Precision measurement company Mettler-Toledo (NYSE:MTD) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 11.8% year on year to $1.05 billion. Its non-GAAP profit of $12.41 per share was 5.8% above analysts’ consensus estimates.

Is now the time to buy Mettler-Toledo? Find out in our full research report .

Mettler-Toledo (MTD) Q4 CY2024 Highlights:

Patrick Kaltenbach, President and Chief Executive Officer, stated, “We had a strong finish to the year as we capitalized on very good customer demand for Laboratory products, especially in Europe. Strong sales growth and solid execution of our margin improvement initiatives contributed to excellent Adjusted EPS and cash flow.”

Company Overview

Founded in 1945, Mettler-Toledo (NYSE:MTD) designs and manufactures precision instruments and services for use across healthcare research, quality control, production, and retail.

Research Tools & Consumables

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

Sales Growth

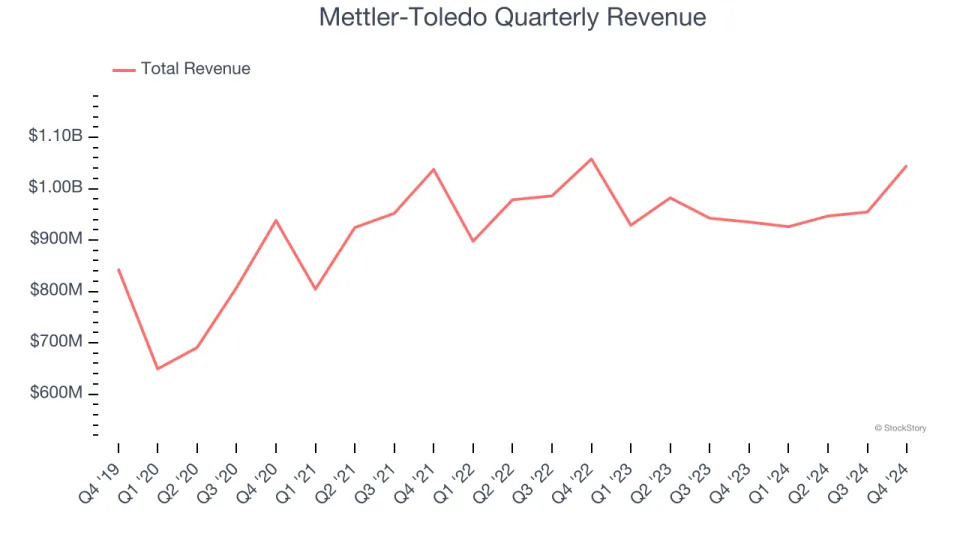

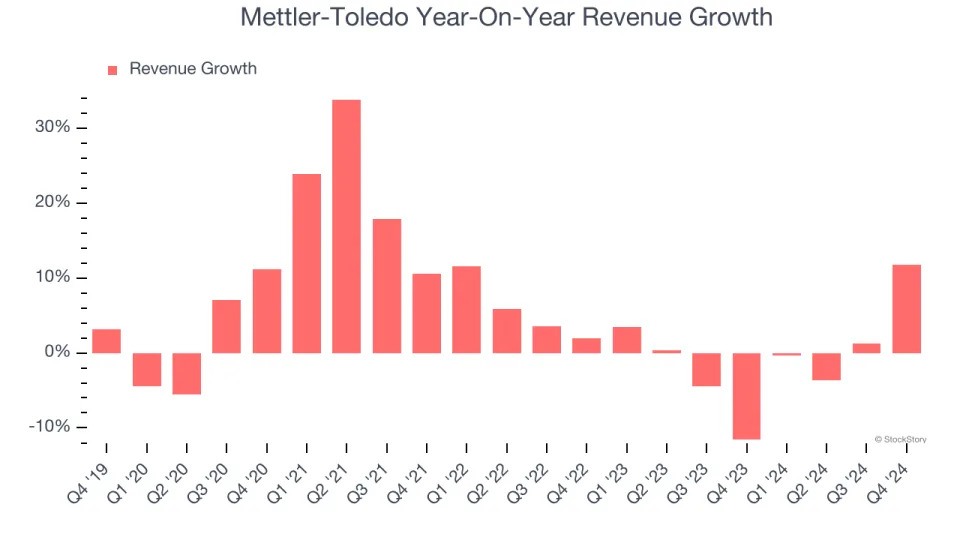

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Mettler-Toledo grew its sales at a mediocre 5.2% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Mettler-Toledo’s recent history shows its demand slowed as its revenue was flat over the last two years.

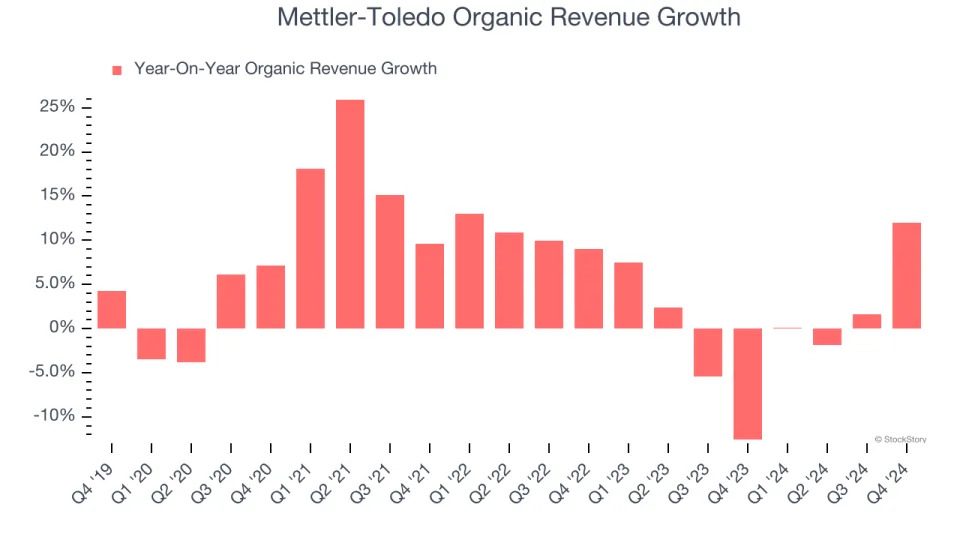

Mettler-Toledo also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Mettler-Toledo’s organic revenue was flat. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Mettler-Toledo reported year-on-year revenue growth of 11.8%, and its $1.05 billion of revenue exceeded Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Adjusted Operating Margin

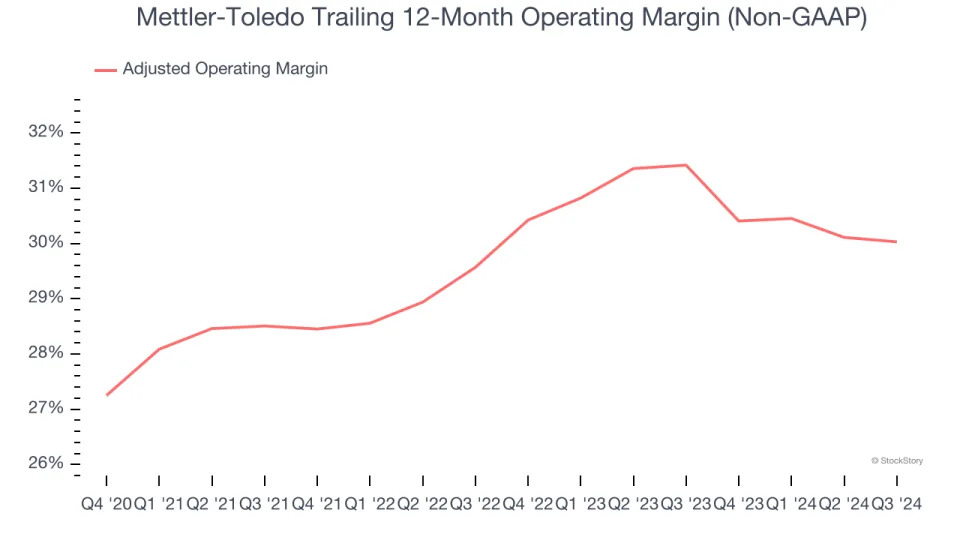

Mettler-Toledo has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 29.4%.

Analyzing the trend in its profitability, Mettler-Toledo’s adjusted operating margin rose by 4.5 percentage points over the last five years. This performance was mostly driven by its past improvements as the company’s margin was relatively unchanged on two-year basis.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

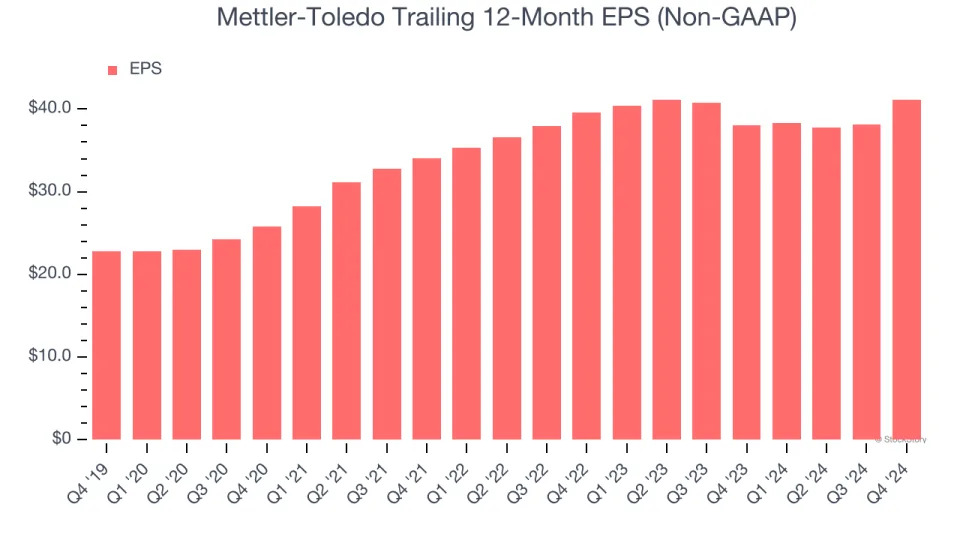

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Mettler-Toledo’s EPS grew at a spectacular 12.5% compounded annual growth rate over the last five years, higher than its 5.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

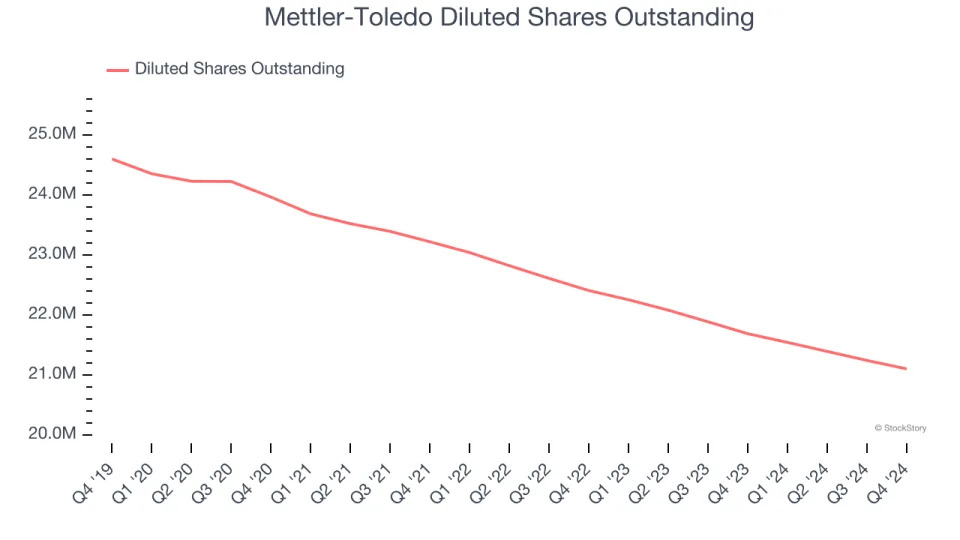

We can take a deeper look into Mettler-Toledo’s earnings to better understand the drivers of its performance. As we mentioned earlier, Mettler-Toledo’s adjusted operating margin expanded by 4.5 percentage points over the last five years. On top of that, its share count shrank by 14.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Mettler-Toledo reported EPS at $12.41, up from $9.40 in the same quarter last year. This print beat analysts’ estimates by 5.8%. Over the next 12 months, Wall Street expects Mettler-Toledo’s full-year EPS of $41.16 to grow 2%.

Key Takeaways from Mettler-Toledo’s Q4 Results

We were impressed by how significantly Mettler-Toledo blew past analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 10.9% to $1,500 immediately after reporting.

Sure, Mettler-Toledo had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .