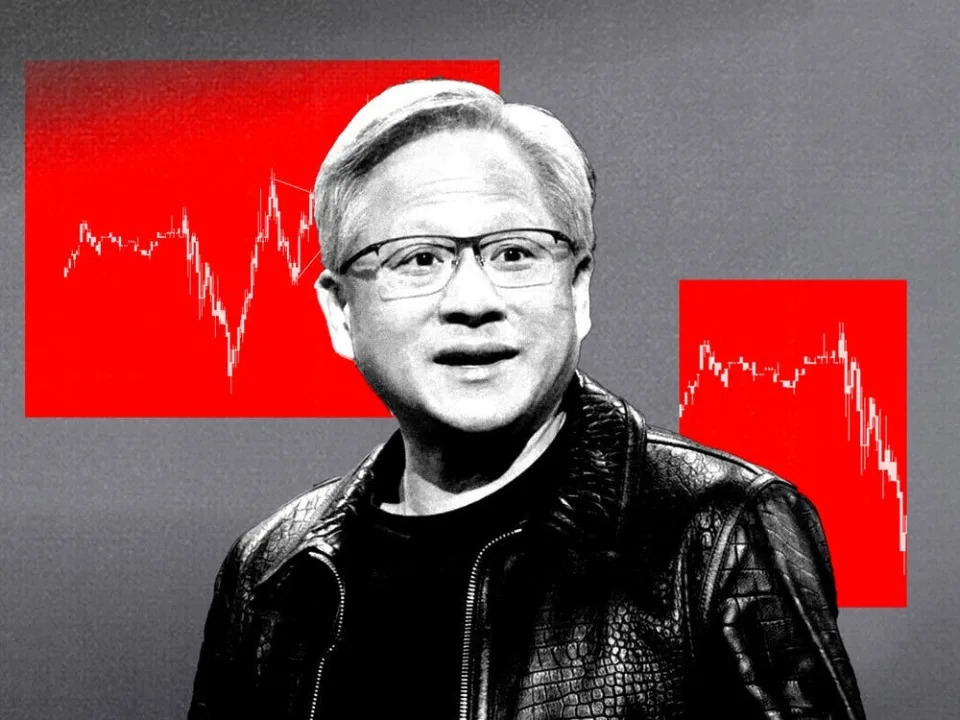

Nvidia shares flashed the dreaded "death cross" signal on Thursday.

The technical sell signal occurs when the 200-day moving average rises above the 50-day moving average.

The stock's 50-day moving average hit $127.39, dipping below the 200-day moving average of $127.73 early in Thursday's trading session before paring losses to rise about 1%.

The moving average crossover strategy can signal a reversal in a prior trend, suggesting that after a massive 948% rally since October 2022, shares of Nvidia could be on the verge of a downtrend.

The last time Nvidia flashed a death cross signal was in April 2022, amid a broader bear market for stocks. Shares of Nvidia went on to decline 47% before they bottomed out in October 2022.

Ari Wald, head of technical analysis at Oppenheimer & Co., said the death cross signal in Nvidia shares isn't a foolproof signal of a coming decline, and could ultimately be a head fake.

"While every major decline starts with a 'death cross' not every 'death cross' leads to a major decline," Wald told BI.

Instead, the current death cross in Nvidia shares could reflect the stock's range-bound behavior for nearly a year.

"The stock has shown a loss of momentum for a number of months which can be shown by the fact the stock has made little progress over the last 6-9 months," Wald said.

He added that he is staying on the sidelines with Nvidia stock until the broader market shows signs that it's bottomed after its latest decline. The S&P 500 entered correction territory last week, falling 10% from its peak in February.

"For now, we'd continue to respect the continued deterioration in the stock's trend, including the most recent 'death cross,'" Wald said.

Wald sees $128 as a key resistance level and $100 as key support for Nvidia shares.

Read the original article on Business Insider