Joel E. Cohen, a mathematician and biologist representing Celsius Network’s valuation adviser, Stout Risius Ross, confirmed the accuracy of the fair value of certain of the debtors’ assets and liabilities as of May 31, 2023.

Following months of back and forth, most Celsius creditors recently voted in favor of a plan to see approximately $2 billion worth of Bitcoin

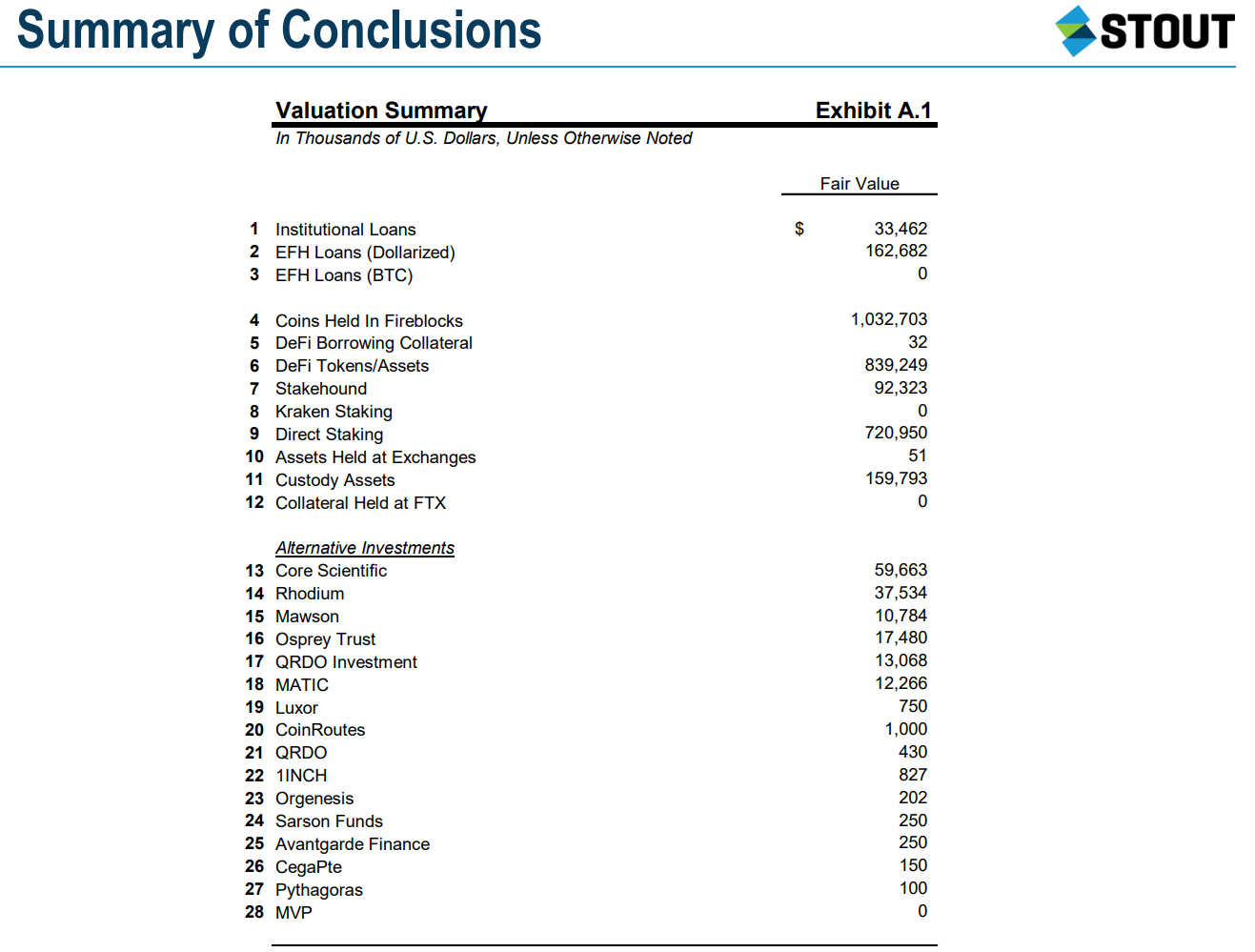

Two days after attaining consensus around Celsius’ reorganization plan , a Sept. 28 court filing confirmed the accuracy of the value of debtors’ assets and liabilities. Stout conducted the valuations of cryptocurrency assets, loans and alternative investments.

In the declaration provided at the New York bankruptcy court, Cohen explained the methodologies used in the valuation analysis and concluded:

“Based on my work performed and the information and methodologies considered, I believe the Valuation Report accurately reflects the fair value of certain of the Debtors’ assets and liabilities as of May 31, 2023.”

According to a disclosure statement filed on Aug. 17, approximately $2 billion will be redistributed among creditors, and the plan will also distribute equity in a new company, temporarily dubbed “NewCo.”

Related: SEC raises concerns over Coinbase in objection to Celsius restructuring plan

Sporting a similar situation, bankrupt cryptocurrency lending platform BlockFi’s liquidation plan got approval from the New Jersey bankruptcy court.

The repayment amount received by BlockFi’s unsecured creditors will largely depend on whether BlockFi succeeds in its legal battle against FTX and other bankrupt cryptocurrency firms.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Blockchain detectives: Mt. Gox collapse saw birth of Chainalysis