Insights from the Latest 13F Filing for Q3 2024

Prem Watsa ( Trades , Portfolio ), renowned for his conservative investment philosophy, recently disclosed his third-quarter portfolio for 2024. Born in India and a follower of Warren Buffett ( Trades , Portfolio )'s principles, Watsa has built a reputation through his company, Fairfax Financial. This firm is known for its strategic focus on high returns on invested capital and long-term value creation, primarily through insurance and reinsurance businesses.

New Additions to the Portfolio

Prem Watsa ( Trades , Portfolio ) expanded his portfolio by adding two new stocks in the third quarter of 2024:

Significant Increases in Existing Positions

Watsa also increased his stakes in four companies:

Complete Exits from Positions

In a notable shift, Prem Watsa ( Trades , Portfolio ) exited nine positions during this quarter:

Reductions in Holdings

Watsa reduced his position in one stock:

Portfolio Overview and Sector Allocation

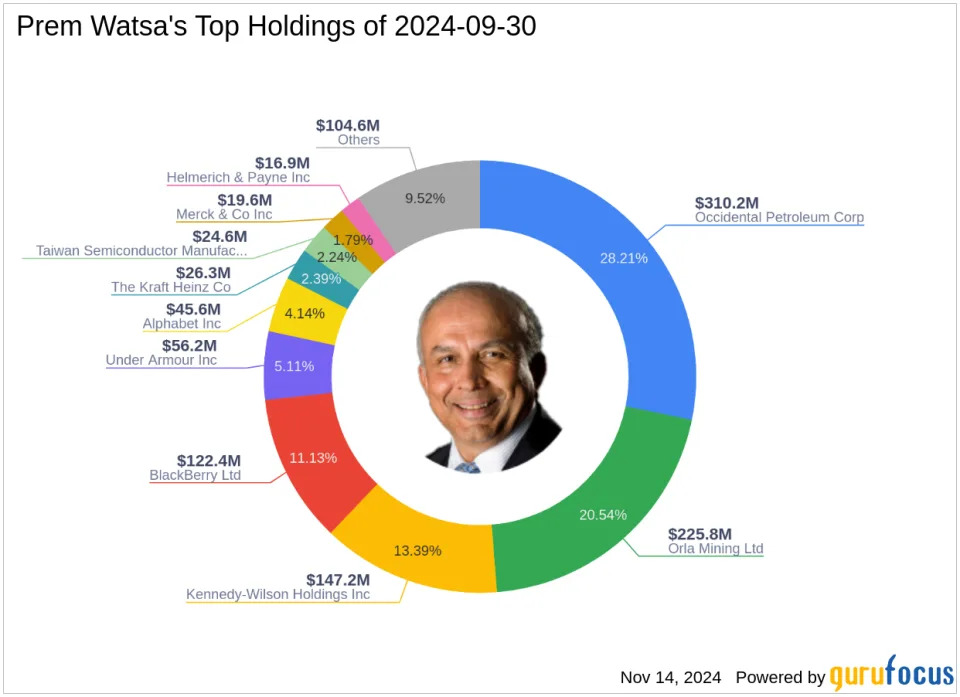

As of the third quarter of 2024, Prem Watsa ( Trades , Portfolio )'s portfolio included 31 stocks. The top holdings were 28.21% in Occidental Petroleum Corp ( NYSE:OXY ), 20.54% in Orla Mining Ltd ( ORLA ), 13.39% in Kennedy-Wilson Holdings Inc ( NYSE:KW ), 11.13% in BlackBerry Ltd ( NYSE:BB ), and 5.11% in Under Armour Inc ( NYSE:UAA ).

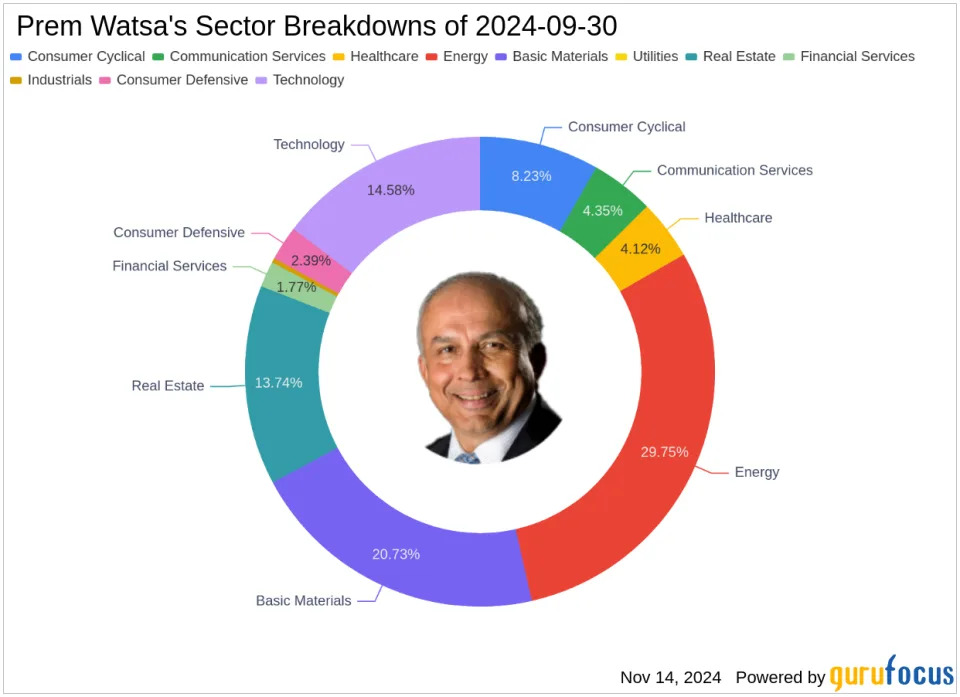

The investments are predominantly concentrated across 10 industries, covering Energy, Basic Materials, Technology, Real Estate, Consumer Cyclical, Communication Services, Healthcare, Consumer Defensive, Financial Services, and Industrials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on

GuruFocus

.