Lawmakers in the US state of Ohio have introduced a bill that prohibits the state legislature from imposing taxes on digital assets when used as a payment method.

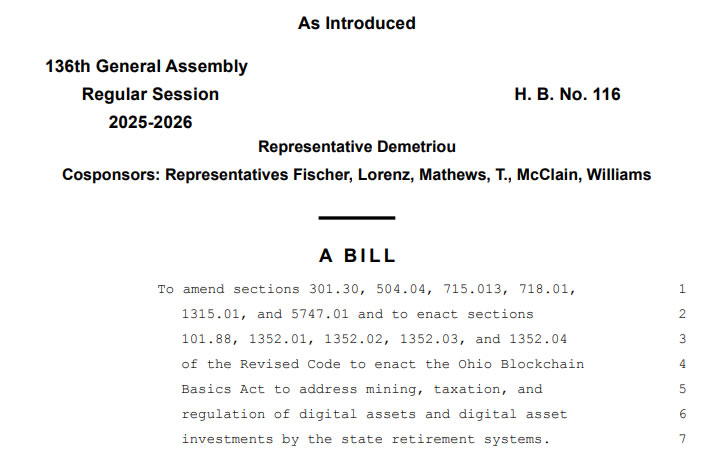

Ohio House Bill 116, introduced on Feb. 24 by Representative Steve Demetriou and co-sponsored by Tex Fischer, Brian Lorenz, Ty D. Mathews, Riordan McClain and Josh Williams, aims to amend existing legislation preventing municipalities from imposing extra taxes or fees on crypto assets beyond those applied to traditional fiat transactions.

“The general assembly shall not enact a bill that proposes to impose a fee, tax, assessment, or other charge on digital assets used as a method of payment for goods and services,” it reads .

The bill defines “digital assets” as cryptocurrencies, stablecoins and non-fungible tokens.

The bill clarifies that taxes usually applied to legal tender, such as state or sales taxes, would still apply to crypto transactions, but there should be no new levies.

The “Ohio Blockchain Basics Act” also stated that no state agency or political subdivision may prohibit individuals from accepting crypto assets as payment for goods and services.

Right to self-custody, crypto mining

The bill also lets its residents retain the right to self-custody their digital assets using hardware or self-hosted wallets and partake in crypto staking.

Additionally, activities such as mining, staking, and exchanging crypto assets for other crypto assets do not require “money transmission” licensing under existing Ohio laws.

Individuals are also permitted to engage in crypto mining in residential areas if they comply with local zoning regulations. Meanwhile, mining businesses are explicitly allowed in industrial zones and cannot be unfairly targeted by local zoning changes.

Under the proposed legislation change, Ohio state retirement funds will also be required to evaluate the potential risks and benefits of investing in a crypto exchange-traded fund and report back to the General Assembly within a year.

Related: IRS issues temporary relief on crypto cost-basis method changes

Ohio representatives have been proactive with crypto-related bills in recent months. In September, Ohio Senator Niraj Antani introduced a bill requiring the state to accept cryptocurrency for payment of state taxes and fees.

In December, Ohio House Republican leader Derek Merrin introduced HB 703 , aiming to establish a strategic Bitcoin reserve for the state.

Meanwhile, Ohio Senator Sandra O’Brien introduced another bill in February to create an “Ohio Bitcoin Reserve Fund,” with a five-year hodling period.

Magazine: Is XRP on its way to $3.20? SEC drops Coinbase lawsuit, and more: Hodler’s Digest