Health insurance company UnitedHealth (NYSE:UNH) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 9.8% year on year to $109.6 billion. Its non-GAAP profit of $7.20 per share was 1.3% below analysts’ consensus estimates.

Is now the time to buy UnitedHealth? Find out in our full research report .

UnitedHealth (UNH) Q1 CY2025 Highlights:

“UnitedHealth Group grew to serve more people more comprehensively but did not perform up to our expectations, and we are aggressively addressing those challenges to position us well for the years ahead, and return to our long-term earnings growth rate target of 13 to 16%,” said Andrew Witty, chief executive officer of UnitedHealth Group.

Company Overview

With over 100 million people served across its various businesses and a workforce of more than 400,000, UnitedHealth Group (NYSE:UNH) operates a health insurance business and Optum, a healthcare services division that provides everything from pharmacy benefits to primary care.

Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Sales Growth

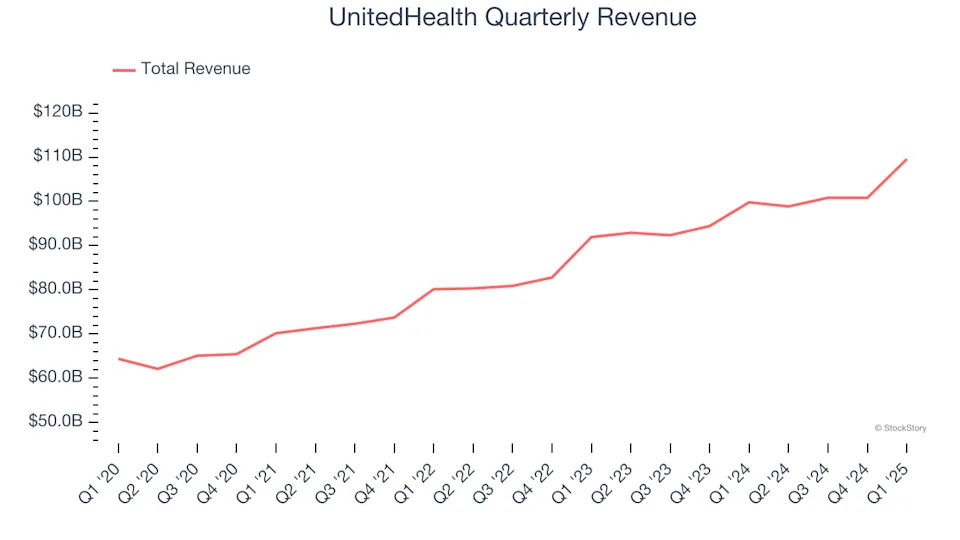

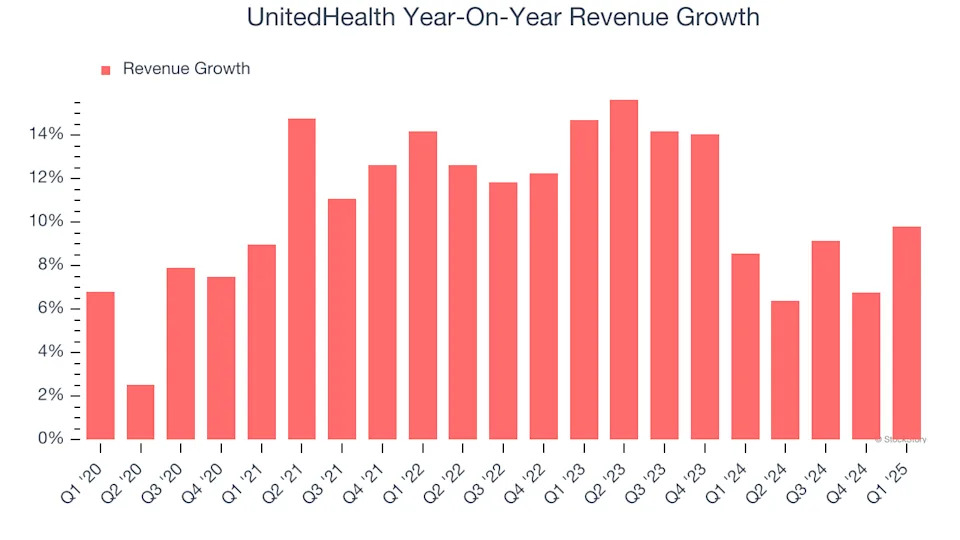

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, UnitedHealth grew its sales at a decent 10.7% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. UnitedHealth’s annualized revenue growth of 10.5% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, UnitedHealth’s revenue grew by 9.8% year on year to $109.6 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, an improvement versus the last two years. This projection is particularly noteworthy for a company of its scale and suggests its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Operating Margin

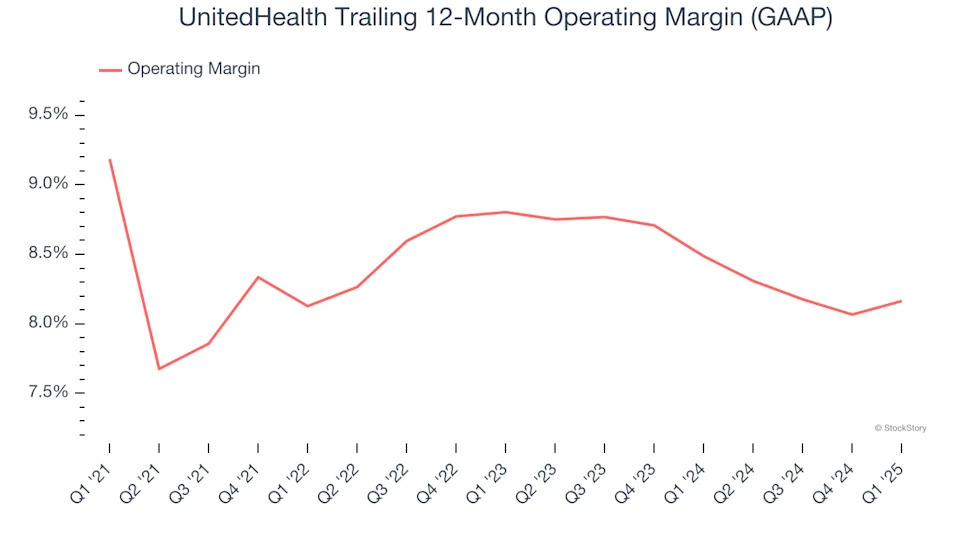

UnitedHealth was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.5% was weak for a healthcare business.

Analyzing the trend in its profitability, UnitedHealth’s operating margin decreased by 1 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. We like UnitedHealth and hope it can right the ship.

In Q1, UnitedHealth generated an operating profit margin of 8.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

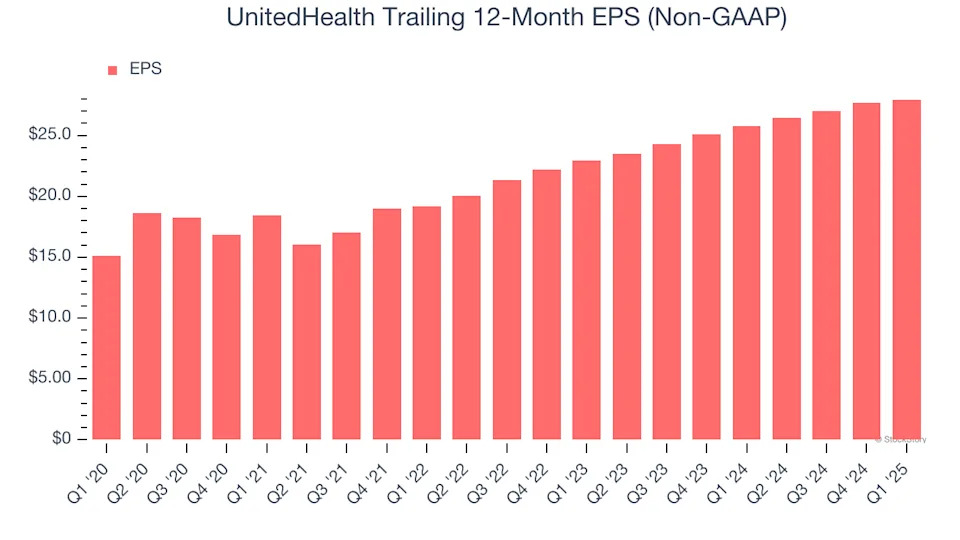

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

UnitedHealth’s EPS grew at a spectacular 13.1% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

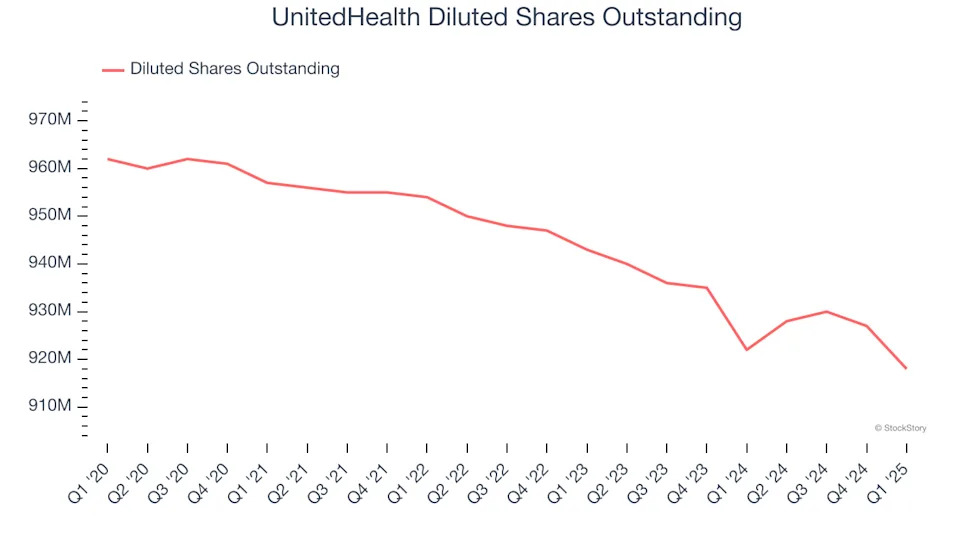

We can take a deeper look into UnitedHealth’s earnings to better understand the drivers of its performance. A five-year view shows that UnitedHealth has repurchased its stock, shrinking its share count by 4.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, UnitedHealth reported EPS at $7.20, up from $6.91 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects UnitedHealth’s full-year EPS of $27.96 to grow 10.1%.

Key Takeaways from UnitedHealth’s Q1 Results

We struggled to find many positives in these results. Its revenue and EPS in the quarter both fell short of Wall Street’s estimates. Looking ahead, full-year EPS guidance missed significantly as well. Overall, this was a softer quarter. The stock traded down 9.5% to $529.60 immediately after reporting.

The latest quarter from UnitedHealth’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .