Trade, tariffs, energy - market reaction to Trump's first day

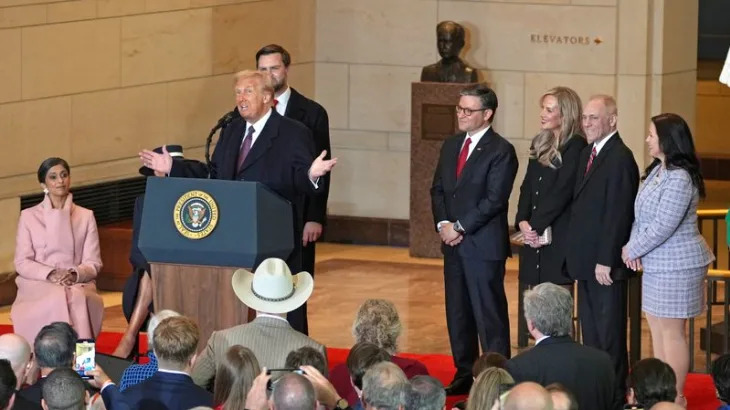

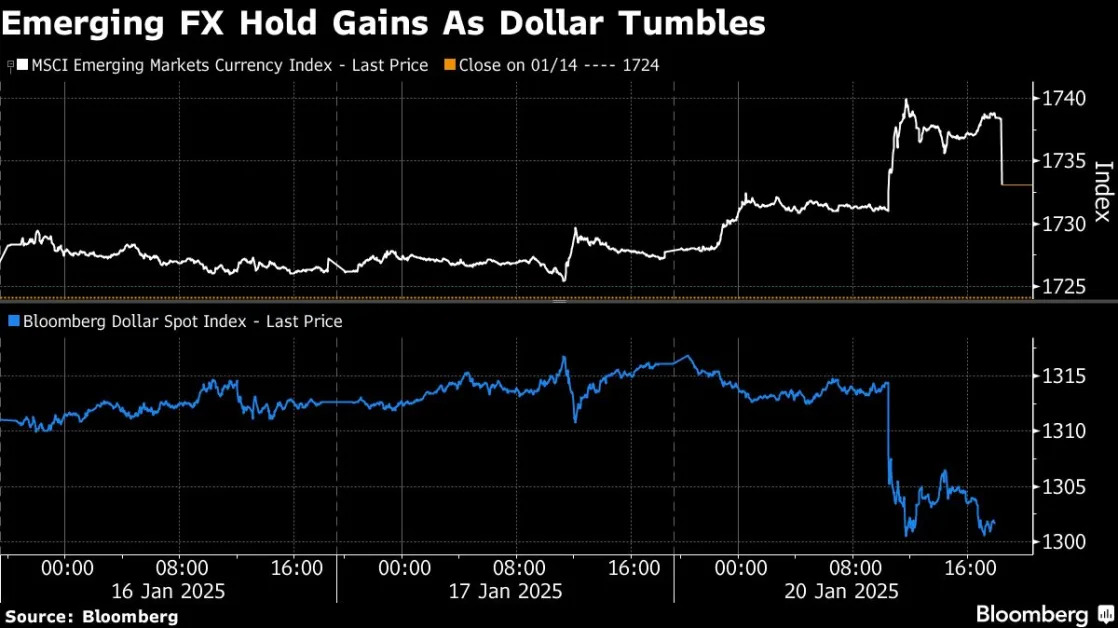

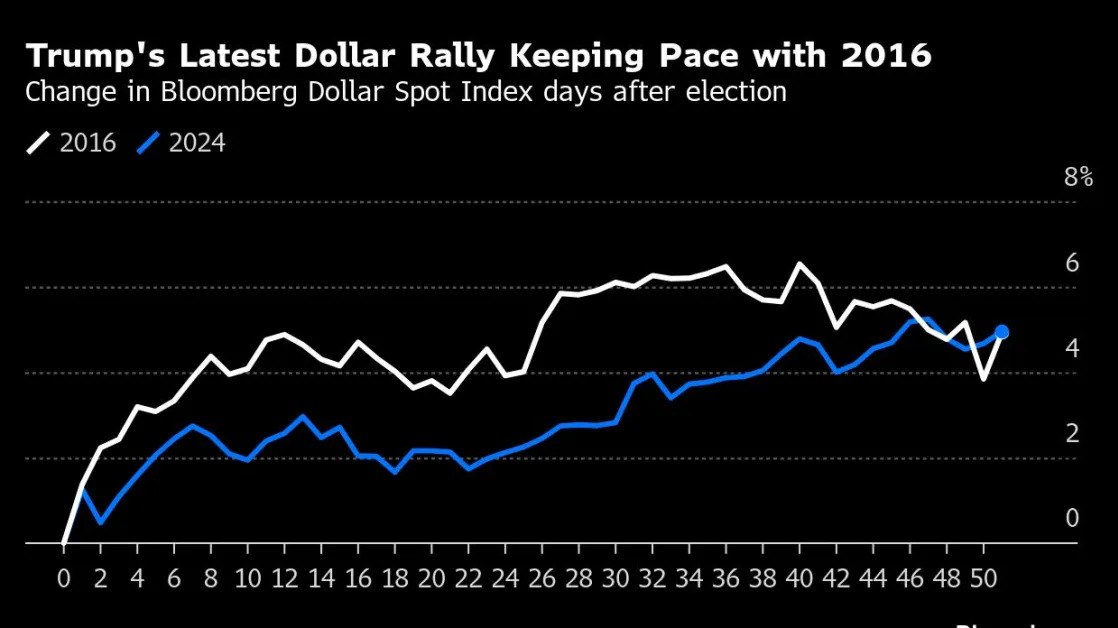

SINGAPORE/LONDON/NEW YORK (Reuters) -Global markets were volatile while the dollar rebounded on Tuesday in choppy trading in the first few hours of Donald Trump's new presidency after he announced plans for trade tariffs on neighbouring countries. Trump was quoted saying his team was thinking of tariffs around 25% on Canada and Mexico which could be announced on Feb. 1.