Fashion brand Ralph Lauren (NYSE:RL) announced better-than-expected revenue in Q4 CY2024, with sales up 10.8% year on year to $2.14 billion. Its non-GAAP profit of $4.82 per share was 6.5% above analysts’ consensus estimates.

Is now the time to buy Ralph Lauren? Find out in our full research report .

Ralph Lauren (RL) Q4 CY2024 Highlights:

"Our teams around the world executed very well across geographies, channels, and categories this holiday to deliver on our long-term, Next Great Chapter: Accelerate strategy," said Patrice Louvet, President and Chief Executive Officer.

Company Overview

Originally founded as a necktie company, Ralph Lauren (NYSE:RL) is an iconic American fashion brand known for its classic and sophisticated style.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

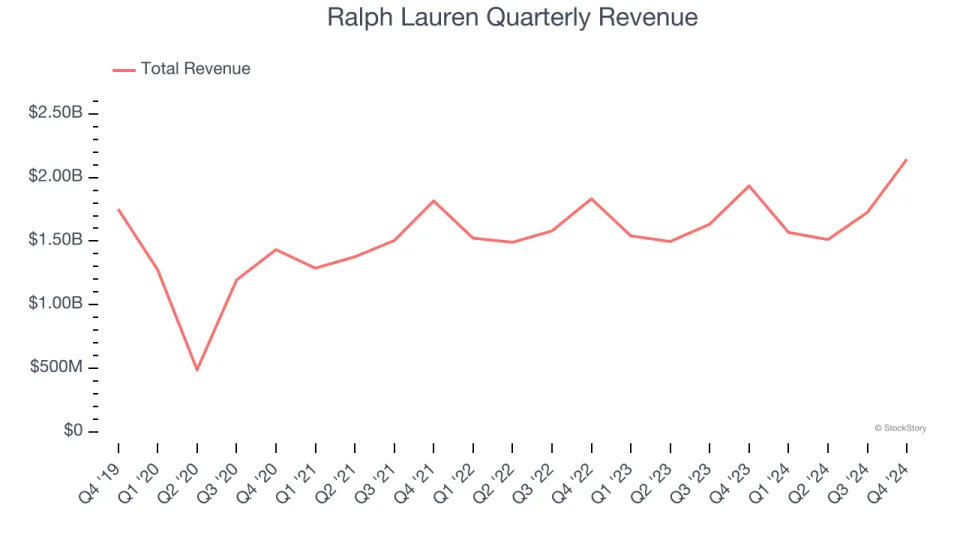

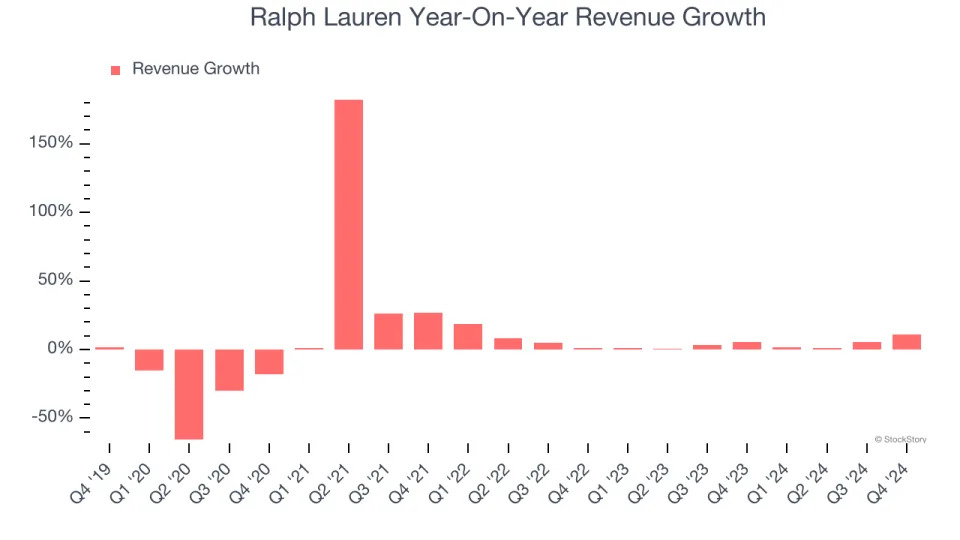

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Ralph Lauren’s sales grew at a weak 1.7% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Ralph Lauren’s annualized revenue growth of 4% over the last two years is above its five-year trend, but we were still disappointed by the results.

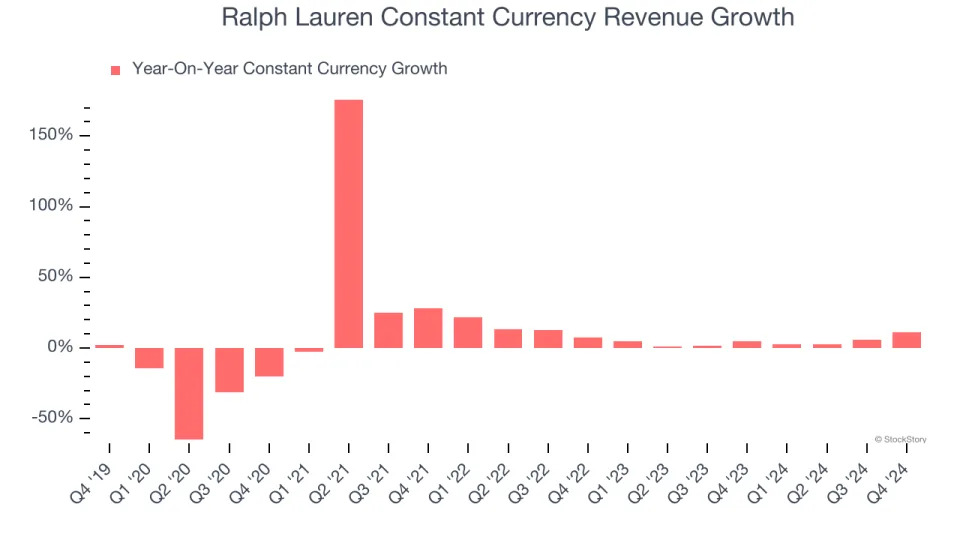

Ralph Lauren also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 4.4% year-on-year growth. Because this number aligns with its normal revenue growth, we can see Ralph Lauren’s foreign exchange rates have been steady.

This quarter, Ralph Lauren reported year-on-year revenue growth of 10.8%, and its $2.14 billion of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

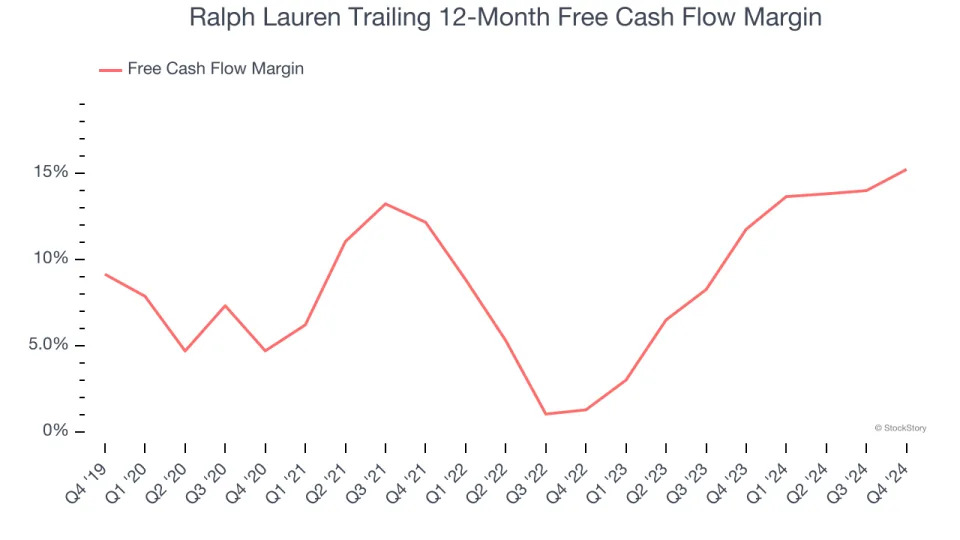

Ralph Lauren has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.5% over the last two years, better than the broader consumer discretionary sector.

Ralph Lauren’s free cash flow clocked in at $677.2 million in Q4, equivalent to a 31.6% margin. This result was good as its margin was 2.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Ralph Lauren’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 15.2% for the last 12 months will decrease to 12.8%.

Key Takeaways from Ralph Lauren’s Q4 Results

We were impressed by how significantly Ralph Lauren blew past analysts’ constant currency revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Looking ahead, its revenue guidance for 2025 of 6-7% growth is quite healthy. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 12.5% to $280.12 immediately following the results.

Sure, Ralph Lauren had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .