A wallet owned by bankrupt crypto exchange FTX has moved $10 million worth of digital assets from the Solana

According to data from blockchain analytics platform Arkham Intelligence, the FTX wallet has transferred $6.23 million worth of Ether

These included $1.2 million of FTX Token

On Aug. 24, FTX proposed a plan to appoint Mike Novogratz ’s Galaxy Digital Capital Management as the investment manager charged with overseeing the sale and management of its recovered crypto holdings.

According to the plan, the FTX estate would only be permitted to sell $100 million of the tokens per week, however, that limit could be raised to $200 million on an individual token basis. These limits are intended to minimize the impact of token sales while simultaneously allowing FTX to make creditors whole.

In addition to this plan, the exchange also filed a separate motion to hedge its larger holdings of Bitcoin

While the propositions set forward in the filings are not yet legally binding, the case of FTX token sales is expected to come before the Delaware Bankruptcy Court on Sept. 13.

Related: FTX court filing reveals former Alameda CEO’s $2.5M yacht purchase

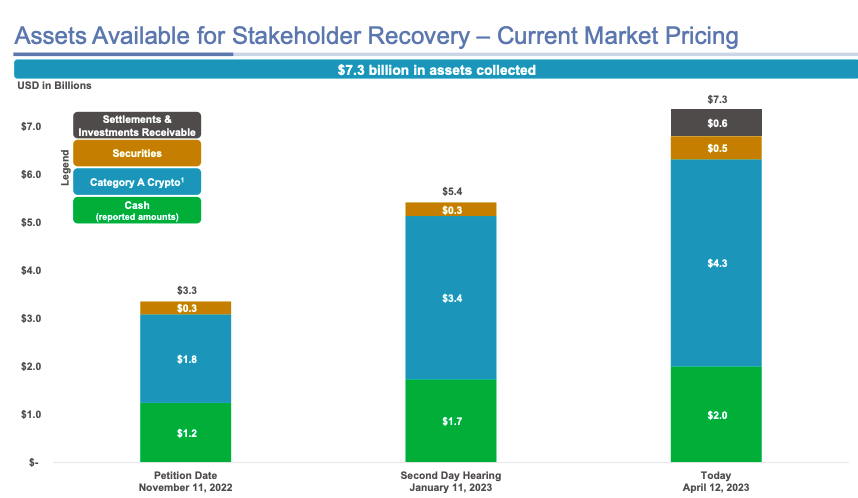

In an April 12 hearing, FTX disclosed that it had recovered roughly $7.3 billion in liquid assets, with $4.8 billion of that sum being comprised of assets recovered as of November 2022.

According to documents raised in the hearing, FTX held a total of $4.3 billion in crypto assets available for stakeholder recovery at market prices as of April 12.

The current reorganization plan for FTX includes a potential reboot of the cryptocurrency exchange, with FTX CEO John Ray III saying that the company had “begun the process of soliciting interested parties to the reboot of the FTX.com exchange.”

According to FTX lawyers, the launch of the new exchange is expected to be completed sometime in the second quarter of 2024.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in