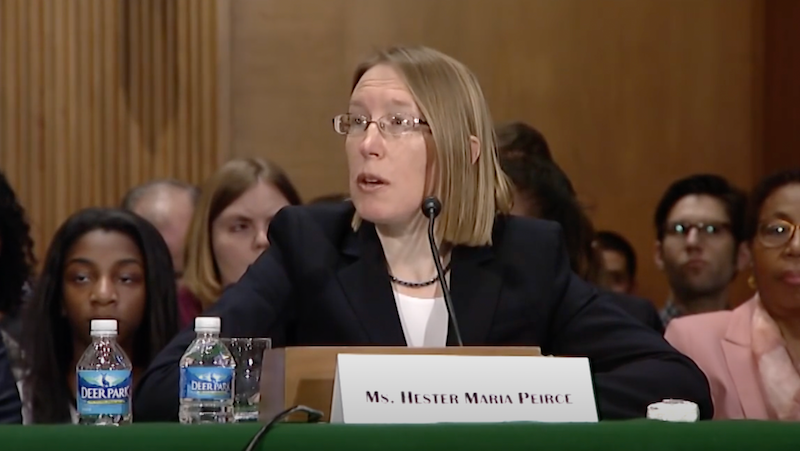

The retroactive token and coin offering relief measures proposed by US Securities and Exchange Commission Commissioner Hester Peirce will likely benefit crypto firms and projects with a certain profile, attorneys told Cointelegraph.

Franco Jofré, an attorney and a senior adviser at Miller & Chevalier, said firms that conducted initial coin offerings during the ICO boom of 2017–2018 have a strong argument for relief under the new proposal.

Projects that exhibit strong utility use cases for their tokens or coins, as opposed to purely speculative instruments with an investment focus, will also likely qualify for any potential relief, Jofré added. The attorney said:

“If the SEC provides relief, it could introduce clearer criteria distinguishing security tokens from true utility tokens. For example, tokens issued primarily for access to a service or platform or those structured to function more like digital goods rather than equity substitutes.”

These include decentralized finance projects, layer-2 scaling solutions, and other crypto infrastructure that use tokens for governance and security. Custodians and centralized exchanges are also notable candidates for relief, the attorney told Cointelegraph.

Related: SEC is scaling back its crypto enforcement unit: report

SEC has the authority to dismiss prior lawsuits, but there’s a catch

Jofré and Eli Cohen — the general counsel at real-world asset tokenization platform Centrifuge — said the SEC has the full authority to dismiss the lawsuits it brought against crypto firms for allegedly offering unregistered securities.

However, Jofré said any potential relief from the SEC would exclude firms it deemed to have engaged in fraud or misled investors during their initial coin offerings. According to him, the SEC was unlikely to drop all of its litigation against crypto firms.

The attorney added that if the SEC redefines the criteria for securities offerings or adopts a new approach to interpreting initial coin sales, then pending litigation will have a greater chance of being dropped.

Moreover, the SEC could decide not to offer retroactive relief to crypto firms at all and only focus on granting prospective relief, Jofré said.

New regulatory approach is welcomed but will take some time

Consensys attorney Bill Hughes said that the regulatory approach under the new leadership at the Securities and Exchange Commission is a breath of fresh air but implementing changes will take some time.

In a statement to Cointelegraph, the attorney urged patience while the new leadership at the SEC settles into its role. Hughes added:

"I expect the crypto industry to be mindful of the issues [Peirce] identifies and will go forward with an admirable degree of patience. But at the same time, no one can expect us to wait forever for a new leaf to be turned."

"I think it’s fair to expect that leaf to turn by the summer at the latest," Hughes continued.

The attorney also praised the agency's invitation for crypto firms to provide input for the regulatory process — something industry executives have requested for years.

Magazine: Godzilla vs. Kong: SEC faces fierce battle against crypto’s legal firepower