 50-bps reduction at the February meeting, lifting the kiwi .