Creating a strategic cryptocurrency reserve in the United States could boost Bitcoin’s

US President Donald Trump’s plans for a national crypto stockpile, along with similar proposals across dozens of US states, could trigger a multibillion-dollar buying spree with a 20x multiplier effect on Bitcoin’s price, according to Sygnum, a crypto asset manager.

“Because the liquid supply of bitcoin is very small […] larger inflows cause upward price shocks,” Katalin Tischhauser, Sygnum’s research head, told Cointelegraph.

Tischhauser added that federal or state government Bitcoin buying would be “likely to trigger another wave of allocations from institutional investors as well,” not to mention other countries’ governments.

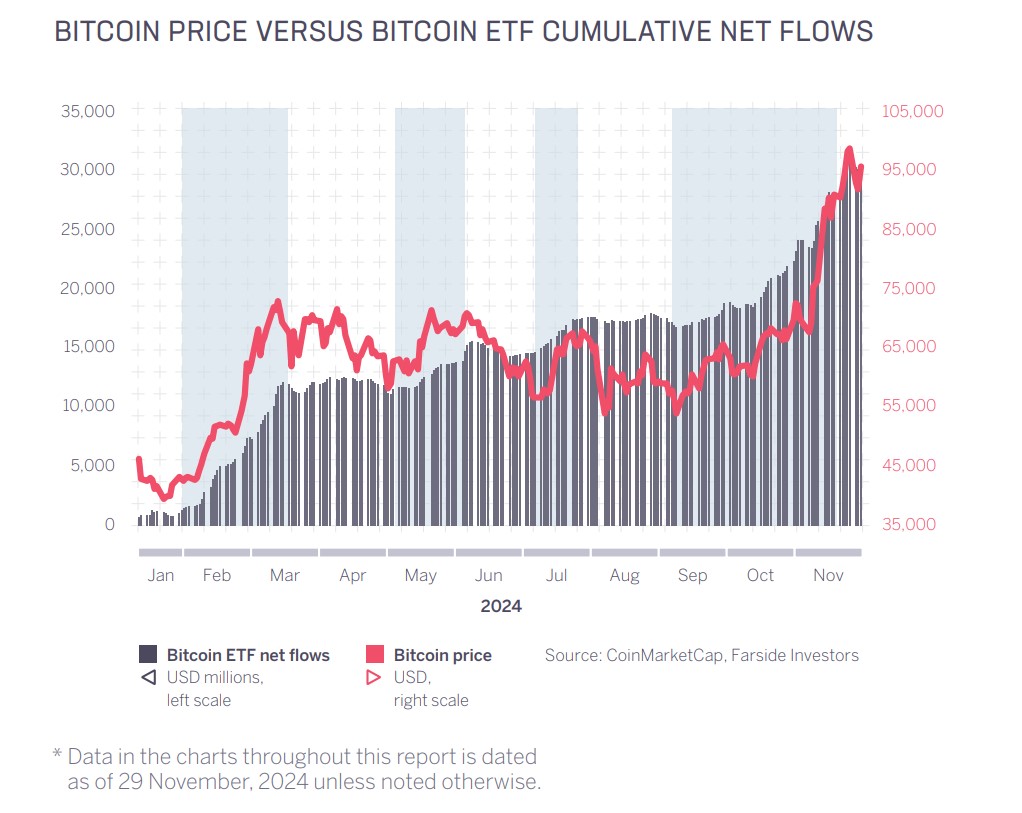

Institutional capital flows are already exerting a “multiplier effect” on BTC’s spot price, with every $1 billion worth of net inflows into spot exchange-traded funds (ETFs) driving an approximately 3-6% price move, Sygnum said in its Crypto Market Outlook 2025 report.

Related: Reaction to Trump’s crypto reserve: ‘Short-term optimism, long-term caution’

Planned crypto reserve

On March 2, Trump confirmed his commitment to creating a US crypto stockpile holding Bitcoin, as well as altcoins such as Ether

Crypto markets surged following Trump’s announcements, but surrendered those gains later in the week as macroeconomic unease and a looming trade war took center stage.

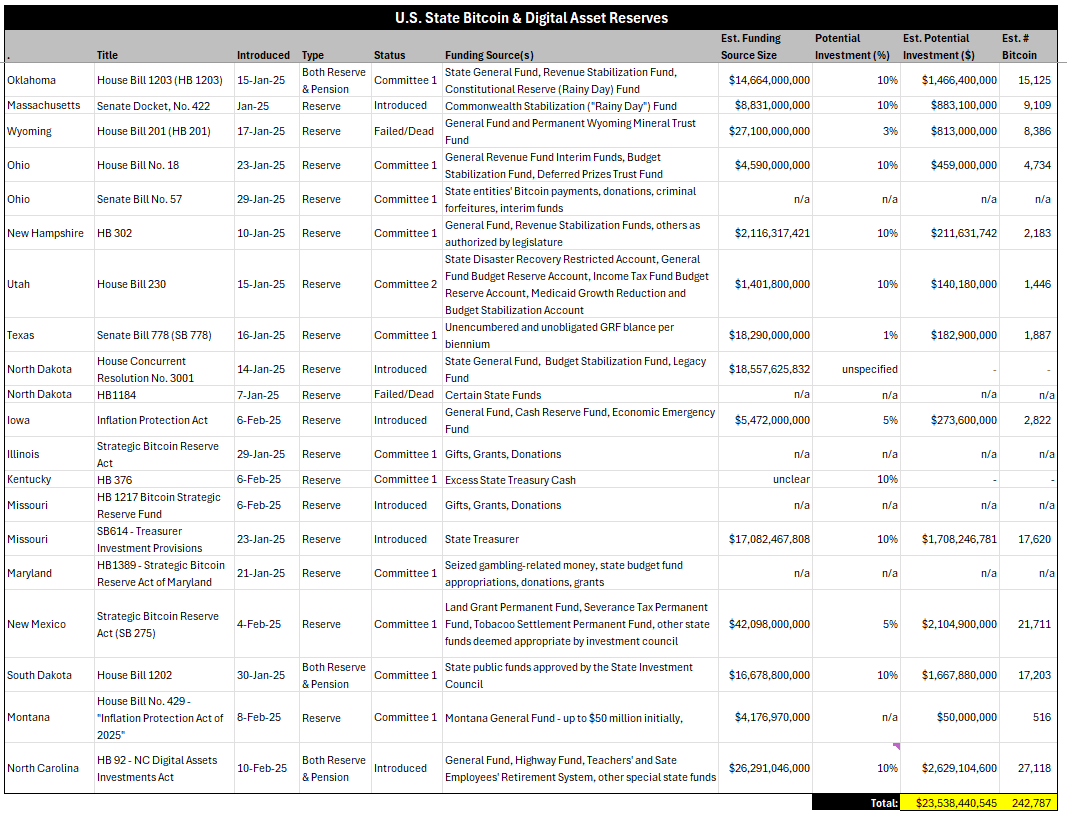

Trump has endorsed the idea of a national crypto pool since July 2024, when US Senator Cynthia Lummis pitched the BITCOIN Act, proposing a US reserve specifically for Bitcoin. More than half of US states have fielded proposals to create similar reserves at a state-level.

However, progress has been uneven. Five states already rejected crypto reserve plans, Tischhauser said. Meanwhile, creating a federal crypto stockpile would presumably require Congressional approval, a lengthy and uncertain process.

“[T]he market currently rates the probability [of a national Bitcoin stockpile] relatively low” because of challenges including confusing messaging and legal hurdles, Katalin Tischhauser, Sygnum’s research head, told Cointelegraph.

“[A]ny positive surprise would be bullish for the bitcoin price,” Tischhauser said.

The White House intends to reveal more details about the plans during a March 7 crypto summit, according to US Commerce Secretary Howard Lutnick.

He suggested that Bitcoin will have a special status in the US crypto reserve, which will include ETH, Solana, XRP

“That level of support coming from the administration is bullish for sure but calling it a strategic reserve has created a lot of confusion,” Tischhauser said.

“With the inclusion of the other tokens, I think we are talking about a proposed direct investment by the US government in the industry.”

Magazine: Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’