US President Donald Trump said he would announce a decision regarding reciprocal tariffs on import goods from trading partners on Feb. 13.

“Three great weeks, perhaps the best ever, but today is the big one: reciprocal tariffs!!! Make America Great Again,” the president wrote on Truth Social.

Previous news of import tariffs and a looming trade war sent crypto and stock markets plummeting as countries like Canada, Mexico and China considered counter-tariffs as a response.

Market analysts continue to debate the effects of President Trump’s trade tariffs on the crypto markets, Bitcoin

Related: Risk-on assets? Trump tariffs lead to mass Bitcoin, crypto liquidations

Trump tariffs and the potential effects on markets

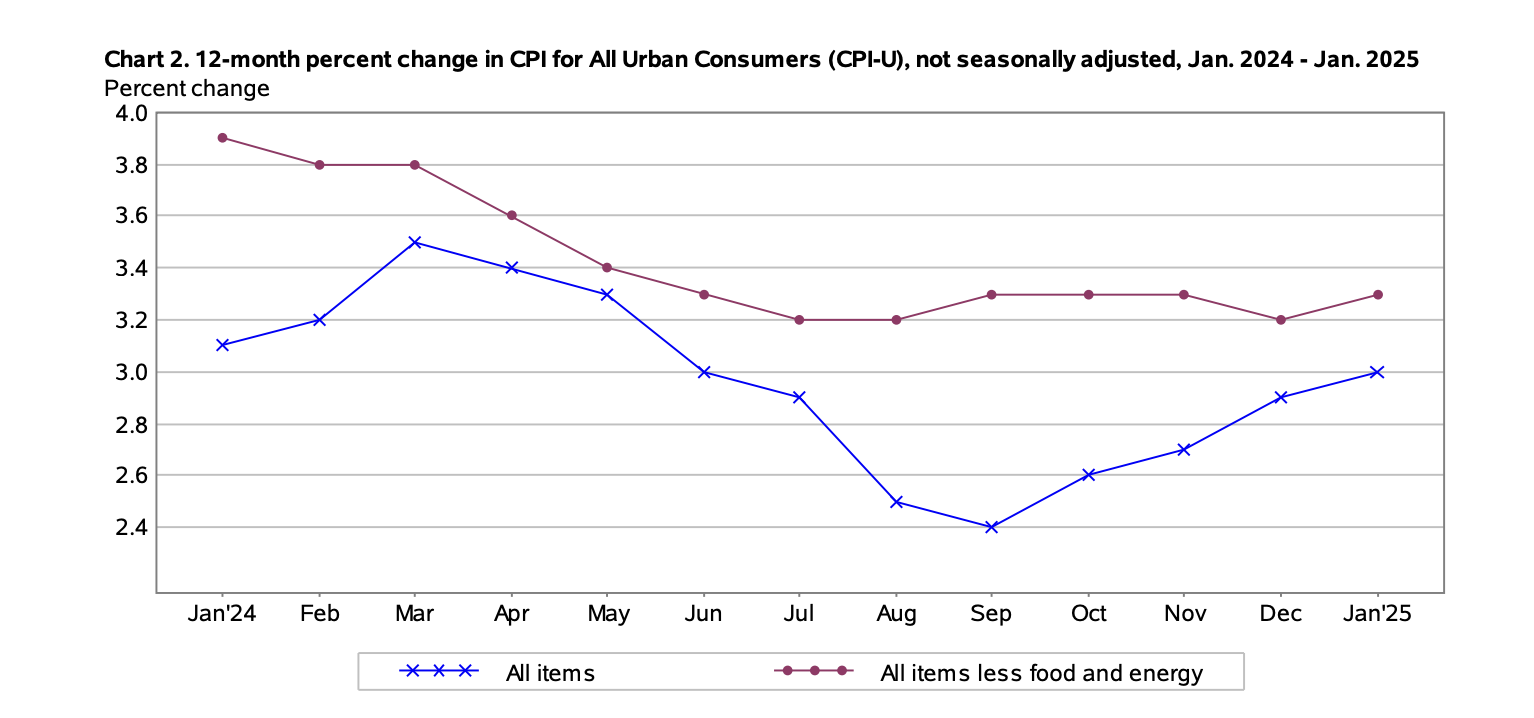

Tariffs have the potential to drive consumer prices higher, increase inflation and create volatility in financial markets.

The Feb. 12 US Consumer Price Index (CPI) data came in 0.1% higher than expected, with inflation hitting 3% — and Bitcoin dropping below $95,000 on the news.

Coin Bureau CEO and market analyst Nic Puckrin told followers on social media to keep an eye on the Producer Price Index (PPI) as an indicator of potential price increases in anticipation of trade tariffs.

PPI measures the costs of raw materials and other products businesses use to manufacture consumer products.

Puckrin wrote that the market expects the PPI to rise by 0.3% in advance of a tariff announcement from President Trump.

BitWise analyst Jeff Park took a more long-term view and said that a trade war could send Bitcoin prices soaring to new heights.

Park argued that the end goal of the tariffs was to weaken the US dollar in global financial markets, something that previously occurred under the Plaza Accord in 1985.

The Plaza Accord was an agreement between the United States, Japan, West Germany, France and the United Kingdom to artificially weaken the US dollar, making US exports more attractive in international trade.

The analyst added that tariffs would affect all economies but would be disproportionately felt by residents living outside of the United States and lead to greater inflation.

This inflation would, in turn, cause the residents of those countries to seek alternative store-of-value assets, such as Bitcoin.

Magazine: Bitcoin payments are being undermined by centralized stablecoins