Trucking market still on track to tighten, but progress only gradual

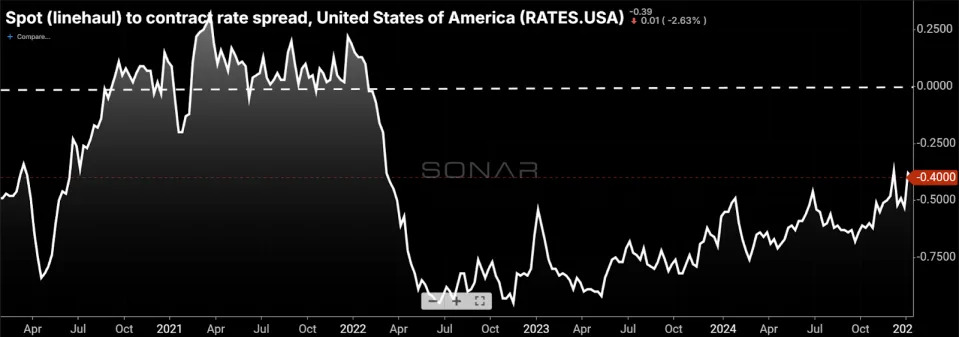

While most evidence still suggests that freight markets are on a path toward tightening, comments by public carriers so far this earnings season highlight the lack of an immediate inflection. As JP Hampstead described in his article earlier this week, “progress in tightening capacity and rising rates is halting and gradual.” Knight-Swift, the largest U.S. truckload carrier, reported a 0.7% decline in truckload revenue per loaded mile despite a major efficiency effort that included a 6% reduction in its number of tractors in service. SONAR data that suggests the market is still on a trajectory toward tightening include rising tender rejection rates, which are high relative to January the past two years, and rising spot rates, resulting in a narrower spread to contract rates. It’s worth noting that an increase in demand, which typically occurs in March, may be what the market needs to break out of its seasonal depression .

Spot rates have risen to be $0.40/mile below contract rates, on average. That is within the normal range, giving credence to the view that the freight recession is over. (Chart: SONAR )

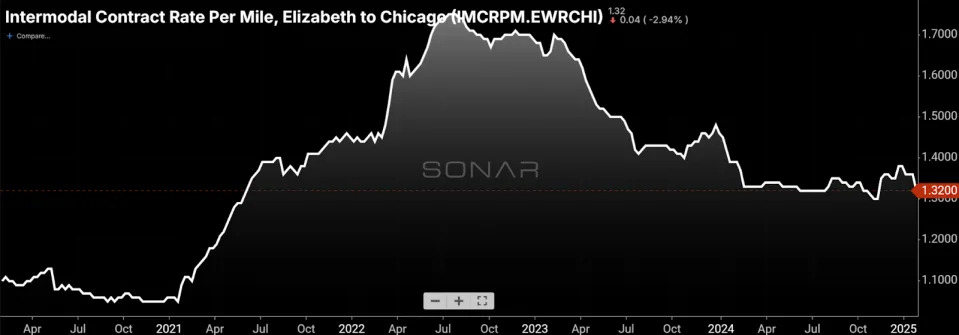

Rail intermodal contract rates may not rise sharply until 2026

Domestic intermodal contract rates, including fuel, in the Chicago to Newark lane started the year below early 2023 and 2024 levels. CSX suggests that major rate increases may not be felt until early next year. (Chart: SONAR )

That was the main takeaway from eastern Class I railroad CSX’s earnings call last week. The truckload market is highly competitive with the intermodal market in the eastern U.S., where CSX competes, and according to executives at the railroad, “the truck cycle has yet to inflect.” While CSX is guiding analysts to positive intermodal volume growth this year which includes conversions from truckload to intermodal, it cautioned analysts about how its pricing lags market dynamics. Shorter intermodal contracts are one-year in duration and a large portion of the contracts roll over early in the year, so while there may be some pricing momentum this year, according to the railroad, the bigger impact could be felt next year.

Will deportations lead to a labor crunch?

(Image: FWTV)

On Monday’s The Stockout show , in addition to a discussion on Trump’s executive orders, inventory and labor, Grace Sharkey and I debuted a new segment titled, “Who asked for this?”

(Image: People.com)

The aim of the new segment is to highlight a newly introduced CPG item each week that the audience at large has not heard of. This week, it was Totino’s pizza-flavored Cinnamon Toast Crunch, which is only available online. While largely for comedic relief, the segment also highlights an emerging trend in the CPG industry of introducing new eye-catching products to spur excitement and demand. That reflects a departure from the strategy in recent years which largely involved frequent price increases and reducing the number of SKUs to focus on those with the fastest turn times. Most mid-range CPG items appear to have reached a point at which further price increases will be met with resistance, both from retailers and customers defecting to private labels. Exceptions will largely be items where CPGs can clearly demonstrate to retailers that there is significant inflation in a key ingredient, such as cocoa.

The post Freight markets improve slower than carriers would like appeared first on FreightWaves .