The interim judicial managers of the collapsed cryptocurrency lender Hodlnaut have reportedly rejected the latest buyout deal amid the settlement token plummeting 90%.

Hodlnaut administrators have opposed the takeover terms from cryptocurrency exchange OPNX, which was established by Kyle Davies and Su Zhu, the co-founders of failed hedge fund Three Arrows Capital (3AC).

In a recent court filing, the interim managers argued that the $30 million offer of Flex (FLEX) tokens is “illiquid” and has “speculative value,” Bloomberg reported on Sept. 19. A majority of Hodlnaut Group’s creditors accounting for 60% of the total debt amount also opposed the OPNX deal.

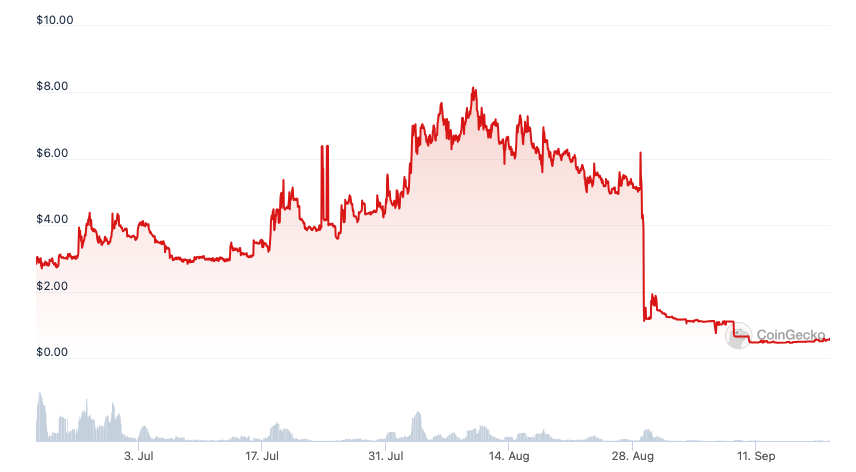

The administrators referred to FLEX losing roughly 90% of value since OPNX made an offer to take over 75% of Hodlnaut in early August 2023. At the time of the proposal, FLEX traded at around $7. According to data from CoinGecko, the Flex Coin is trading at $0.58 at the time of writing.

Apart from the concerns around FLEX, Hodlnaut’s interim judicial managers were worried about “no injection of cash or assets with similar liquidity,” implying major digital assets like Bitcoin

Related: Court approves sale of FTX digital assets, up to $3.4B worth to be unleashed

FLEX is the native token of the Coinflex exchange, which is closely related to the OPNX platform as its founders Mark Lamb and Sudhu Arumugam also participated in the OPNX launch.

Coinflex suspended all withdrawals in June 2022, with the CEO citing extreme market conditions and “continued uncertainty involving a counterparty.” The exchange filed for restructuring in a Seychelles court as it seeks to recover $84 million in losses from a large individual customer. Coinflex expects to officially cease operations on Oct. 31, 2023, advising its customers to withdraw all funds from the platform by the shutdown date.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Hall of Flame: Crypto lawyer Irina Heaver on death threats, lawsuit predictions