Asset manager Hashdex has submitted its second amended application for a proposed exchange-traded fund (ETF) designed as a one-stop-shop cryptocurrency portfolio, according to a Nov. 25 regulatory filing.

The revised filing signals continued progress for the crypto index ETF with the Securities and Exchange Commission (SEC), the United States’ top financial regulator.

Hashdex filed its first amended S-1 in October after the SEC asked for more time to reach a decision on whether to authorize the ETF for trading.

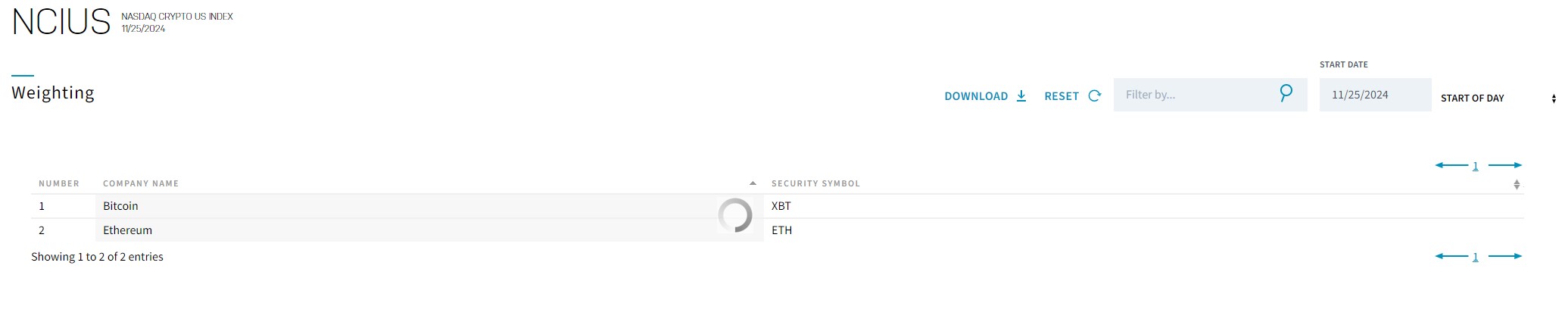

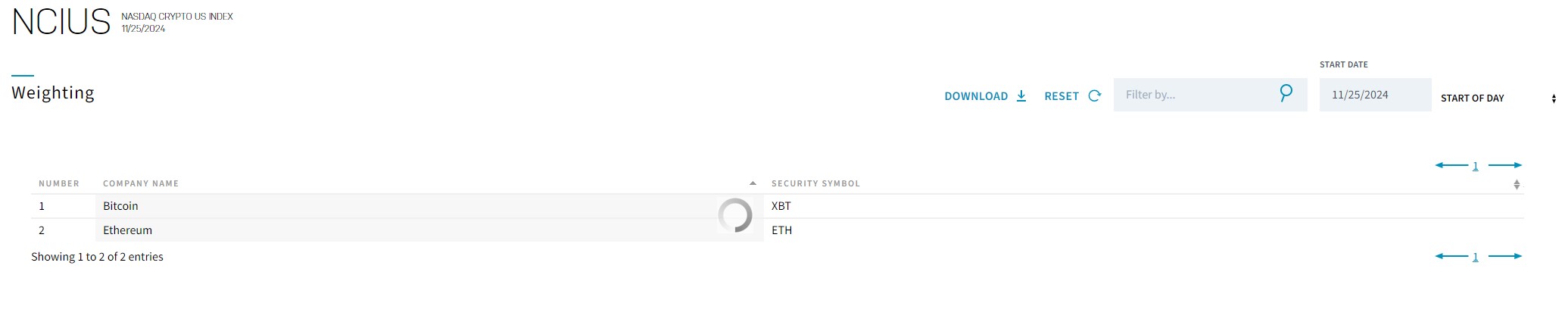

The Hashdex Nasdaq Crypto Index US ETF will initially comprise Bitcoin

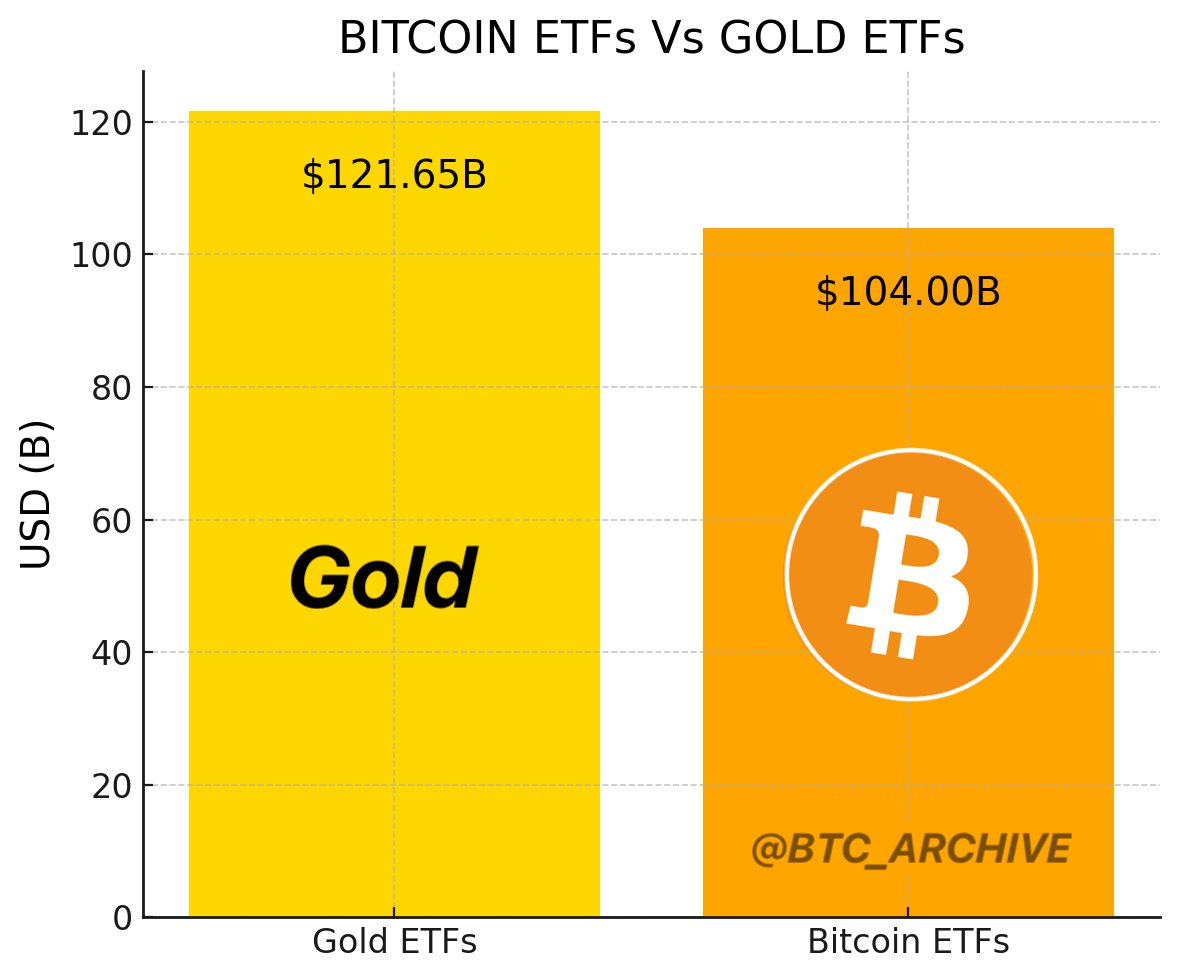

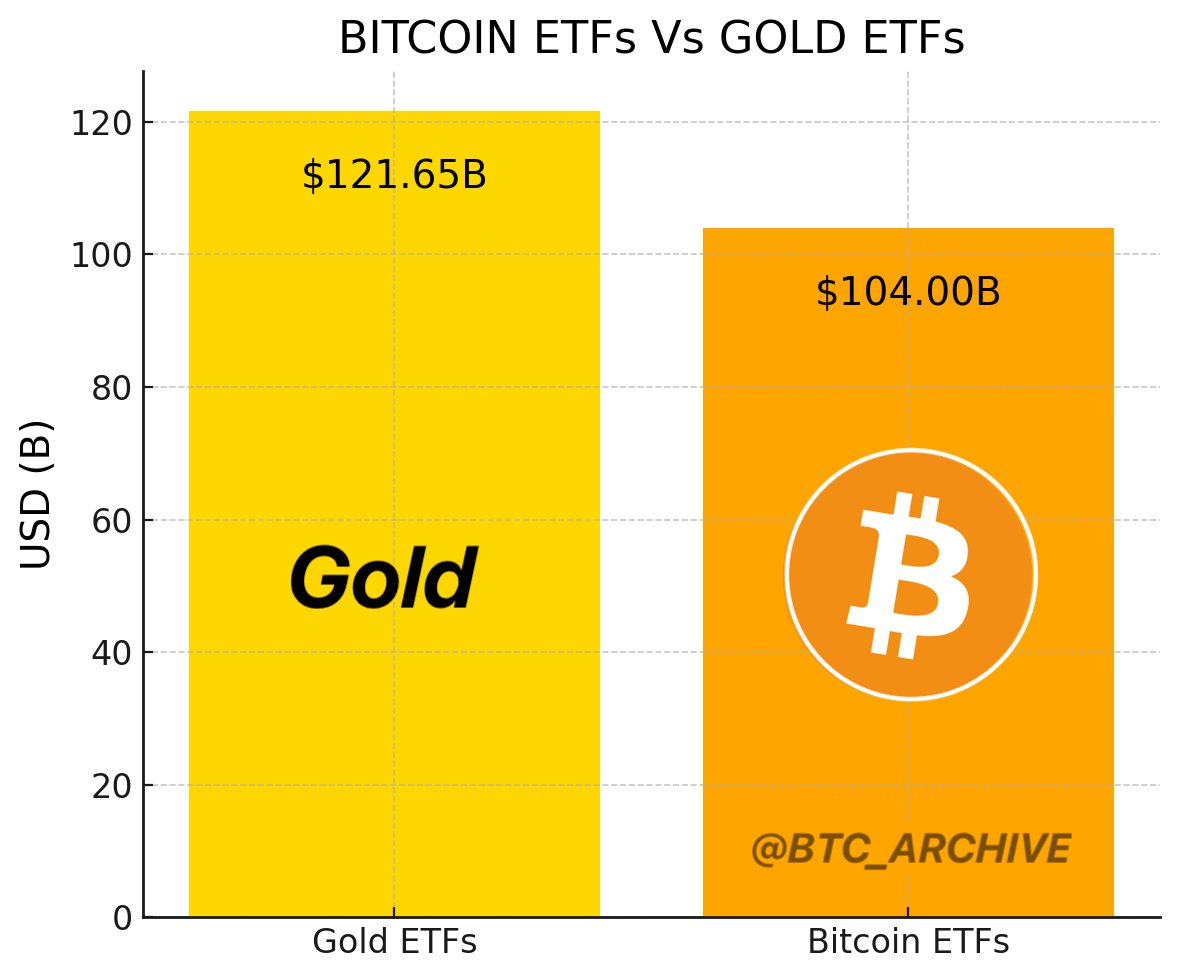

Related: BlackRock’s Bitcoin ETF flips gold fund

Industry analysts say crypto index ETFs are the next big focus for issuers after ETFs holding BTC and ETH listed in January and July, respectively.

“The next logical step is index ETFs because indices are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” Katalin Tischhauser, head of investment research at crypto bank Sygnum, told Cointelegraph in August .

The SEC has softened its stance on crypto oversight after Donald Trump — who has promised to turn the US into the “world’s crypto capital” — prevailed in the US elections on Nov. 5.

On Nov. 21, SEC Chair Gary Gensler, known for his hardline stance on cryptocurrency regulation, said he would depart the agency on Jan. 20, 2025.

In July, Trump vowed to “fire” Gensler in a bid to woo crypto enthusiasts ahead of the presidential election. Gensler will leave the agency the same day Trump starts his second presidential term.

Asset managers Franklin Templeton and Grayscale are also seeking to launch crypto index ETFs.

The Franklin Crypto Index ETF will track the performance of the CF Institutional Digital Asset Index, which, like the Nasdaq Crypto US Index, currently only comprises BTC and ETH.

The Grayscale Digital Large Cap Fund , which was created in 2018 but is not yet exchange-traded, holds a crypto index portfolio comprising BTC, ETH, Solana

Grayscale’s fund is unique among proposed index ETFs in tracking a basket containing alternative cryptocurrencies.

Magazine: US enforcement agencies are turning up the heat on crypto-related crime

Asset manager Hashdex has submitted its second amended application for a proposed exchange-traded fund (ETF) designed as a one-stop-shop cryptocurrency portfolio, according to a Nov. 25 regulatory filing.

The revised filing signals continued progress for the crypto index ETF with the Securities and Exchange Commission (SEC), the United States’ top financial regulator.

Hashdex filed its first amended S-1 in October after the SEC asked for more time to reach a decision on whether to authorize the ETF for trading.

The Hashdex Nasdaq Crypto Index US ETF will initially comprise Bitcoin

Related: BlackRock’s Bitcoin ETF flips gold fund

Industry analysts say crypto index ETFs are the next big focus for issuers after ETFs holding BTC and ETH listed in January and July, respectively.

“The next logical step is index ETFs because indices are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto,” Katalin Tischhauser, head of investment research at crypto bank Sygnum, told Cointelegraph in August .

The SEC has softened its stance on crypto oversight after Donald Trump — who has promised to turn the US into the “world’s crypto capital” — prevailed in the US elections on Nov. 5.

On Nov. 21, SEC Chair Gary Gensler, known for his hardline stance on cryptocurrency regulation, said he would depart the agency on Jan. 20, 2025.

In July, Trump vowed to “fire” Gensler in a bid to woo crypto enthusiasts ahead of the presidential election. Gensler will leave the agency on the same day Trump starts his second presidential term.

Asset managers Franklin Templeton and Grayscale are also seeking to launch crypto index ETFs.

The Franklin Crypto Index ETF will track the performance of the CF Institutional Digital Asset Index, which, like the Nasdaq Crypto US Index, currently only comprises BTC and ETH.

The Grayscale Digital Large Cap Fund , which was created in 2018 but is not yet exchange-traded, holds a crypto index portfolio comprising BTC, ETH, Solana

Grayscale’s fund is unique among proposed index ETFs in tracking a basket containing alternative cryptocurrencies.

Magazine: US enforcement agencies are turning up the heat on crypto-related crime