Just a few weeks after the March State of Freight webinar , FreightWaves and SONAR CEO Craig Fuller and SONAR Chief of Market Intelligence Zach Strickland took to the same platform with a significantly altered freight market landscape in front of them.

In March, what was on the table were auto tariffs, now paused. But what happened in the relatively short interim was Liberation Day, and the escalating tariff war with China that has put 145% tariffs on imports from that country, the largest supplier of imported goods to the U.S.

Here are five key points of discussion from Fuller and Strickland.

Freight markets need volumes; what is happening to them so far?

During the webinar, Strickland and Fuller turned to several data series in SONAR to show the state of the market as the era of tariffs takes hold.

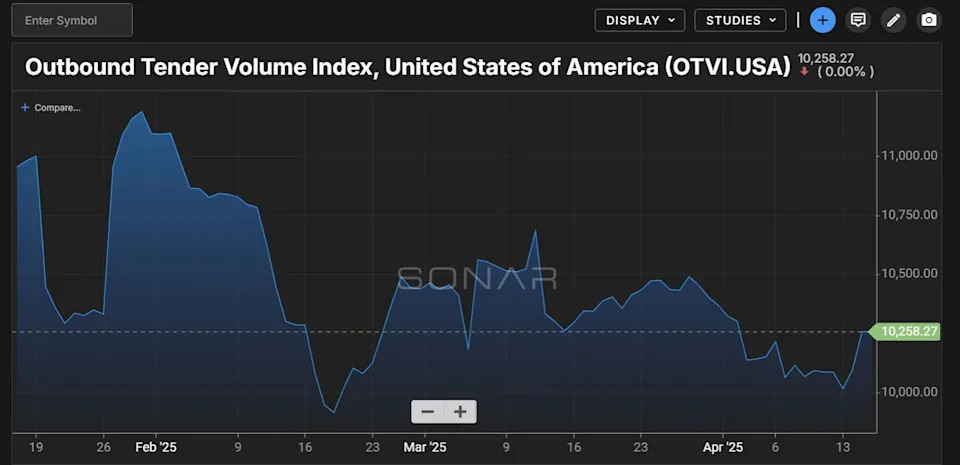

One was the Outbound Tender Volume Index (OTVI), one of the most important SONAR data series that measures changes in the direction of freight volume, which has showed a notable decline in recent weeks. The direction of the OTVI WAS backed up anecdotes relayed by Fuller.

“I was with a large transportation player this week, and they made the comment that a lot of their customers have asked for slower transit time,” Fuller said. Given that logistics is an industry where time normally is of the essence, the request to Fuller was funny because it meant that end customers were looking for a “warehouse on wheels or on tracks.”

“It’s because nobody wants to take possession of the inventory,” Fuller said. “There is an advantage to a warehouse on wheels, because then you don’t have to worry about it.”

The trucking market is hanging in there

Maybe it’s because of the warehouse on wheels effect, but indicators on the strength of the trucking market have not taken a significant downward move as a result of tariff uncertainty.

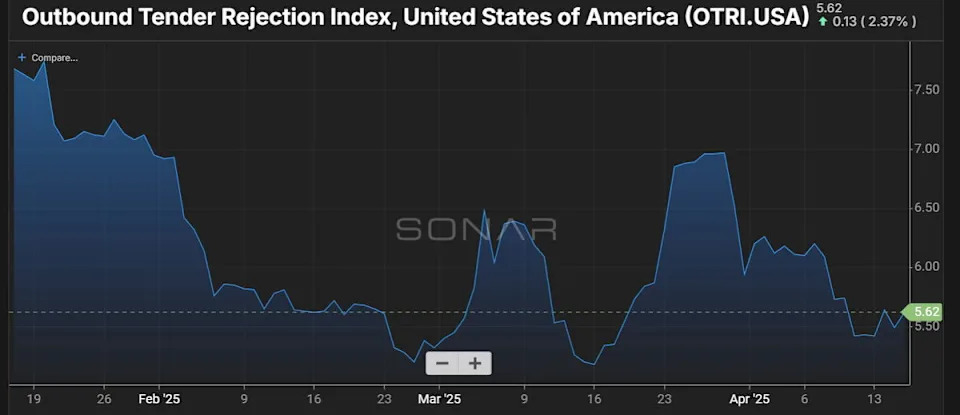

The Outbound Tender Rejection Index, a measurement of truckload capacity, is about the same level as it was in February though it has slipped somewhat in recent weeks.

The OTRI is running at about 5.6%, and that is higher than a year ago, when it was below 4%, indicating tighter capacity at present. That rejection rate, Fuller said, “suggests that the market is still in a recovery process. What concerns me is what’s coming.”

“It’s not really dire,” he said, adding that an OTRI number at the current level might otherwise be seen as the end of the three-year freight recession.

If the market were to turn down from its current levels, Fuller said, it would not just be a new phase of that three-year slump. Instead, he said, “what we’re looking at now is an entirely different cycle caused by this economic blow that potentially could be reverberating through the freight market as well as the broader economy.”

The worst may start to hit soon

Neither Strickland nor Fuller was optimistic about what lies ahead.

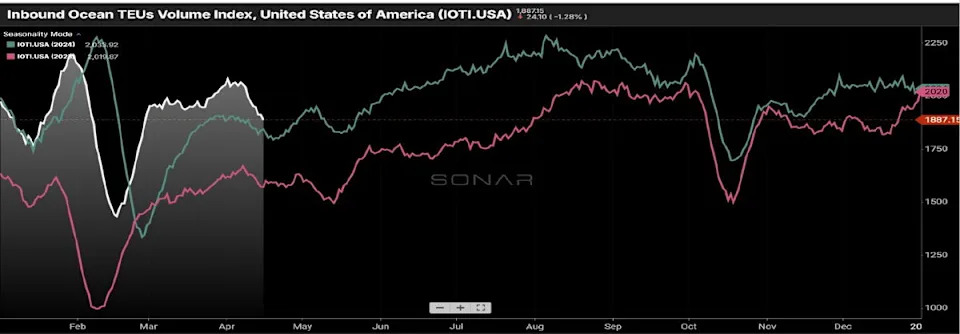

One statistic they cited was SONAR’s IOTI.USA, which is a 14-day moving average of import bookings of twenty foot equivalent units (TEUs). In recent weeks, the index has taken a notable downturn.

Import activity was at a near-record level just a few weeks ago, Fuller said. “But if you look at the day-to-day trade data, it is telling us that bookings are literally dropping off the shelf, and we’re seeing bookings down 60% from where they were before,” he said.

Where that is going to hit would be intermodal, since much of that cargo comes into major ports like Long Beach/Los Angeles and then moves into the rest of the country by rail, and trucking that goes cross country or long distances. “That summer surge, where a lot of import activities take place, I don’t know that we’re going to see that this year,” Fuller said. “I’d be surprised if we did.”

In an ominous warning, Fuller said he expects drayage activity in California to begin collapsing in just a couple of weeks as a result of the downturn in import volume.

How small importers might react

Fuller said the 10% across-the-board tariffs implemented by the Trump administration were probably seen by most companies as a cost that they could deal with. Even when the discussion was about a 54% tariff from China, “that felt like many businesses could absorb that cost.”

But at 145%, “we’re talking about effectively cutting off most trade. It is just basically a message that the administration does not want to see trade with China.”

Fuller spoke from the perspective of also owning several small e-commerce businesses that sell among other things model airplane products.

But it was observations Fuller said he heard from a freight forwarder that were the most stark.

“The comment made to me was a lot of our customers are going to go bankrupt,” Fuller said. “And the reason is that companies that have a single source supply chain in China did not have enough time to deal with the short-term pain. For them, they’re just cancelling altogether.”

He said in his own business, there are some products that at a 145% tariff, “we’re not going to make any money on. It is just easier to cut it all off.”

And that cutoff will come with a wish: “we’ll hope that this gets resolved quickly,” Fuller said. But it’s difficult to forecast, because as Fuller added, “a lot of times the suppliers don’t even know what’s going on.”

The Chinese might have an advantage in waiting it out

Fuller doesn’t see the Chinese backing down anytime soon.

He noted that in China, Mao Zedong, who Fuller noted led the country during a period when anywhere from 40 million to 60 million people died due to various Mao policies, is nonetheless a revered figure still. Xi Jinping, whom historians have said is the most powerful leader in China since Mao, “wants to be the sort of second coming of Mao.”

Given that, Fuller doesn’t see China blinking anytime soon.

“How long are we going to stay in this situation where you have Donald Trump at a 145% tariff and China saying, we’re going to take the pain?” Fuller said. “The Chinese can suffer a lot longer than Americans.”

The people of the U.S., according to Fuller, “care more about commerce and business than we do about suffering the pain and sacrifice that is being asked of us.” Americans support a push to re-establish manufacturing in the U.S., he said, “but for how long?”

More articles by John Kingston

Another federal circuit weighs broker liability, boosting odds of Supreme Court review

Freight fraud everywhere, but Truckstop CEO asks: Is anybody going to jail?

Breaking from the FreightTech AI pack: Companies make their case at TIA meeting

The post Five takeaways from the State of Freight: a market at the precipice appeared first on FreightWaves .