Cloud security and compliance software provider Qualys (NASDAQ:QLYS) reported Q4 CY2024 results exceeding the market’s revenue expectations , with sales up 10.1% year on year to $159.2 million. The company expects next quarter’s revenue to be around $157 million, close to analysts’ estimates. Its non-GAAP profit of $1.60 per share was 17.2% above analysts’ consensus estimates.

Is now the time to buy Qualys? Find out in our full research report .

Qualys (QLYS) Q4 CY2024 Highlights:

"Customers are starting to leverage the breadth and depth of the Qualys Enterprise TruRisk Platform as they look to rearchitect and transform their security stacks," said Sumedh Thakar, Qualys' president and CEO.

Company Overview

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

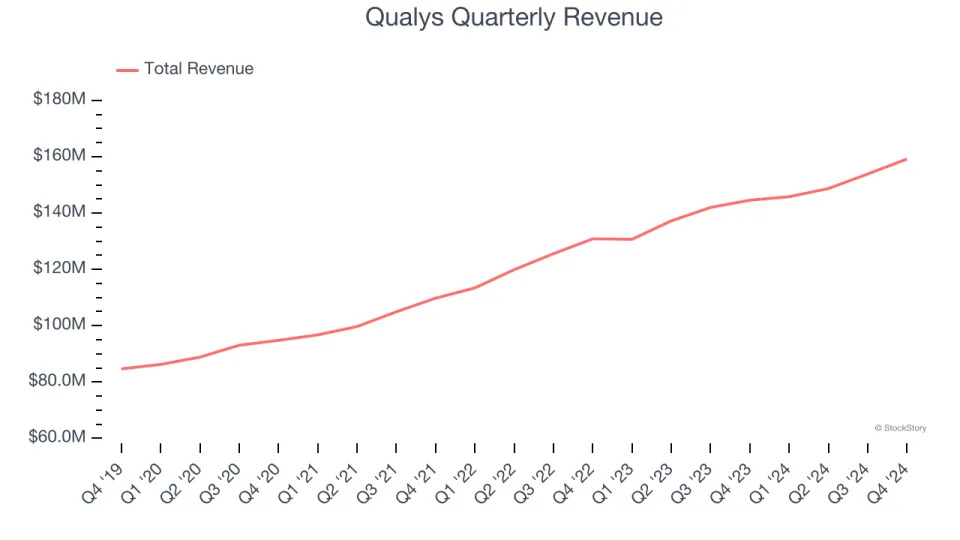

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Qualys grew its sales at a 13.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, Qualys reported year-on-year revenue growth of 10.1%, and its $159.2 million of revenue exceeded Wall Street’s estimates by 1.9%. Company management is currently guiding for a 7.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

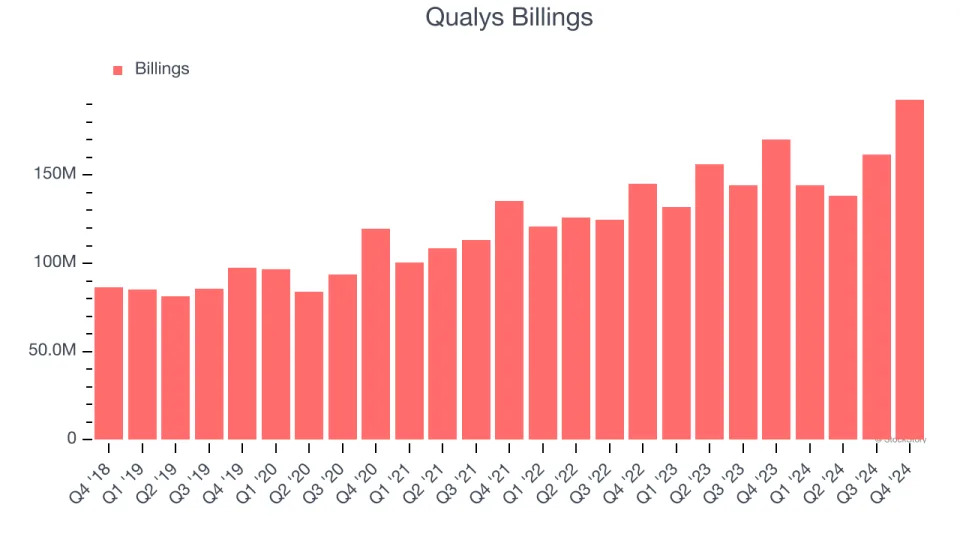

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Qualys’s billings came in at $192.8 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 5.9% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Qualys does a decent job acquiring new customers, and its CAC payback period checked in at 44.5 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from Qualys’s Q4 Results

We liked that Qualys beat analysts’ billings expectations this quarter. On the other hand, its full-year EPS guidance missed significantly and its revenue guidance for next year suggests growth will slow. Zooming out, we think this was a mixed quarter. The market seemed to focus on the negatives, and the stock traded down 5.4% to $133.25 immediately after reporting.

So do we think Qualys is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .