Stocks, dollar drift as US-Japan trade talks in focus

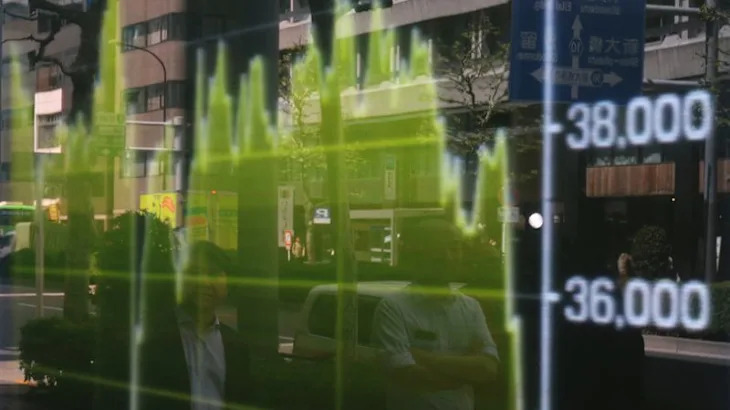

Asian equities edged higher on Thursday, while the dollar firmed slightly as traders took stock of trade negotiations between the U.S. and Japan even as uncertainties around tariffs implemented by President Donald Trump kept sentiment fragile. Investors were also digesting comments from Federal Reserve Chair Jerome Powell, who warned of the risk of slowing growth and rising prices due to tariffs, while gold prices scaled record highs again on safe-haven flows. Japan's Nikkei rose 0.7% while the yen weakened as Japan kicked off talks with the United States.