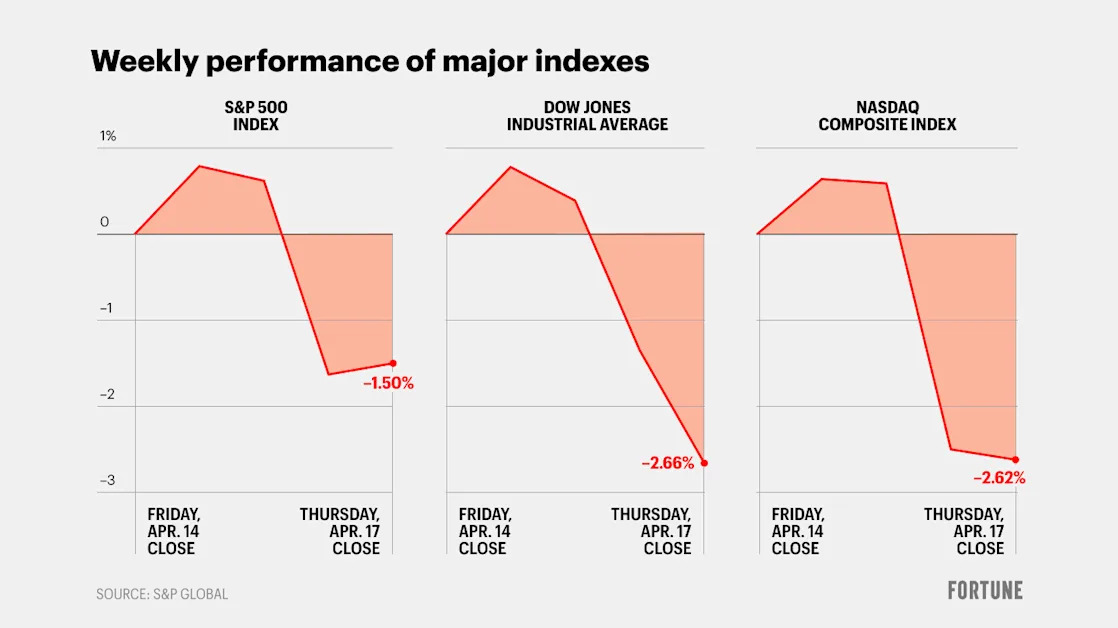

Beneath Market’s Uneasy Calm, Dread Runs Deep Across Wall Street

(Bloomberg) -- It was an unexpected, if improbable relief. The panic unleashed by Donald Trump’s trade war, which convulsed financial markets around the globe and sowed doubts about America’s standing in the world, died down nearly as quickly as it began.Most Read from BloombergTrump Signs Executive Orders on Federal Purchasing, Office SpaceDOGE Places Entire Staff of Federal Homelessness Agency on LeaveHow Did This Suburb Figure Out Mass Transit?Why the Best Bike Lanes Always Get BlamedNashvill